For Chinese trade negotiators this has been the "silver lining", if you can call it that, of the swine fever epidemic, less pressure to get their hands on massive amounts of soybeans.

I believe we were the first analysts to comment publicly on this dynamic, over seven months ago.*

Here's more from the South China Morning Post:

As US-China trade talks resume, how much demand does Beijing have for American farm goods?

- US soybean exports have largely been replaced by those from Brazil, with the situation complicated by the impact of African swine fever

- US trade representative Robert Lighthizer is set to lead a US team to Shanghai next week to meet with Vice-Premier Liu He and Commerce Minister Zhong Shan

With negotiators from China and the United States set to have their first face-to-face talks since May next week, the likelihood of a large Chinese purchase of American agricultural goods appears to be growing.

US President Donald Trump met with technology executives in Washington on Monday, amid expectations that he will ease the ban on US companies supplying components to Chinese telecommunications giant Huawei. Chinese officials have said that an easing of the Huawei ban was a precondition for making large purchases of US farm goods.

China’s state media reported on Sunday that Chinese firms have started making purchase enquiries to US agricultural exporters and applying for exemptions from Beijing’s tariffs. Analysts are speculating as to the scale of potential purchases, which have fallen away significantly since the trade war began in July 2018.

US Department of Agriculture (USDA) data from last week showed that China had made a 51,072 metric tonne purchase of sorghum, despite the grain being subject to a 25 per cent import tariff. This was the largest weekly purchase since April, but also came in the same week that China cancelled a 9,853 metric tonne purchase of soybeans. China’s imports of US soybeans have plummeted since the trade war began, but given the scale of its demand over recent years, soybeans are likely to be high on negotiators’ agenda.

