With yesterday's (and today's) big jump in agricultural commodities, especially corn, which seems to be in everything from pork chops to ethanol as well as the ubiquitous HFCS, and the move higher in oil, it's a good thing the core CPI and PPI reports will exclude food and fuel.

From ZeroHedge:

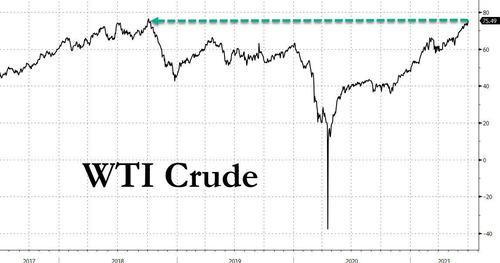

Brace for shock at the pump. WTI crude prices surged by over $2, rising more than 3% to $75.8/bbl...

... the highest since 2018...

... amid reports that ahead of the conclusion of today's OPEC, JMMC and OPEC+ meetings, Saudi Arabia and Russia have agreed on a preliminary deal regarding raising oil output, one which will include a monthly oil output increase of less than 500k bpd to OPEC's current holdback of 5.8 million barrels until December-2021, which is less than the market consensus of 500kbp/d. Reuters adds that OPEC+ is also likely to ease oil output cuts by 2 million bpd between August and December, which suggest that OPEC+ is weighing inflation risks in the short-term, however by year-end the market is expected to be in a deficit of over 3mmb/d, which is why most banks have projected oil to rise above $85 toward the end of the second half.

Additionally, local sources add that OPEC+ is currently debating extending the production deal to the end of 2022 (from the original April 2022), according to a delegate, which will lead to the further supply constraints and even higher prices.

While OPEC+ intentions should hardly be a surprise to the market, the fact that oil prices are only now spiking shows how far behind the curve algos and CTAs have been. Or as energy expert Art Berman puts it, "So much commentary about how OPEC doesn’t matter any more yet today so many tweets expressing frustration with OPEC for not increasing supply."....

....MUCH MORE