Ah, a fellow traveler.

Though he doesn't use the terms "advantage flywheels" and "hyper-Pareto distribution of profits" those concepts are exactly what Mr. White is writing about.

And the answer to the question posed in the headline is, contra , yes.

Unless there is some sort of action by forces/institutions larger than the megacaps they will continue to metastasize.

Via ZeroHedge, May 2:

Authored by Simon White, Bloomberg macro strategist,

The largest firms in the US are unsurpassably pulling ahead of their smaller rivals by earning more, investing more, holding more cash and buying back more of their stock.

The bull market is thus likely to remain historically lackluster and less robust as smaller companies continue to lag their bigger counterparts.

They say the rich get richer, and nowhere is that more true than for the most-valuable firms in the US. The “Magnificent Seven” is by now a well-worn moniker for a septet of some of the biggest companies in the world, such as Nvidia, Apple and Amazon.

Yet the widening leadership that the largest firms already enjoy extends beyond the monopolies or oligopolies that benefit many of them. They are also bolstering their financials and investing in the future in such a way that they are leaving their smaller brethren in the dust, rendering their lead invulnerable.

Large-cap indexes in the US have never been so concentrated, with the Magnificent Seven accounting for 27% of the S&P 500’s market cap. The outperformance really began to take off in the pandemic. Expanding to the largest 50 stocks in the S&P, we can see these began to significantly outpace the index’s smallest 250 members after 2020.

What lies behind this dominance? There are at least five reasons:

Massive loosening of monetary policy in the pandemic

The US running its largest ever pro-cyclical deficit

Tech firms benefiting from mass working-from-home during Covid

Companies taking advantage of the pandemic disruptions to raise margins by almost more than they ever have before – with the largest firms taking advantage of monopolies to raise prices the most

The AI boom kickstarted by ChatGPT

These advantages are allowing the largest firms to move into an unbeatable position, condemning the smallest ones to playing permanent second fiddle. Such a set-up means the bull market is fated to be mild compared to historical bull runs, as well as being less robust.

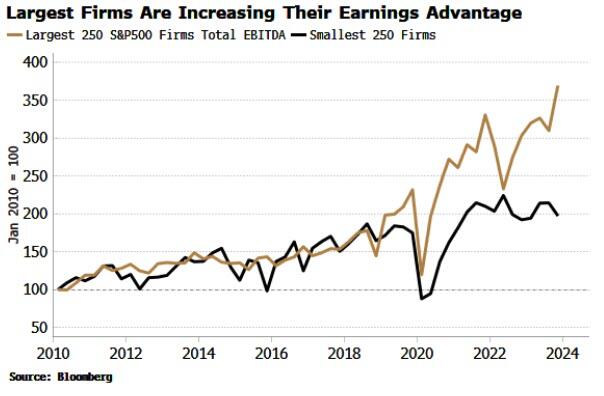

Market concentration can also be seen in earnings, with the largest 50 firms accounting for 35% of the S&P’s total Ebitda. An acceleration in earnings at the largest firms since the pandemic is fortifying that effect. The top 50’s Ebitda has risen over 3.5x since 2020, while it has only doubled for the smallest 250 companies in the S&P.

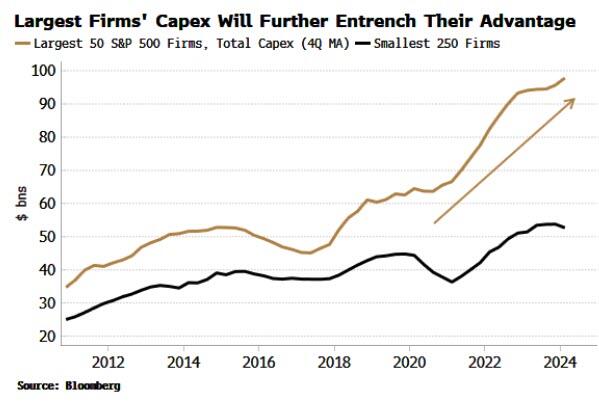

Those earnings are further ingraining big firms’ advantage. They are now outspending their smaller cousins on future investment on an epic scale. Tech firms are ploughing money into GPU chips, data centers and energy production in a way that makes it increasingly impossible for others to ever catch up – not only in technology, but across the economy as AI gnaws away more and more at the need for many jobs.

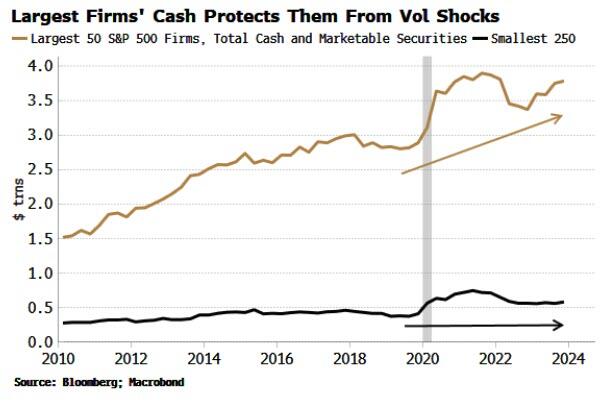

The largest firms are also bolstering their cash positions. While smaller companies’ cash and marketable securities is up only marginally since the pandemic, the pile at large firms is going from strength to strength and is on a strong upward trend. The biggest 50 companies in the S&P hold 53% of the index’s total corporate cash, compared to only 8% for the smallest 250.

Having cash is essentially being long volatility. If anything unexpected happens, you are in a better position to deal with it. A financial shock causes margins to rise? That cash is there to cover it. A rival goes bust? The cash can be used to acquire it on the cheap. Smaller firms are increasingly short volatility and are vulnerable to or are unable to capitalize from unexpected shocks.

This cycle has been dominated by rising rates, so it’s no surprise interest expenses have increased across the board. The largest and the smallest firms have seen their quarterly interest costs climbing by about $7-8 billion since the pandemic....

....MUCH MORE

We've been yammering about this stuff for years but it really became apparent during the covid days when mega retailers remained open, whether physically in the case of a WalMart or online like Amazon, as their smaller competitors were forced by government decree to close.

If interested see April 30's "Elon Musk says any company that isn’t spending $10 billion on AI this year like Tesla won’t be able to compete" (TSLA), not so much for Elon but for the embedded links on the conceptual basis of business reality in 2024 and beyond.