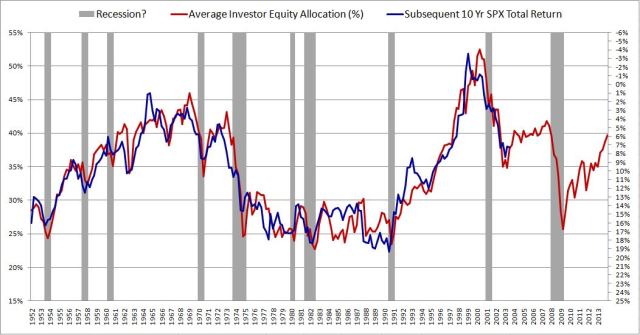

From Philosophical Economics (note the inverted return scale):

The Single Greatest Predictor of Future Stock Market Returns

Consider the following chart, which shows the average investor portfolio allocation to equities from January 1952 to December 2013:

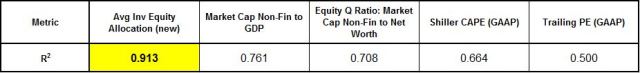

The metric in this chart takes no input from any variables traditionally associated with valuation: earnings, book values, profit margins, discount rates, etc. It consists only of a simple ratio between two numbers that can easily be calculated in FRED. Yet, as a predictor of future stock market returns, it dramatically outperforms all other stock market valuation metrics commonly cited.

In this piece, I’m going to do five things. First, I’m going to explain, in very simple terms, the accounting principles behind the metric. The explanation will include instructions (with ready-made links) for how to graph the metric in FRED. Second, I’m going to discuss the dynamics of asset supply, with a special focus on equities. Third, I’m going to challenge the conventional framework for understanding the relationship between valuation and stock market returns. Fourth, I’m going to introduce a new framework, one that relates stock market returns to equity asset supply. Fifth, I’m going to present a scatterplot of the predictive performance of the metric alongside other metrics, and discuss what the metric is currently forecasting for U.S. equity returns. I’m going to conclude by briefly touching on the question of whether or not the current U.S. stock market is “overvalued.”HT: Abnormal Returns

Accounting Principles: Cash, Bonds, Stocks

To begin, let’s arbitrarily divide the universe of financial assets into three categories: (1) cash, (2) bonds, and (3) stocks. By “cash”, I mean bank deposits and circulating currency. By “bonds”, I mean any certificate of obligation to repay borrowed cash–commercial paper, bills, notes, bonds, etc. By “stocks” (or “equity”), I mean shares of ownership in a corporation (public or private). Note that these definitions are intentional simplifications....MUCH MORE