And just a heads-up: in 2008 Albert made one of the most astoundingly accurate and timely market calls in history. More after the jump.

From ZeroHedge:

Albert Edwards admits he is "perplexed."

Writing in his latest Global Strategy report, the SocGen strategist admits that "until recently (ie the last few days), I had thought that the 35%+ rally in the S&P from its 23 March 2190 low would stall at around 2980 - the 62% Fibonacci Retracement level, as occurred in the previous two (2001 and 2008) bear markets. Hence, I was genuinely surprised to see the S&P climb above the technically important 2980 level, and yesterday power above its 200-day moving average."

Instead, the S&P is now less than 10% from February’s all-time high, and with the US unemployment rate heading towards 20%, Edwards asks rhetorically: "At what point does the stark disconnect between Wall Street and Main Street become a political embarrassment for the Fed? Maybe never."

Maybe never, but most likely soon: as Bank of America's Michael Hartnett wrote last Friday, the absolute limit of bear market rallies in 1929, 1938, 1974 was a 61% rebound from lows (after an avg 49% drop), which would take the S&P500 to 3180 this rally, so another 120 points which at this rate means another 3-4 days of gains.

Edwards does not look that far back, however, and instead he reminds is that the rally from the March lows is similar to last year’s rally, which similarly was narrowly concentrated on the large cap ‘growth’ stocks aka the FAANGs (Facebook, Apple, Amazon, Netflix and the stocks formerly known as Google, but now called Alphabet).

And while the bearish strategist offers a mea culpa, saying "I have been very wrong as I had expected to see a collapse in the FAANG stocks and ‘tech’ generally, as the recession exposed large parts of the tech universe as cyclical stocks masquerading as ‘growth’ stocks, ... but how wrong I was, as the stay-at-home nature of this coronavirus-induced recession has instead given the FAANG and tech stocks a whole new impetus", he advises his clients that he, too, has been here before, in the first half of 2008 to be specific.

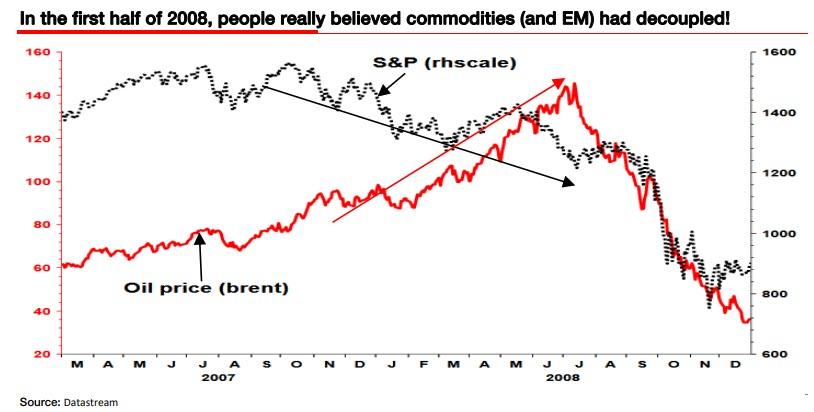

Cast your minds back. The S&P had topped out in October 2007 - the bear market had begun and the US economy had slipped into recession. Do you remember the mantra that emerging markets had de-coupled from the global downturn and commodities would remain resilient as a result? Do you remember the touting of ‘BRIC’ EM investing? So, for most of H1 2008, commodity prices soared.At the time Albert said this talk of de-coupling was nonsense, and is "what behaviourists call a bubble of belief as Fed liquidity had funnelled into this asset class as a last refuge from the cyclical meltdown."

Fast forward to today when Edwards saying the current decoupling of tech/growth/momentum, or generally - the FAANG rally - too "will end in collapse in the same way EM and oil did in H2 2008. Indeed, the title and first paragraph above are taken directly from my weekly of 5 March 2008 with FAANG replacing commodities and EM." And just to make his point, we notes that his lead in sentence was taken directly from his weekly of 5 March 2008 with FAANG replacing commodities and EM.

I have a high conviction that before the end of this year theFor those who prefer visual reminders, this is what the S&P did for the 6 months after the recession of 2007 had started:EMsFAANGs will be unravelling, as the structural arguments supporting these bubbles turn to cyclical sand.

