From the Chicago Tribune, Dec. 5:

Car insurance industry, meet potential disrupters Google and Apple.

Currently,

nearly all mainstream insurers that offer driver-monitoring programs

use relatively expensive devices that plug into a portal under the

dashboard.

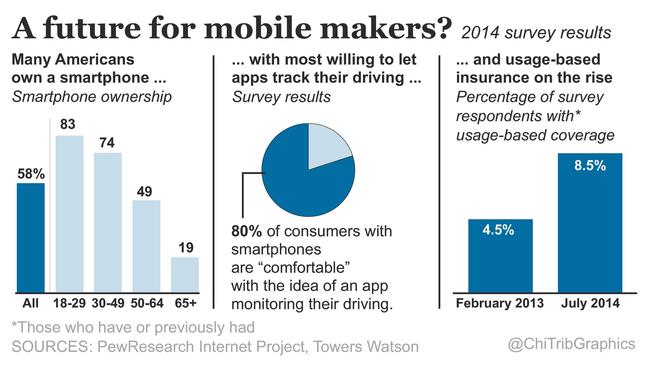

Usage-based insurance programs, also called telematics, are a small but growing segment of the auto insurance business.

Developing

Android and iPhone smartphone apps, in contrast, would cut carriers'

upfront costs when they offer telematics insurance programs, which track

policyholder habits such as mileage and braking in exchange for

potential savings on insurance.

The prospect of smartphones

becoming the central nervous system of usage-based insurance could

disrupt the property and casualty industry, which historically has

gathered its own loss data and kept that information in-house.

Google and Apple also have other advantages, including being

ubiquitous in the lives of many consumers and having been accepted as

big data collectors.

"Because of what Google and Apple can do,

they are in the position to gather so much data, and that data may be

more insightful than traditional variables," such as credit scoring and

motor vehicle records, said Sandeep Puri, a Deloitte consulting director

and co-founder of D-rive, the firm's auto insurance telematics

business. He offered his insights while participating in a Telematics

Update panel discussion titled "Big Impact Disrupters Enter the Market"

in Chicago.

The balance of power in driver-monitoring programs

could shift to Google and Apple if smartphones catch on as usage-based

insurance policies, Puri and other speakers at the event suggested.

They

also raised questions such as: What happens when, say, Google has the

data about losses to insurers? Does it charge insurers for it?...MORE