Last year it took $1.41 of stimulus to generate $1.00 of GDP growth.

Although that is better than the $2.33:1.00 ratio back in Q2 2012 when we posted this bit:

The Real Problem With Stimulus

I've mentioned a few times that Keynes was all about the countercyclical thing.but the ratio is awful considering the U.S. has not seen a recession in over 10 years.

In the U.S. we have devolved to perma-stimulus, every dollar of deficit spending being stimulus, and have no plans to ever stop. Anyone who argues that stimulus isn't stimulus unless it is labeled stimulus is being sillier than I felt when I typed this sentence.

Deficit spending is stimulus whether you call it ARRA,sweet, sweet Biden loveor Democracy's flaw.

The Biden reference is to the fact the former Vice-President was overseer of the ARRA stimulus in 2009 - 10 and the Recovery Summer in 2010.

From Wolf Street:

US GDP Rose by $850 Billion in 2019 as US National Debt Surged by $1.2 Trillion. Debt-to-GDP Ratio Hit 108%

Dream of 3% economic growth remained a dream despite surge in government borrowing and spending.

The dreams of 3%-plus economic growth in the US remained dreams in 2019, despite tax cuts and ballooning federal government spending, which are a stimulus. But the resulting budget deficit caused the gross national debt to balloon far faster than GDP grew.

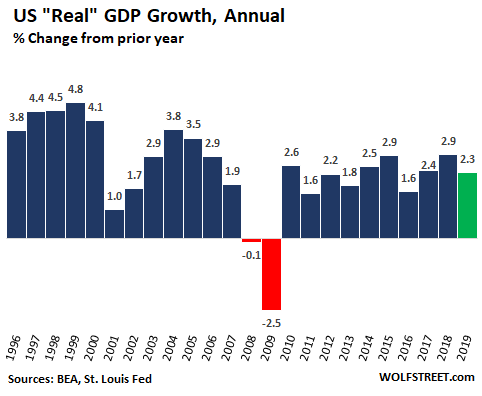

In the fourth quarter, the economy as measured by inflation-adjusted “real” GDP grew at an annual rate of 2.1% from the third quarter. This brought the total growth of real GDP for all of 2019 to 2.3%, which is the average annual GDP growth since 2012:

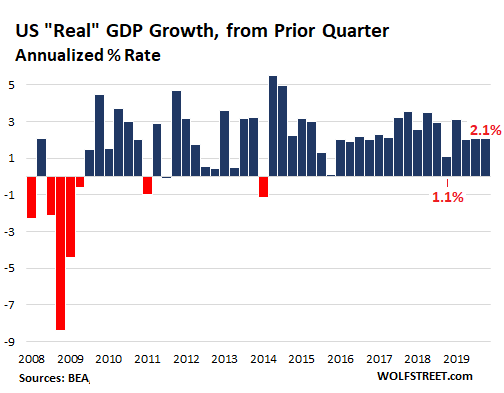

This is according to the first estimate by the Bureau of Economic Analysis, released today, based on incomplete data. As more data accumulates, the BEA revises the estimates. The next revision will be released on February 27. These revisions are often minor, but sometimes they’re whoppers, completely changing the economic picture, as they did for Q4 2018, when the initial estimate of GDP growth was a hot 3.1%, which was subsequently crushed down to a frigid 1.1%.

In Q4 2019, the “real” GDP growth rate of 2.1% was essentially the same as over the prior two quarters, and below the average growth rate since 2012 of 2.3%:

On the positive side in Q4, imports of goods and services fell 8.7%, with goods imports alone dropping 11.6% (a decline in imports adds to GDP). But exports ticked up only 1.4% (an increase in exports adds to GDP).

Also pushing up GDP in a big way: federal government expenditures in Q4 rose at an annual rate of 3.6%. This brought the increase in federal government spending for the entire year 2019 to 3.5%. Defense spending surged 4.9% in 2019. Nondefense spending inched up only 1.6%. We’ll get to the debt that this federal government spending produced in a moment.

Growth was dragged down in Q4 by the sharp decline in gross private domestic investment of 6.1%, including a 10.1% drop in investment in structures and a 2.9% drop in investments in equipment.

Consumer spending (“personal consumption expenditures” adjusted for inflation), which accounts for 68% of GDP, grew at an annual rate of 1.8% in Q4. While this growth rate was down from Q3 (3.1%) and Q2 (4.6%), it was higher than in Q1 (1.1%) and in Q4 2018 (1.4%). For the year 2019, consumer spending, on this inflation-adjusted basis grew 2.6%, at the low end of the range of the past six years:........MUCH MORE

If interested see also July 2016's "Izabella Kaminska and the Declining Efficiency of Debt: This is Getting Serious"