From ING Think, May 19:

Trade war uncertainty is denting Chinese confidence, resulting in slower economic activity in April. Retail sales and fixed-asset investment both underperformed forecasts amid heightened caution. Yet the impact on manufacturing was less than feared.

In this articleProperty market softened in April as trough remains elusiveRetail sales growth slows with strength quite unevenIndustrial production showed tariff impact is focused on lower endFixed asset investment growth slows amid uncertaintyCaution amid uncertainty is acting as headwindProperty market softened in April as trough remains elusive

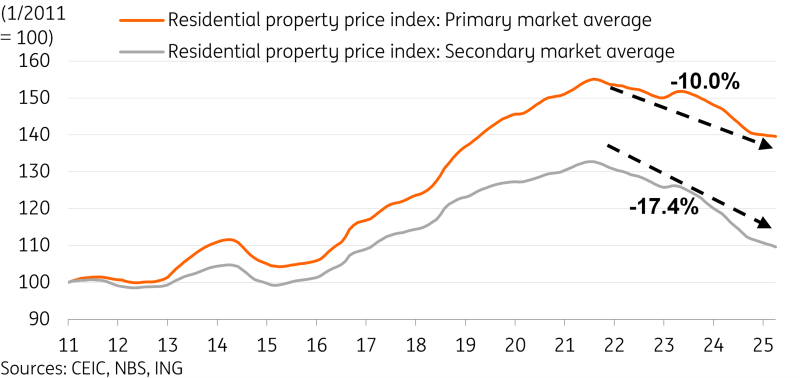

China's 70-city property prices for April continued to slide overall, with new home prices down -0.12% month-on-month and existing home prices down -0.41% MoM, both seeing slightly steeper declines than the pace in March. Establishing a trough on a national level is taking some time, as the recovery of the property market remains uneven and gradual. It's possible that tariff-related pessimism and uncertainty kept more buyers on the sidelines in April.

As the headline number suggests, April's city-level breakdown also softened a bit from March. Data showed that 25 of 70 cities saw new home prices unchanged or higher. This is a little lower than the 28 in March, but still a respectable number. Steps that could be taken to slow new supply coming to market include potentially moving away from the home pre-sale model. This could help new home prices recover faster.

The secondary market continues to underperform, with only 6 of 70 cities showing existing home prices stable or higher in April, down from 14 of 70 in March. The health of the secondary market is arguably more important in terms of stabilising domestic household confidence, as these are the assets on household balance sheets.

The 10bp rate cut in May could lower mortgages a little, and marginally help the property market recovery process. Data in recent months has showed a generally slower rate of decline. There are certainly silver linings in individual cities, but a nationwide turnaround has yet to be confirmed.

Property price decline has slowed but not yet turned around

Retail sales growth slows with strength quite uneven

Retail sales grew at 5.1% year-on-year in April, down from 5.9% YoY in March, and notably softer-than-expected on a headline level....

....MUCH MORE