There are signs that such is the case. More on those tomorrow.

From the Daily Mail (as if you couldn't tell from the 400-word headline), August 26:

- Boise, Idaho; Charlotte, North Carolina and Austin, Texas were the three most overvalued areas in the United States, according to Moody's Analytics

- Moody's found that found that 183 of the nation's 413 largest regional housing markets are 'overvalued' by more than 25 percent

- If a recession hits, house prices in those 183 regions could plummet by as much as 20 percent, Moody's predicted

- If there is not a recession, they will still fall 10-15 percent, the analysts believe - echoing other experts

- The housing inventory is at its highest level since April 2009, as sellers struggle to get rid of their property because mortgages have become more expensive

- Mortgage rates have nearly doubled since January, rising to 5.13 percent for a 30-year loan as of last week, according to Freddie Mac

House prices could fall by up to 20 percent next year if there's a recession, experts warn - and property in some areas of the country is overvalued by as much as 72 percent.

Mark Zandi, chief economist for Moody's Analytics, was pessimistic about the housing market in May, but he has now made his forecasts even more bleak, Fortune reported on Wednesday.

It comes amid ongoing arguments over whether the US is already in a recession, with the country recording two consecutive quarters of negative growth - the traditional definition of such a slump.

The news is particularly dire for people who have purchased homes in what Fortune terms 'bubbly' markets, with Boise in Idaho, Charlotte in North Carolina and Austin in Texas all named the most overvalued markets.

But a total of 180 other areas across the US have property deemed overvalued, many of them highly-desirable.

They include LA, Orlando, Seattle and Indianapolis, where property is all estimated to be 30 percent overvalued.

Homes in Houston are around 34.5 per cent overvalued, while properties in Montana are 25 per cent overvalued.

Picturesque Bend in Oregon - regularly voted one of the United States' best places to live - has homes that are 43.8 per cent overvalued, according to Moody's, with Billings in Montana 25 per cent overvalued....

....MUCH MUCH MORE

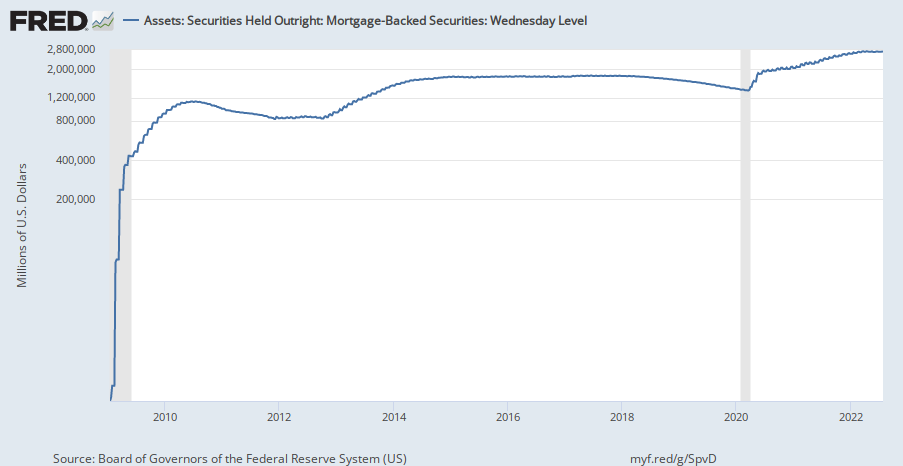

Our best guess is that the Federal Reserve's buying of Mortgage Backed Securities has created a price bubble so large that the median home price is double what it would have been in the absence of such buying. August 23:

The Mortgage Backed Securities Trap The Federal Reserve Set For Itself, In One Chart

As we saw yesterday the Fed had never bought these confections, what one observer has called "dog crap in a cat crap wrapper" until the Great Financial Crisis

Maybe confection is the wrong word.

However, during the GFC the market for bundled mortgages stopped functioning, no one trusted the quality of the mortgages inside the wrappers, what with their various tranches and flavors and ratings shenanigans.

So the Fed stepped in and started buying in size, so much so that when presented on a semi-log chart it is a graphical representation of madness:

Ben Bernanke was Chairman of the Fed from February 1, 2006 to January 31, 2014.

Janet Yellen was Chair from February 3, 2014 to February 3, 2018.

It is on them that, after the initial emergency, the assets stayed on the balance sheet and distorted the housing finance market beyond recognition.

It is on them that mortgage

interest rates were so low as to cause another housing bubble, driving

house prices to levels at least double what they would otherwise be,

probably more than double, and condemning generations to being nothing

more than tenants with no chance whatsoever of stepping on the first

rung of wealth accumulation.

And because the Fed owns so much agency MBS paper it doesn't dare sell into the market for fear of crashing the MBS market and jacking interest rates to ridiculous levels.

So the Fed announced on May 4, 2022 they would reduce the size of the MBS holdings by letting them run-off. There are three ways that existing mortgages are, in effect canceled, so they can be allowed to run off:

1) they are paid off by the homeowner.

2) they are replaced by new mortgages upon the sale of the property.

3) they are replaced by refinancing.

There has been much discussion of the fact that refi's plummet in a rising rate environment, the homeowner keeps their current mortgage.

We are about to see the second source of roll-off available mortgages shrink dramatically as affordability issues force potential home buyers to stop bidding house prices higher and the volume of transactions grinds down.

Then the first source of paper available for roll-off, pay-offs, becomes suspect in the face of recession with its concomitant rise in delinquencies and defaults.

The fact that Saints Bernanke and Yellen not only didn't shrink the position but, as of the last H.4.1 report from Mr. Powell's Fed, allowed it to get to $2.727 trillion, more than triple the 2013 level, is just mind-boggling.

More tomorrow, some possible resolutions of this disaster, none very appealing.

In the meantime I keep referring back to this Bloomberg Opinion piece, August 11:

Fed Purchases Of Mortgage Backed Securities Have Destroyed The Housing Market

And this from Barron's, August 7:

"The Fed Is About to Ramp Up Balance-Sheet Shrinkage. It May Get Dicey"

Finally, if interested, a search of the blog with the keyword: H.4.1