And one of the best market calls ever.

From Newsweek:

"Over half our annual revenues come from digital sales so we've decided, a little bit like in other industries like newspapers or music or in broadcast, that it is time to flick the switch in how we primarily make and create our products," Pearson plc CEO John Fallon told the BBC.John Deere has been the evil face of the "right to repair" question i.e. did you actually buy what the manufacturer says "No you were just leasing the software" which question was partly answered in a U.S. Supreme Court ruling against a textbook publisher that we've highlighted over the years. Here's a 2018 iteration:

The move is a doubling down of sorts for Pearson, which made a major investment in higher education courseware (HECW) in the United States, but still suffered a five percent drop in revenue in 2018. Pearson funded the transition to digital textbooks, online coursework and subscription models in part with high-profile sales of subsidiary companies like the Financial Times and the Economist.

Pearson's new strategy for speeding adoption of digital textbooks is to stop updating print textbooks, leaving them to grow more obsolete against ebook alternatives. The typical textbook is revised every three years, with Pearson releasing new editions of approximately one-third of its 1,500 titles every year. Now, rather than 500 new print editions a year, as in 2019, Pearson will only update 100 textbook releases annually. Contrast that with ebook textbook releases, which will be updated on a rolling basis, like video games....MUCH MORE

"The Right to Repair Battle Has Come to Silicon Valley"

You didn't thinks all those posts on John Deere and "Kirtsaeng v. John Wiley & Sons, Inc." were simply about tractors and textbooks did you? I mean, sure they were, but they were also about whether you own the stuff you buy and if the Supreme Court would uphold the First Sale Doctrine.And on Pearson:

Possibly The Funniest (Profitable) Stock Recommendation of All Time (PSON)

Paul Murphy now heads up the Financial Times' FT Investigations but can still be seen at FT Alphaville from time to time.

Originally posted Dec. 30, 2015 as:

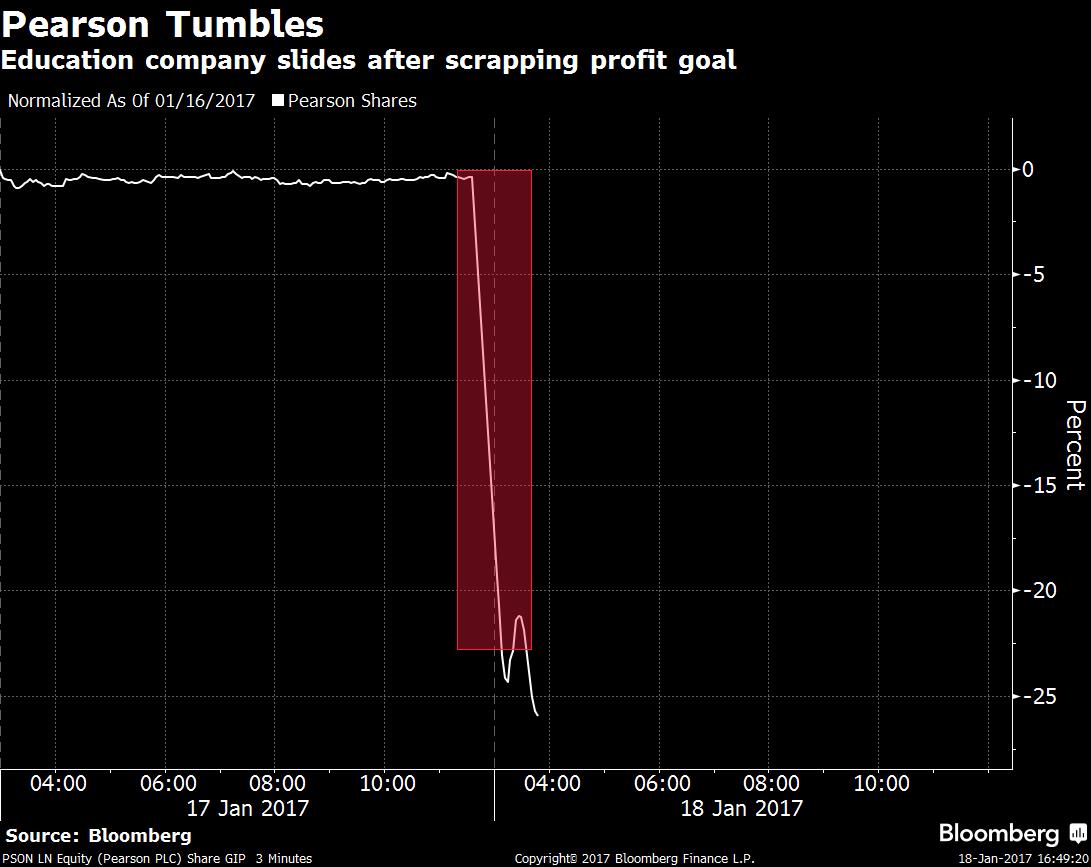

Possibly the Funniest (profitable) Thing We Saw In 2015: FT Alphaville's Founder/Editor Channels Mr. SubliminalThen updated on January 18, 2017 with this:

-from Bloomberg's Tracy Alloway (formerly FT Alphavillein)

Original post:

For our younger readers, here is Mr. Subliminal on Donald Trump cheating on his wife Ivana in 1990:

For our younger readers, here is Mr. Subliminal on Donald Trump cheating on his wife Ivana in 1990:

And here's FT Alphaville's editor, Paul Murphy,

Hard-bitten journalist

on former FT Alphaville owner Pearson and its stock, Dec. 1, the day the

Financial Times was handed over to Nikkei, while appearing to be having

a normal conversation with Alphavillein Bryce Elder:--------

--------

-------

-------

-------

--------

...MUCH MORE

The stock is currently trading at 739p, down 11.17% so far this month, after trading under 700 a couple weeks ago....

Updated stock price, January 18, 2017:

583.50 GBX down 224.50 (27.78%) on the day.And FT Alphaville's latest commentary on Pearson.