$4.4210 last.

From RBN Energy:

Several key factors point to a gradual increase in natural gas power burn over the next few years. More gas-fired units are coming online, and more coal-units are being retired. But with gas prices trending higher this spring and summer than in the same periods last year, 2014 gas use by the electric sector may end up unchanged from 2013--unless this summer is a scorcher. The stronger pricing is good news for producers, of course, as is the very real need to replenish depleted gas stocks. Today, in the first episode of a new series on power burn demand for natural gas, we look back at 2013 and forward to prospects for 2014.

The amount of gas consumed annually for power burn is a zig-zaggy thing, of course, due to factors like the strength (or weakness) of the economy, temperature, gas and coal prices, and even precipitation levels in hydro-dependent regions. After a very mild winter and with gas prices at 10 year lows (encouraging unprecedented levels of coal to gas power switching), 2012 was something of an anomaly as gas burn increased 6 Bcf/d over 2011 to 24.9 Bcf/d. In 2013 – a more normal year – natural gas consumed for power was down 2.6 Bcf/d from 2012 to 22.3 Bcf/d, in part due to higher natural gas prices and also because a milder summer reduced demand for air conditioning. Over the longer term the trend has been gradual gains in the amount of gas-fired power generated and gradual declines in the amount of power produced by coal-fired units.

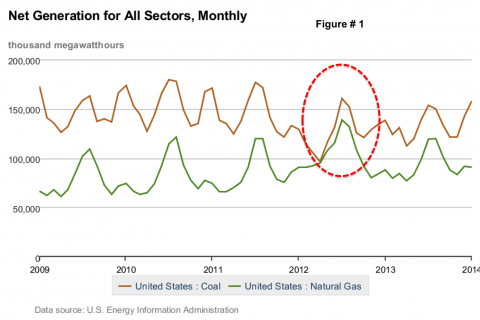

(Click to Enlarge)

As we did in our gas power burn analysis last spring (see 2012 Natural Gas Power Burn—Was That a Wild and Crazy Year?), let us turn first to the latest data from the U.S. Energy Information Administration (EIA) and its nifty Electricity Data Browser - an application that allows users to browse through power generation statistics and select data, report types and charts interactively. Figure # 1 shows the amount of power generated (in thousand MWh) by coal (brown line) and natural gas (green line) over the past five years. You can see major peaks each summer and minor peaks each winter in both the gas and coal power generation data, with—as we said earlier—that special situation in the spring and summer of 2012 when gas prices plummeted and the electric sector (which dispatches or runs the units with the lowest costs) ramped down its coal use and ramped up its use of natural gas (red dotted circle on the chart).The summer peaks of coal- and gas-fired generation sagged lower than previous years in 2013 with the unusually cool temperatures. But look at the trend of coal and gas generation, dismiss the anomaly of 2012, and consider two things. First, the general trend since 2009 is that the gap between coal and gas has been narrowing, with coal’s contribution falling and gas’s on the rise. Second, even with the very mild weather last summer, the output of gas-fired units in July and August of 2013 (at just under 120 million MWh each month) was almost identical to their output in those months in 2011—a typically hot, high-demand summer. So if we get back to normal summer weather in 2014, you would expect an increase in power demand generally and probably in gas-fired generation too....MUCH MORE