Just as the introduction of the futures in December 2017 was a tell:

....We are not ingénues. Like most folks who have been at the market a while we understood what the introduction of bitcoin futures meant back in December 2017: top tick.CBOE futures begin trading Dec. 10; CME futures begin trading Dec. 17 and on December 18, 2017 bitcoin hit its all-time high at $19,498.63. And thirteen months later, in January 2019 it traded at $3400.

So too was the hype-n-tout leading up to the Coinbase direct listing.

For two months it was the topic of conversation among the Bitcoin bulls.

From Slope of Hope:

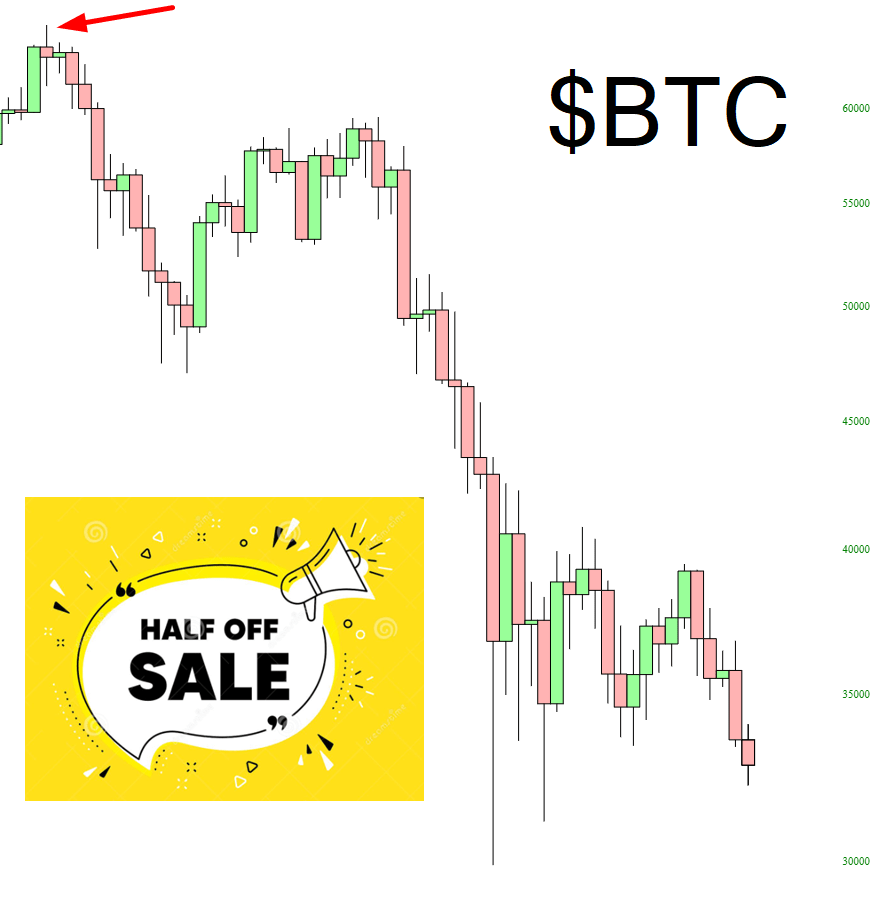

There’s nothing easier than hindsight. Yet hindsight – – even that which gazes upon only a few weeks past – – can be instructive. Let us examine the wipeout which has taken place in the entire crypto space over the past month by simply examining some of the breathless coverage that was going on near the top.

We need not look far. Examine this headline from no less a source than NASDAQ, which proclaims, on the heels of Bitcoin’s ascendency to $64,000, that the top may be “nowhere near”. It will come as absolutely no surprise to you that this was published roughly to the millisecond that the top itself was hammered out.

Of course, back in those days, a long, long four weeks ago, it seemed every company on the planet was trying to get on the crypto bandwagon and mimicking Elon Musk’s behavior by buying billions of dollars of crypto for their own corporate treasury. One doesn’t see many press releases lately about how much crypto this-or-that megacap corporation has been purchasing, because they have, in short order, already looked like complete buffoons.

This plays out in the public markets too, of course. Here we see a Bloomberg headline in anticipation of the widely-heralded Coinbase IPO that was forthcoming.

....MUCH MORE

The preparatory hype got Coinbase to trade like this:

Screaming far above the $250 'reference' price and then disillusion sets in.

I've mentioned before that our favorite post of the year-to-date is February 19's:

Seeing The Opportunity In The Financialization Of BitcoinI don't know if she intended it to but what Ms Kaminska's post did was prime us for the possibility that we might see a replay of the 2017 move. And as Louis Pasteur said:

(In the fields of observation chance favours only the prepared mind.)

—Lecture, University of Lille (7 December 1854)