Please don't be Albert, please don't be Albert...

From MacroBusiness (Australia), August 9:

Albert Edwards of Societe General on the tech shakeout.

What just happened? Don’t look Ethel

The FT’s ever-excellent Rob Armstrong sums up the current turmoil nicely in hisUnhedged column, arguing that the recent rout has been driven by a combination of:

- “The perception of increasing recession risk in the US

- The unwinding of the yen carry trade as the spread between Japanese and US rates shrinks

- Internal dynamics in a market dominated by momentum trading, risk parity strategies, passive investors and other wicked inventions that suppress volatility before suddenly releasing

- And finally, the unwinding of a very crowded, concentrated, and overpriced Big Tech trade.”

These four factors nicely encapsulate the key drivers I would also highlight. The immediate trigger might have been fear of recession (unfounded or not), but the three other factors then ganged up to form a merciless lynch mob.

It is all very reminiscent of the events I witnessed first-hand in the October 1987 crash. Back then, contrary to the Louvre Accord designed to stabilise a weak dollar, an unexpected West German rate hike triggered fears that the Fed would also have to hike to prop up the dollar at the risk of tipping the US into recession. The Fed didn’t actually hike, and a recession was avoided, but on the day over-exuberant investors combined with a proliferation of ‘portfolio insurance strategies’ to blow the market to smithereens. Ouch!

These days investors have even more sophisticated (explosive) strategies at their fingertips. The VIX surge on Monday chimed with the February 2018 ‘Volmageddon’ shock. Looking for more recent analogies, the mainstream media asserted that the UK’s October 2022 bond market meltdown was due to PM Liz Truss’s career-ending budget. Yet, in a littlepublicised working paper, BoE economists attribute two-thirds of the surge in gilt yields in October 2022 to pension fund hedging strategies, the modern day equivalent to 1987’s portfolio insurance strategies – see link (bottom of page 34).

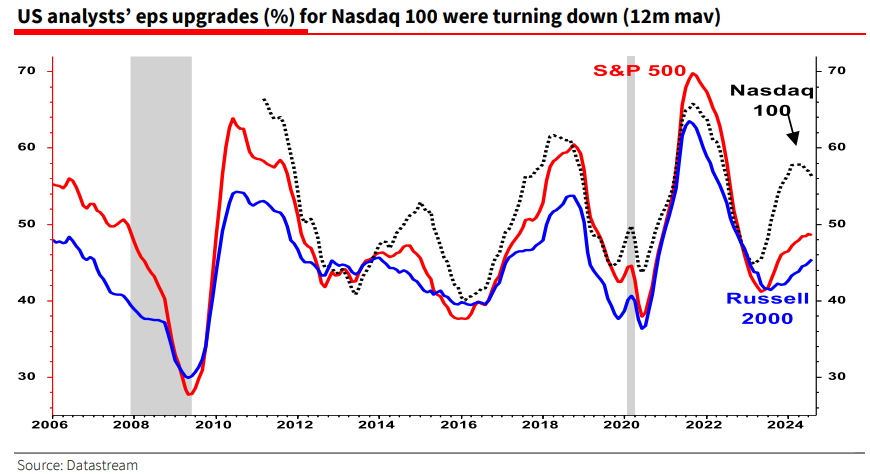

There is a very simple explanation for the latest equity market meltdown. I showed the chart below in my 18 July note Are we on the brink of another Nasdaq crash? To put it simply, a downturn in analysts’ optimism on tech profits almost always spells trouble.

Mixed earnings from some of the Magnificent 7 attracted attention last week, but tech earnings optimism actually topped many months ago – in February to be exact. Typically, when eps optimism starts to slide,tech stocks lose momentum and fall below their 200-day moving average – with the subsequent undershooting at least proportionate to the previous overshoot....

....MUCH MORE

Société Générale's title for the report (August 8) was "ALBERT EDWARDS Buy the dip or jump off a sinking ship?" Here's the link to Robert Armstrong's UnHedged column, August 6:

"Anatomy of a rout"