Over the next twenty years the entire U.S. electrical grid will have to be replaced.

Fifteen years ago when President Obama and Vice President Biden were talking Recovery Summer and "shovel ready jobs" the go-to stock for transmission infrastructure was Quanta Services (PWR). Unfortunately the

Builders are running into shortages of transformers—those buzzing boxes at the top of power poles—and transmission wires.

“We’re…seeing extended lead times for transformers,” said David Schulz, CFO at electrical distributor Wesco , at a conference in September. CEO John Engel said on the company’s third-quarter earnings conference call in November that the wait to get transformers was still longer than normal.

On Friday, the National Association of Home Builders announced plans to seek $1.2 billion in government funding to boost U.S. transformer production.

It isn’t just transformers that are needed. Power lines are hard to source, too. “ Prysmian [lead time] is about 50 weeks plus,” said Jason Huang, CEO at TS Conductor. TS is a start-up making higher-tech transmission wires designed to carry more juice.

Prysmian is one of the dominant producers of cables globally. Its backlog of orders sits at about $11 billion, up from about $2.3 billion at the end of 2019.

Those data points are three canaries in the coal mine—so to speak—signaling that the U.S. isn’t quite ready to expand its electricity grid.

“You already have a tight supply situation,” added Huang, in an industry he said is poised to double its capital spending. The industry is “not even seeing that increase in your capex spending yet,” he said “This is just today’s environment.”

Overall, electricity demand growth is projected to accelerate, thanks to EVs and everything else that is going electric. The Energy Department sees electricity generation capacity expanding at a rate of about 2.6% a year over the coming 20 years, about double the rate since 1990.

Electric utilities in the U.S. have spent roughly $135 billion a year on average for the past few years to maintain and increase their capacity. That number should be near $170 billion in a couple of years, according to the Edison Electric Institute....

....MUCH MORE

"The Great Electrician Shortage"*PWR, A story in three posts:

October 2009

Transmission: "Quanta Services believes in more power to more people" (PWR)

Quanta will be a huge beneficiary of any transmission infrastructure build-out. From BloggingStocks...August 2010

Transmission: Quanta Services Meets; Cuts Outlook... (PWR)

And as the old nature shows used to say as the lions approached the Wildebeest:

"Sadly now, there can be but one outcome."The stock was down 5.36% yesterday and another 3/4% afterhours to $20.15.

This is another one of the infrastructure companies that, if the politicians had been telling the truth about the stimulus money, would have been one to bet on....

PWR closed at $21.72.

This is one of the companies that should have benefited from all the "shovel-ready" talk of a couple years ago but, of course, that was just talk.

One of these days the country will get around to upgrading the electrical grid, hopefully before the brownouts start....

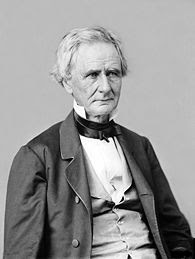

The 26th Secretary of War, the Democrat and Republican (!) Senator from Pennsylvania, Simon Cameron:

Our Hero

"The honest politician is one who

when he is bought, will stay bought."