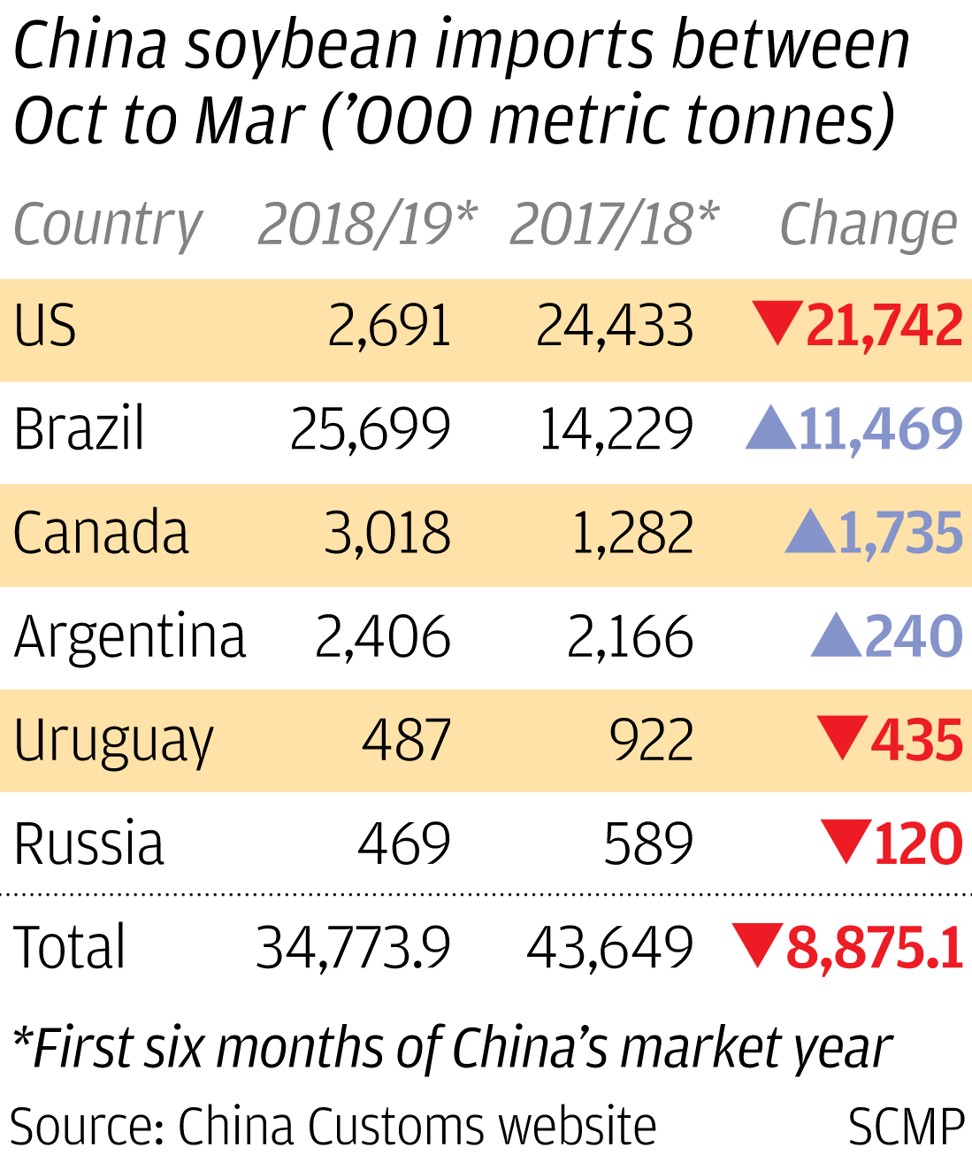

US soybean imports plummet under trade war

Speaking to reporters in Washington on Tuesday, US Agriculture Secretary Sonny Perdue confirmed that agricultural purchases were underway.

“As you all know, there has been a 20 million metric tonne commitment on soybeans. I think the latest numbers I saw this week, I think we were up to 13.67 [million], if I recall directly,” Perdue said. “So they still have a ways to go, and that’s what the president is reminding them of as well.”This is an improvement on the earlier part of 2019. Chinese Customs data shows that in the first six months of the marketing year, between October 2018 and March 2019, China bought just 2.7 million metric tonnes of US soybeans, around a tenth of the 24.4 million metric tonnes during the same period the previous year. Brazil, meanwhile, stepped up its exports of soybeans from 14.2 million metric tonnes to 25.7 million metric tonnes, effectively replacing US exports.

The situation is complicated by an outbreak of African swine fever, which analysts at Rabobank forecast could wipe out more than half of China’s pig herd either through culling or disease. The bank has forecast that 200 million – around half of China’s pigs – could be eliminated....

....MUCH MORE

December 10, 2018

American LNG to China has never been part of the pitch. On the other hand the softness in soybeans, exacerbated by the culling of the Chinese swine herd due to the African Swine Fever, could be a problem if it persists or if Chinese dining habits change and pork becomes less prominent on the menu.

Looking out a few months to the start of the U.S. planting season the USDA reports there will be some soybean acres switched over to wheat which would pull some potential supply out of the equation.

"US soybeans may be the surprise casualty of swine fever in China"

April 17, 2019

Not that big a surprise. If 200 million Chinese porkers either die of the disease or are preemptively "culled" they won't be eating many beans now will they.

Front soybean futures 889.25 up 1.25.

.

"China faces long struggle to tackle African swine fever"

June 1, 2019

The disease is having second and third order effects as well.

There had already been in place a small change in preference away from pork among Chinese consumers which rising prices would exacerbate.

The Chinese government has been doing what they can to keep pork prices from rising—which would spur substitution effects even further—by making releases from the strategic pork reserves so demand has not yet pushed prices up to the +70% range forecast a couple months ago.

If prices do jump that much, demand for pork drops further.

Additionally, dead pigs don't eat, so you're seeing lower demand for soybeans, a reduction more important to global soybean markets than the U.S. tariffs and/or Chinese boycotts.

June 1, 2019

The disease is having second and third order effects as well.

There had already been in place a small change in preference away from pork among Chinese consumers which rising prices would exacerbate.

The Chinese government has been doing what they can to keep pork prices from rising—which would spur substitution effects even further—by making releases from the strategic pork reserves so demand has not yet pushed prices up to the +70% range forecast a couple months ago.

If prices do jump that much, demand for pork drops further.

Additionally, dead pigs don't eat, so you're seeing lower demand for soybeans, a reduction more important to global soybean markets than the U.S. tariffs and/or Chinese boycotts.

And many more.