The major stock index futures are all up more than 1% with ten minutes to go before the cash market open.

From ZeroHedge, May 2:

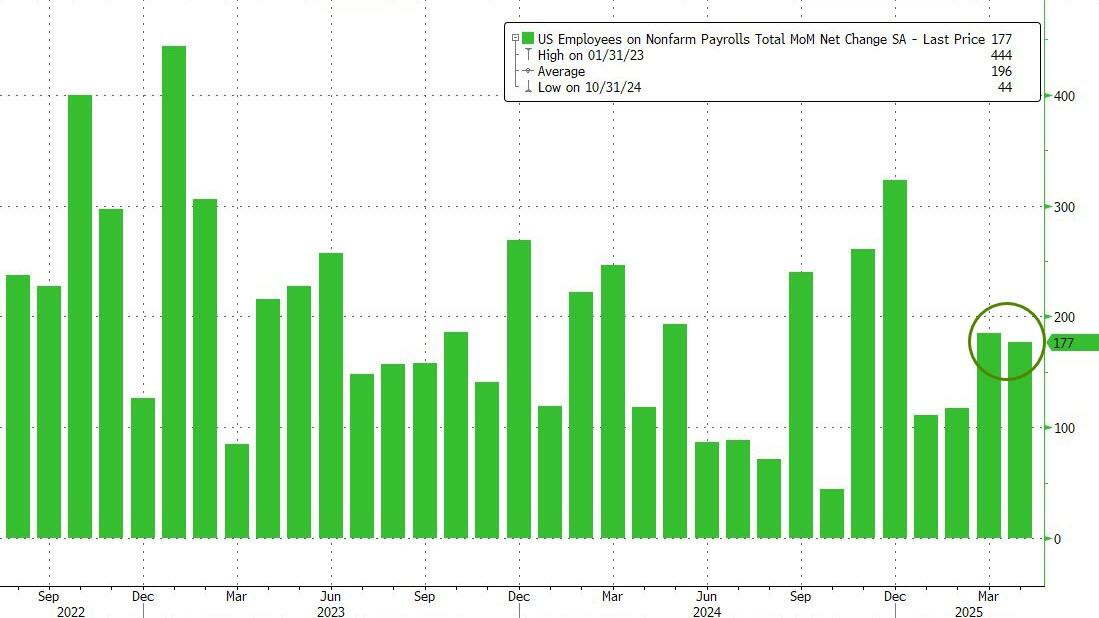

April Jobs Unexpectedly Jump By 177,000, Higher Than All Estimates

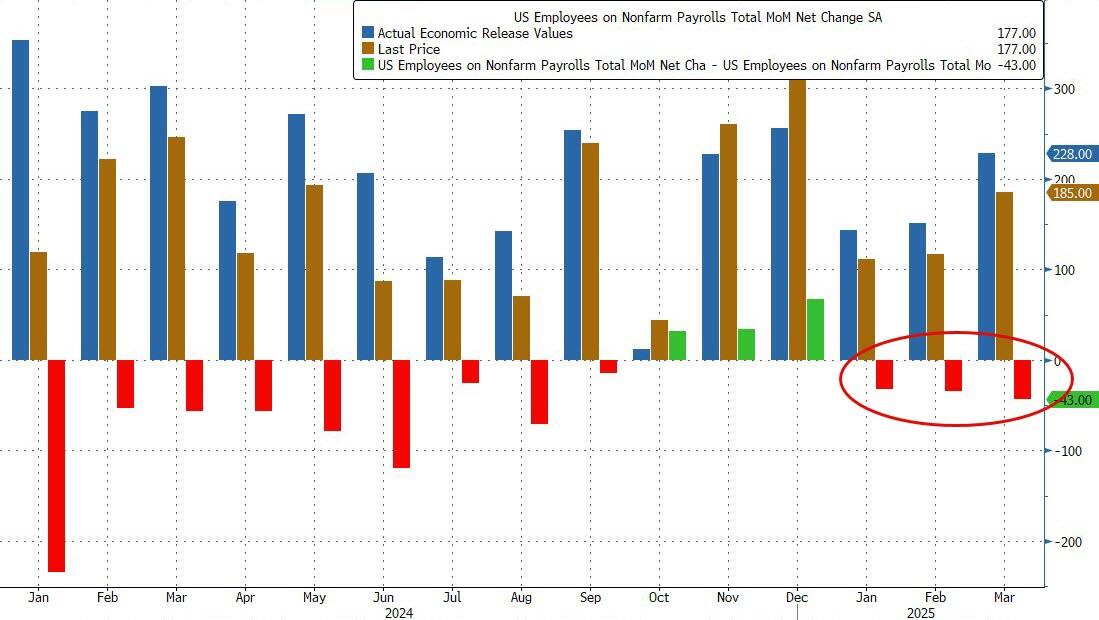

Ahead of today's jobs report, we knew the number would be a big drop from March's 228K, the only question was how big said drop would be, and whether a tariff hit would be accounted for in today's number (as we said in our preview). We got the answer moments ago when the BLS reported that in April the US added 177K jobs, which while certainly a big drop from last month's 228K, came in well above the Wall Street median estimate of 138K, and clearly indicated that the tariff hit has yet to come.

While hardly a blowout number, today's print was so strong, it came above the highest Wall Street estimate of 171K.