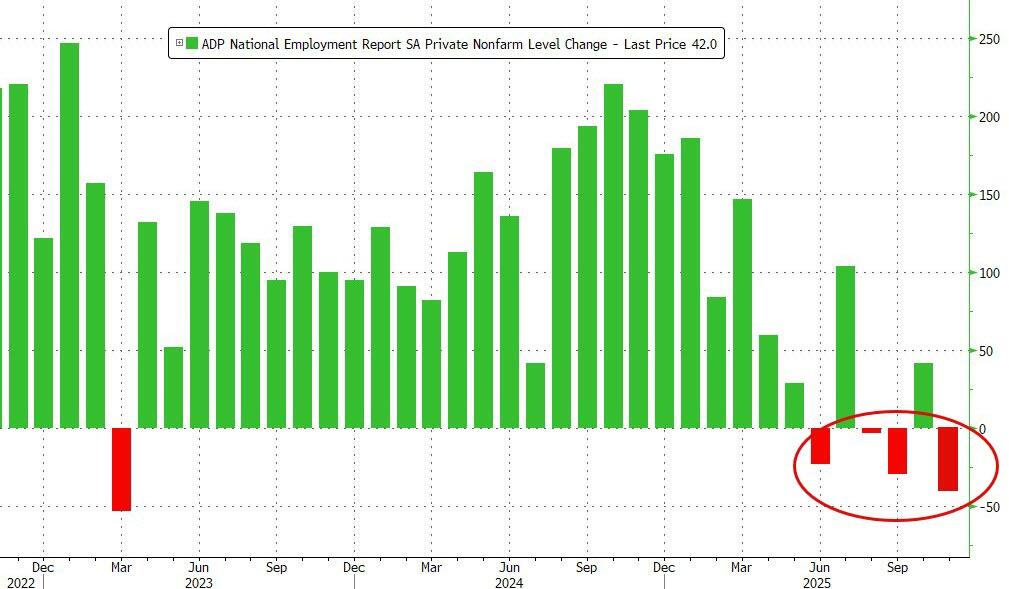

This. This was part of the concern in June!

From ZeroHedge, November 11:

Recent announcements of large layoffs at a few prominent companies have raised concerns that the labor market could be weakening further, and today's new weekly ADP employment report confirms that fear.

The ADP weekly jobless report pointed to a deterioration in US labor momentum, stating that “for the four weeks ending Oct. 25, 2025, private employers shed an average of 11,250 jobs a week, suggesting that the labor market struggled to produce jobs consistently during the second half of the month.”

Added together that is 45,000 job losses in the month (not including government workers), which would be the largest monthly drop in jobs since March 2023...

ADP started issuing more-frequent readouts on the labor market last month, to complement its long-running monthly report.

They are published with a two-week time lag and are based on a four-week moving average.

A sustained increase in layoffs would be particularly concerning now because the hiring rate is low and it is harder than usual for unemployed workers to find jobs.

So far, Goldman does not find clear evidence that most of the increase in these layoff measures is directly motivated by AI, although tech industries saw meaningful increases in layoffs in October across both measures.

At the same time, initial jobless claims - which are less noisy and more representative but could lag layoff announcements and WARN notices - remain low.

Goldman complements these data with a new tool to track layoff discussions among publicly listed companies based on earnings call transcripts.

Their tool suggests that layoff-focused discussions have increased recently, particularly in the ongoing 2025Q3 earnings calls. We find that layoff discussions increase after companies discuss AI in earnings calls at least a few times, although this pattern has only recently started to emerge for non-tech companies.

We combine Challenger announcements, WARN notices, initial claims, and earnings call mentions into a layoff tracker....

....MUCH MORE

As noted in the introduction to an August 2 Barron's article:

"Trump Fires BLS Chief. He’s Missing the Real Reason for the Big Change in Jobs Numbers."

....MUCH MOREFollowing on Reuters' August 1 report "US payrolls revisions jolt markets, making Fed look behind the curve" which focused on the revisions to prior releases rather than the not good 73K figure from the latest report.

And they were right to do so. What this means is for the last two Fed meetings the folks who sit at that beautiful table were informed by numbers that were incorrect, and dramatically so.

Based on the revisions the Fed should have lowered their target rate by a quarter point at the June 18 meeting after which Chair Powell said (CNBC):

“The U.S. economy has defied all kinds of forecasts for it to weaken, really over the last three years, and it’s been remarkable to see … again and again when people think it’s going to weaken out. Eventually it will, but we don’t see signs of that now”And based on the revised jobs number for June - 14,000 versus the initially reported 147,000, a greater than 90% decrease - the Fed should have cut the target by another quarter-point at the just concluded July 30 meeting.

My only quibble with the Reuters report is their headline; the Fed doesn't just look to be behind the curve, they are behind the curve and should immediately do an inter-meeting cut of a half-point.

Even that, because of the time lags between Fed actions and their effects in the real economy, would still leave the Fed behind the curve coming into the September meeting...

"Wharton’s Jeremy Siegel says Fed needs to make an emergency rate cut

Those were part of the outro from September 9's "Today's Jobs Number Revisions: The Fed Is, And Has Been, Behind The Curve (plus Murray Rothbard does a driveby on statistics)".

Also, September 28's "Fed's Bowman says decisive rate cuts needed to offset labor market risks".