China is so big that how it manages its economy and currency matters enormously to the world. Yet over time the way it manages its currency and its foreign exchange reserves has become much less transparent – creating new kinds of risks for the global economy.

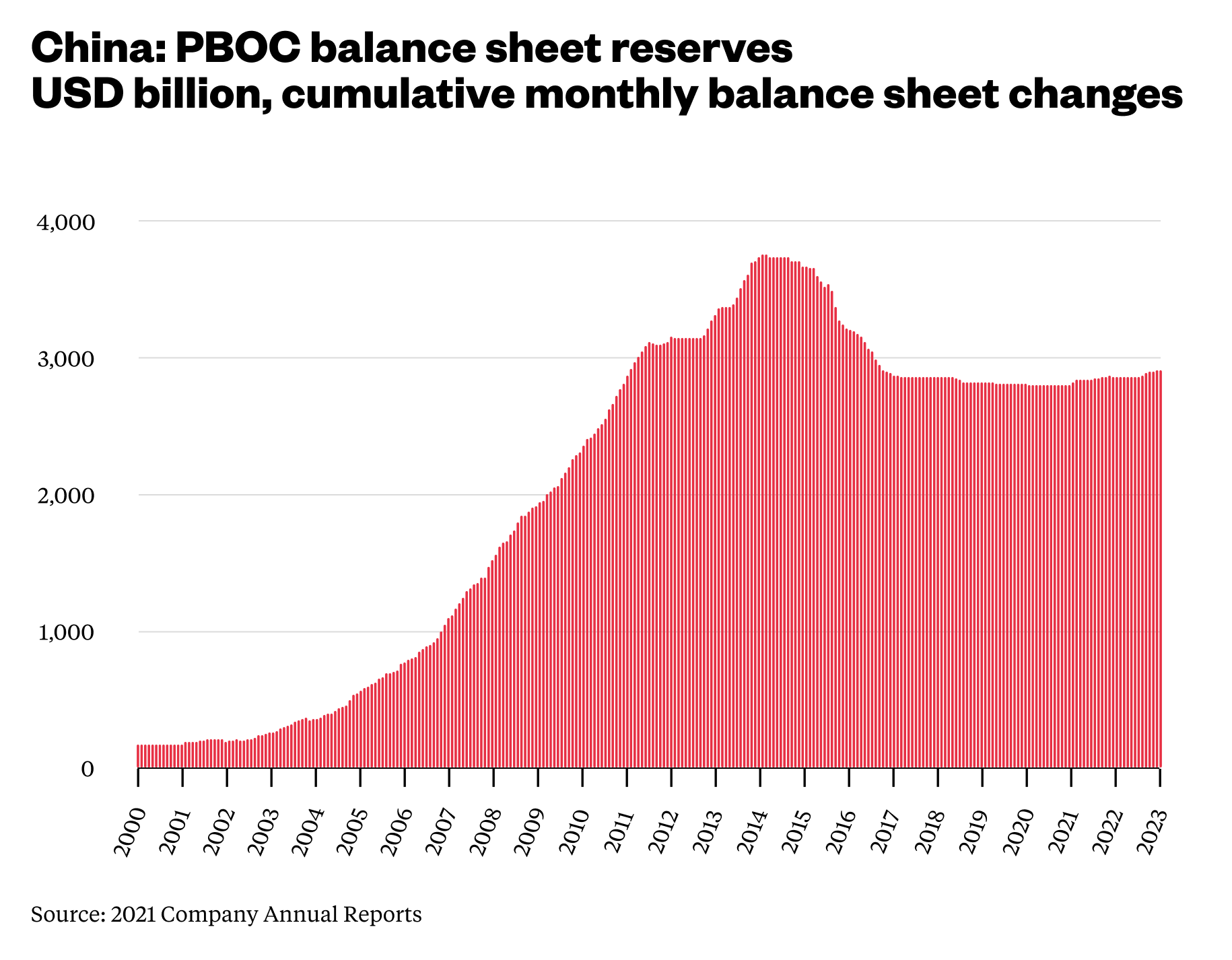

From 2002 to 2012, China’s central bank was active in the currency market almost every day — usually buying dollars to keep China’s currency from rising, and to make sure China’s exports stayed cheap.

During this period, China’s foreign exchange reserves steadily increased. So did China’s holdings of Treasuries and the bonds issued by Freddie Mac and Fannie Mae— the two major types of “Agency” bonds that are implicitly backed by the U.S. federal government Economists worried that China’s intervention in the currency market was keeping trade unbalanced; foreign policy gurus worried that China might sell bonds in a moment of geopolitical tension, turning a security crisis into a financial crisis.

Poof!

But a funny thing happened sometime over the last ten years: China’s reserves stopped rising. Sure, the number reported by the foreign exchange authorities bounces around a bit, as the market value of China’s long-term bonds and euros sambas with global markets. But the foreign exchange reserves reported by the central bank (the People’s Bank of China or PBoC), which accounts for its reserves on its balance sheet at their historical purchase price, has been constant.

The stability of China’s reported reserves is a real puzzle. Despite all the talk of deglobalization, China’s export surplus is actually at an all time high. China’s true current account surplus is likely larger than the $400 billion that China now officially reports. And currency traders know that China’s currency bounces around a lot less than other big currencies — the yuan doesn’t act like a currency that is tightly pegged to the dollar anymore, but it doesn’t act like a freely floating currency either.

So what is going on?

Just as China has “shadow banks” — financial institutions that act like banks and take the kind of risks that a bank might normally take but aren’t regulated like banks — China has might be called “shadow reserves.” Not everything that China does in the market now shows up in the PBoC’s balance sheet....

....MUCH MORE