We used to say the same about Sarasin before Safra bought them but don't really follow the numbers anymore.

At minimum Pictet's idea seems like a smart screen for getting everyone's interests aligned.

I haven't seen the performance figures to comment further though.

May 2020:

Family businesses: Insights on an attractive investment prospect

Pictet-Family – Fund manager interview

Pictet Asset Management has developed a new investment strategy that invests in listed family businesses, companies that count founding families as major shareholders.

The portfolio is a repositioning of the Pictet-Small Cap Europe fund and is managed by Cyril Benier and Alain Caffort.

In this Q&A, they discuss the strategy’s guiding philosophy.

What exactly is a family business?How you define a family business is a matter of interpretation. Sometimes it’s obvious, say when founders hold very large stakes in their own names. But the boundaries can sometimes be blurred. We take a systematic and rigorous approach to our definition. Family businesses that make up our investment universe are public companies in which an individual or family holds a minimum of 30 per cent of voting rights. The family can be by blood or marriage, the stake can be held through a foundation or some other vehicle. Such information is rarely freely available; unearthing it often requires painstaking research.

Why 30 per cent?Research shows that active participation in the general assemblies of publicly listed companies averages around 60 per cent of share ownership. At 30 per cent, a shareholder (or group of closely tied shareholders) effectively has the casting vote and, thus, control.

Why focus on family businesses?

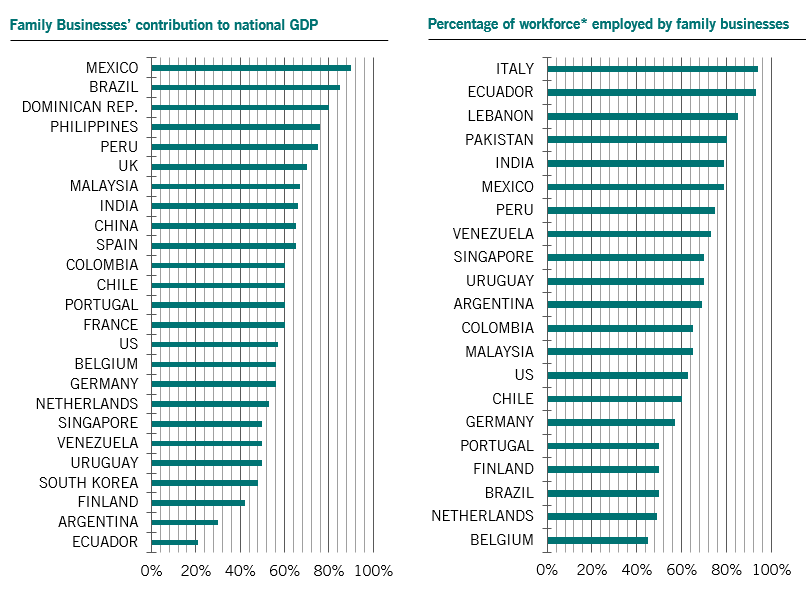

Family businesses are the lifeblood of our society and the backbone of the global economy. They contribute between 50 per cent and 70 per cent of countries’ gross domestic product and employ the majority of their workforces.

Source: Tharawat Magazine, Economic

Impact of Family Businesses – A Compilation of Facts, 06/01/2016

– over

40 sources used including IMD and KPMG

*Data representative of private employers only

There’s a large body of research showing family businesses tend to outperform their peers – financially and in terms of shareholder returns.Of course, as anyone with experience of families and family disputes knows, this type of ownership can also lead to a number of problems – which is why it is also crucial to take an active approach to investing in these companies. And that’s where we can make a difference – ensuring we avoid the pitfalls in this otherwise attractive investment landscape. Please read our related article on the universe for more about why it makes sense to invest in family businesses with an active approach.

This suggests corporate governance is a big focus for you, is that right?

Environmental, social and governance (ESG) factors are all important sources of investment performance. But when it comes to investing in family businesses, governance is key. That’s because governance is intrinsic to a company’s overall values and culture........MUCH MORE