I'm telling ya, this is a big deal. Not just for the $12.5 billion purchase price but for the $100+ billion in assets that GIP manages.

From Institutional Investor, January 12:

“Infrastructure is one of the most exciting long-term investment opportunities, as a number of structural shifts re-shape the global economy,” BlackRock CEO Larry Fink said on the firm’s second-largest deal.

BlackRock has acquired Global Infrastructure Partners, one of the world’s biggest independent investors in roads, airports, utilities and other projects.

The world’s largest asset manager is buying GIP, which has $100 billion in assets, for $12.5 billion in cash and stock ($3 billion of cash and approximately 12 million shares of common stock). The deal announced Friday morning is BlackRock’s biggest in 15 years, since it bought Barclays Global Investors in 2009.

Today, infrastructure is a $1 trillion market but it is forecasted to be one of the fastest growing segments of private markets.

“Infrastructure is one of the most exciting long-term investment opportunities, as a number of structural shifts re-shape the global economy. We believe the expansion of both physical and digital infrastructure will continue to accelerate, as governments prioritize self-sufficiency and security through increased domestic industrial capacity, energy independence, and onshoring or near-shoring of critical sectors,” Larry Fink, BlackRock’s chairman and CEO, said. “Policymakers are only just beginning to implement once-in-a-generation financial incentives for new infrastructure technologies and projects.”

The deal triples the size of BlackRock’s existing $50 billion infrastructure business to $150 billion. BlackRock says the combination will create a top debt and equity investment business, strengthen its deal flow and improve its co-investment capabilities.

GIP’s management team, led by Bayo Ogunlesi and four of its founding partners, will join BlackRock and lead the new platform. Ogunlesi, chairman and CEO of GIP, will also join BlackRock’s board after the deal closes....

....MORE

The backstory on Ogunlesi is pretty interesting. Among other incidental tidbits, he will have to step down from the board of Goldman Sachs before he joins BlackRock's board. Goldman's loss.

Previously:

February 2008: "Infrastructure: a New Alternative Asset Class?"

June 2010: "Who is the World's Top Infrastructure Investor? (Hint: It's not even close)"

December 2022: Private Equity: "For infrastructure, KKR sees 'incredible' opportunities in digital, energy assets"

January 2024: BlackRock Goes Large-by-Large In Infrastructure (BLK)"

January 2024: "Investors look set to pour cash into infrastructure following BlackRock acquisition" (BLK)

And many more. If interested use the 'search blog' box, upper left.

As always, heed the wise words of our first inductee into the Climateer Hall of Fame:

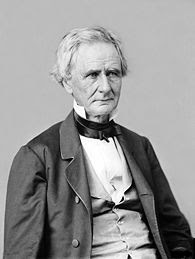

The 26th Secretary of War, the Democrat and Republican (!) Senator from Pennsylvania, Simon Cameron:

Our Hero

"The honest politician is one who

when he is bought, will stay bought."

A classic case study is when the Obama-Biden Administration lied about the "shovel ready jobs" and the American Reconstruction and Recovery Act of 2009 and instead sent the money to their voting constituencies:

February 24, 2010

Private Equity: "Rough Road For Infrastructure Funds" (ABB; CAT; FWLT; FLR; PWR)