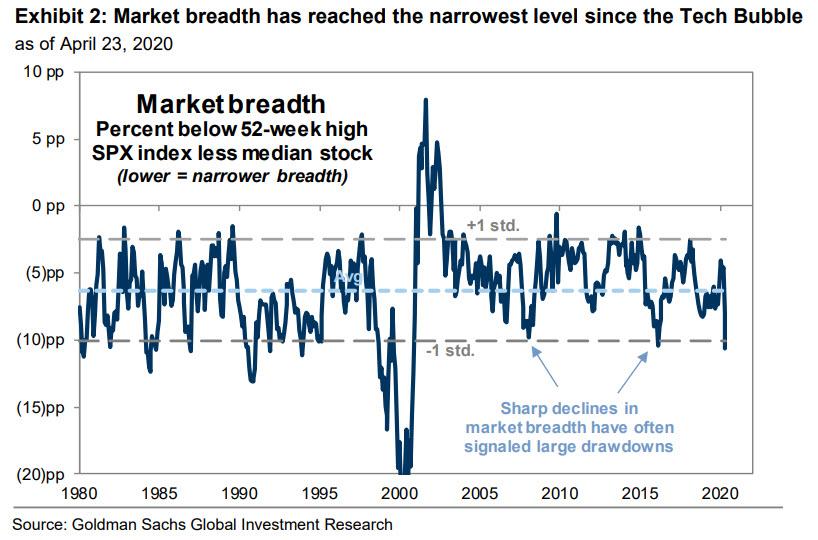

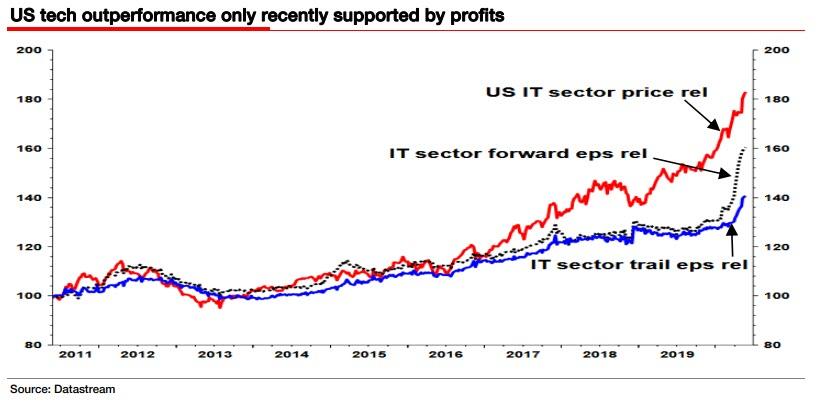

Shifting to the here and now, Edwards then writes that in the run-up to the current recession, "US tech price outperformance far outstripped relative EPS performance." As the SocGen strategist elaborates, "I felt this was yet another Fed inspired, liquidity driven bubble that would burst in the coming recession - like the late 1990s Nasdaq bubble." It's not just him though: even Goldman recently warned that the FAAMGs have gone far too far, and a moment of reckoing is coming as a result of the record concentration in just a handful of stocks as market breadth has plunged to near all time lows.

However, what both Goldman's David Kostin and Albert Edwards missed, is that the unusual stay-at-home nature of this coronavirus-driven recession has boosted IT and media related expenditures generally in a way that could not have been anticipated. Interestingly, US tech sector profits have only really outperformed decisively in the past few months (see chart below), but rather than profits merely catching up with previous heady price outperformance, IT stocks have continued to surge higher relative to the market, especially in the rally since March.

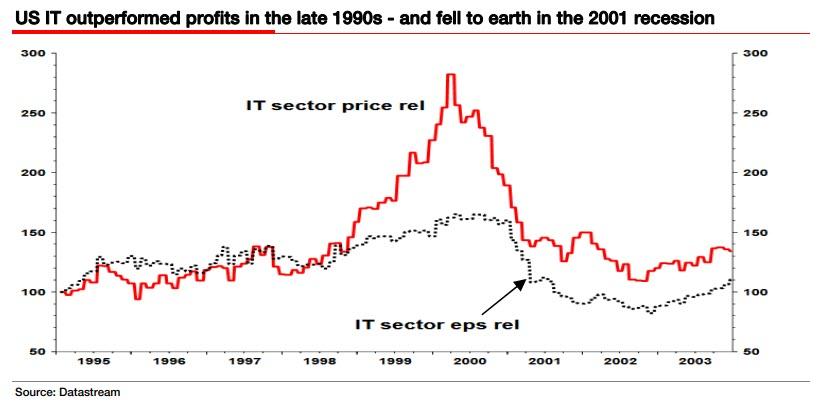

This is not the first time we have seen this pattern: in the late 1990s, Edwards writes, tech stocks also enjoyed a period of massive outperformance that had hugely outstripped what was also a moderate outperformance of their EPS relative to the market (see chart below), "and just like recent times, what propelled US tech valuations to stratospherically high valuations back then was ample Fed liquidity and a bubble of belief."

Then the 2001 recession hit, and many tech stocks suffered a "totally unexpected" fall in profits. These were not growth stocks at all and shouldn't have been on 40x+ PEs. "These were in reality cyclical stocks trading on peak multiples on peak cyclical earnings when they should have been trading on top of the cycle, single-digit PEs" Edwards booms, but of course it is easier to make such observations in retrospect when the frenzy is long gone. Of course, when the market "discovered" these stocks were on the wrong PE ratings based on the wrong forward earnings, the Nasdaq bubble collapsed. And even the true growth tech stocks collapsed in price as all around them earnings bombs were exploding. At that point, "investors rushed for the hills throwing their true growth tech babies out with the bathwater", gloomy Albert concludes.........MUCH MORE

*From 2016's Société Générale's Albert Edwards Not His Usual Jolly Self:

A couple of the commenters on this post appear to have turned into ahistorical dolts, including the fellow who styles himself

Electric Dragon

Albert Edwards has successfully predicted nine of the last zero collapses of civilisation.

That's a good call.

Albert is better at credit markets than he is at equities and like many bears, Gluskin Sheff's David Rosenberg being a prime example, Albert doesn't put enough weight on the efforts of the Central Banks to change reality more to their liking.

Whether in the long run those efforts succeed or not, they should inform ones wagers in the present.

On September 5, 2008 we posted "Meltdown"-Société Générale" which linked to Albert's research note of a couple days earlier:

On September 7, 2008 Fannie Mae and Freddie Mac were placed into conservatorship.

On September 14, 2008 Merrill Lynch agreed to be acquired by Bank of America to avoid a net cap shutdown.

On September 15 Lehman filed their bankruptcy petition.

On September 16 AIG became a 79.9% subsidiary of the U.S. Treasury.

Within 10 more days the Nation's largest thrift, WaMu was seized and five days later Wachovia was gobbled up.