The reason we posted this, way back in April 2007:

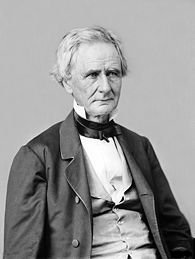

...Finally for investors in rent-seeking organizations there is the real risk that the politicians will change the rules. Heed the words of Sen. Simon Cameron, Republican and Democrat of Pennsylvania:

"The honest politician is one who when he is bought,

will stay bought."

was to point out the risk inherent in "political capitalism".

All the currently available technology alternatives are more expensive than baseload; solar photo-voltaic runs four to six times higher, wind twice as high.

Although there have been periods, in Texas, Colorado and Minnesota where wind-produced electricity was priced lower than baseload, a better indication of cost is the recently signed Power Purchase Agreement between Cape Wind and National Grid (NGG), 20.9 cents/kwh, versus the Mass. average 14.45, which itself is one of the highest in the country (U.S. average Feb. 2010, 9.43 cents).

The alt-energy sector is completely dependent on government subsidies and mandates to be competitive and those in turn are dependent on politicians.

The first thing a politician realizes is that the most patriotic, most self-sacrificing, most important thing they can do is get re-elected.

This realization tends to guide their decision-making and their votes.

In Europe they've hit the wall on the cost of the feed-in-tariffs, the public employee pay-offs and the welfare state all at the same time*, so we end up with stories like this, from Bloomberg:

As Europe grapples with the fallout from Greece’s economic woes, at least one unexpected corner of the economy is suffering: renewable energy companies.That’s because few wind, solar, and other green power installations would be profitable without subsidies, and as governments across Europe curb spending in response to the Greek crisis, those funds are being cut back, Bloomberg BusinessWeek reports in its May 24 issue.

“The uncertainty in Europe is a further burden in a market that is still challenging,” said Kathleen McGinty, a former adviser to President Bill Clinton’s administration who now helps manage $800 million in clean-energy investments as a partner at private equity firm Element Partners in Radnor, Pennsylvania.

The aid to renewable energy, paid by consumers in their power bills, is being slashed by governments that want to cut costs for businesses to boost economic growth and generate tax revenue as bond investors scrutinize their plans to rein in budget deficits more than three times the European Union limit.

German lawmakers on May 6 reduced subsidies to new solar plants by as much as 16 percent. Italian solar industry groups expect support for new generators to be scaled back by as much as a quarter in June.

In Spain, producers have offered reductions of up to 30 percent on subsidies for new solar cell installations. The government may also cut its backing for existing plants, which had been built with an expectation of guaranteed prices for 25 years, a spokesman in the industry ministry said last month.

Budget Deficits

The aid to renewable energy, paid by consumers through their power bills, is being slashed by governments aiming to curb their own budget deficits and to cut energy costs for businesses and consumers.

Across the continent, “the risk to subsidies is increasing,” Barclays Capital Analyst Vishal Shah said. “It’s going to be painful.”

For companies based outside of Europe, the pain is compounded by the decline in the euro whose value has been undermined by Greek crisis. Profits for North American companies selling their products into Europe declined as the currency fell 14 percent against the dollar this year.

Canadian Solar Inc., a panel maker based in Kitchener, Ontario, took a $20 million charge for foreign-exchange losses in the first quarter and may see earnings fall 84 percent if the euro averages $1.25 this year, Barclays estimates. The currency traded at $1.23 yesterday.

Currency Losses

Profits for Baoding, China-based solar-cell maker Yingli Green Energy Holding Co. would fall 42 percent with the euro at $1.25, while Chinese rival Suntech Power Holdings Co. would see a 79 percent drop, according to the Barclays analysis.

“The falling euro has been difficult to manage,” said Jerry Stokes, Suntech’s vice-president of strategy and business development. “Having suppliers in Europe, though, helps manage our costs.”

The troubles are taking a toll on stocks. Canadian Solar is down 50 percent since April 1, and Suntech is off by 35 percent. The 88-company WilderHill New Energy Global Innovation Index has fallen by 15 percent since then, compared with an 8.8 percent decline for the MSCI World index.

Spanish wind turbine-maker Gamesa Corp. Tecnologica SA, which is laying off a 10th of its workers after sales slumped 43 percent in the first quarter, has seen its shares tumble 19 percent since April 1. The company aims to weather the trouble as it expands overseas....MORE

*From "UPDATED: Short General Motors on the IPO"

...Good grief.

I swear the only thing THAT reminds me of is the Simpsons' episode where the aliens, Kang and Kodos plot to become Earth's Overlords via the American political system:Here's Kang showing off his (her?) political skills:

Kang on politics:Kang: Abortions for all.

[crowd boos]

Very well, no abortions for anyone.

[crowd boos]

Hmm... Abortions for some, miniature American flags for others.

[crowd cheers and waves miniature flags]

-From episode 4F02 "Treehouse of Horrors VII"