In this expansion, past economic performance doesn’t indicate future trends. We’ve had 3 slowdowns in this expansion. At the worst point in the prior 2 slowdowns, it looked like the economy was headed for a recession, but it was actually a great time to buy stocks. The stock market decline in Q4 2018 was way ahead of the potential future recovery as the slowdown hadn’t fully played out. However, the point remains that when things looked bad, it was a buying opportunity. It’s not always a good time to buy stocks when the economy weakens. It’s simply a good time to do so if the economy doesn’t fall into a recession.

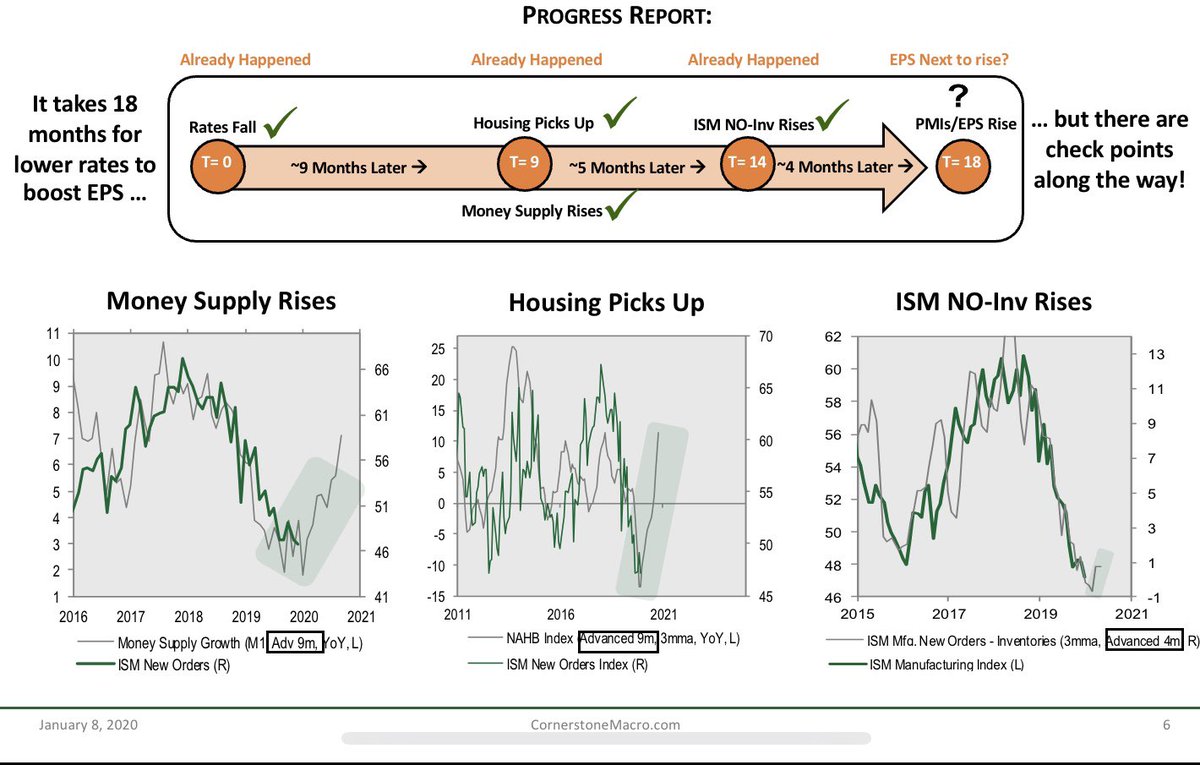

The charts below support the thesis that the 3 rate cuts in 2019 will help the economy and earnings recover in 2020.

Following a process helps us stay focused when things get chaotic. What occurs before #EPS and #PMIs recover every time? Rates fall, money supply increases, housing rebounds, and PMI internals bottom. Is this happening today? You bet. #businesscycle pic.twitter.com/9Ft8pDs5DY— Michael Kantrowitz, CFA (@MichaelKantro) January 8, 2020

At the moment (and for the last few quarters) the Fed's balance sheet and the money supply are more important than interest rates.

And what do you know, starting at the end of April 2019 the rate of increase in the most liquid of the money supply measures, Money of Zero Maturity started increasing at a perceptibly faster rate:

This is even more apparent in the inflation adjusted real MZM:

MZM Real

We'll see how this plays out but for the first time in years will be paying attention to the money supply figures rather than just having them running in the background.