This weekend I pulled out a monograph I wrote in November 2004. The exec. summary fit on a 3x5 card:

Financial Expectations

- Wars cause inflation.(see 1919; 1946*; 1954)

- The dollar will fall to 60 = -1/3.

- In 2009, if not earlier, tax rates will go up (2008 Hillary).

- GDP growth will stagnate.

- The housing market will crack(see affordability index)

- Opec will demand a basket of currencies in payment for oil.

- Ghawar is dying-peak oil

Headlines this morning:

Dollar Falls to Record Low Against Euro on Bets Fed to Cut Rate

UPDATE 2-OPEC to study currency basket for pricing: Venezuela ...

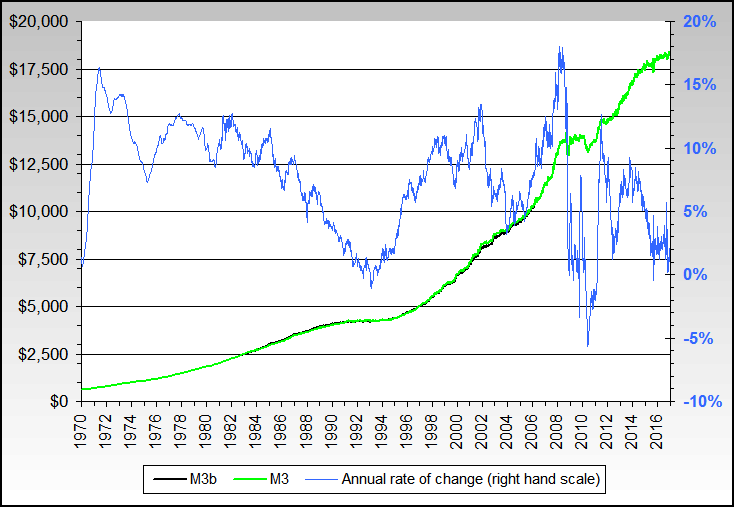

This chart of US dollar M3 growth scares me. The Fed is growing the money supply as fast as it did after the 9/11 attacks and faster than it did in 1982 during the worst recession since the Great Depression. This* Fed release still intrigues me.

From NowandFutures.

M3 consists of M2, institutional money market mutual funds, time deposits in amounts of $100,000 or more, repurchase agreement liabilities of depository institutions (in denominations of $100,000 or more) on U.S. government and federal agency securities, and Eurodollars.

*FRB: H.6 Release--Discontinuance of M3

Discontinuance of M3. On March 23, 2006, the Board of Governors of the Federal Reserve System will cease publication of the M3 monetary aggregate. ...

www.federalreserve.gov/Releases/h6/discm3.htm