From MacroBusiness, December 22:

Albert Edwards: Bond bull to stampede 2024

It is that time of year when sell-side macro strategists make their predictions for the next 12 months. For me, there is one massive bubble waiting to burst in 2024.

•The two main macro surprises for 2023 were that the widely predicted US recession failed to materialise, and China did not enjoy a strong recovery in the wake of the easing of draconian Covid restrictions.

•But one ‘surprise’ did show up and set my head spinning, namely the surge in the US IT tech sector. If 2022 was a bad year for tech, hit by the double whammy of missed earnings and rising bond yields, 2023 saw ChatGPT arrive on the scene and trigger a frenzy of FOMO that even a surge in bond yields above 5% failed to stop.

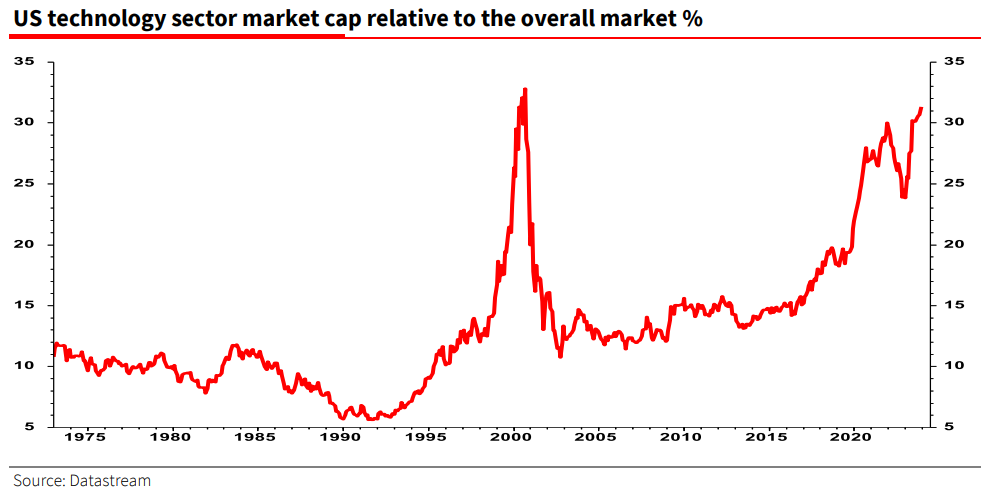

•Now, I acknowledge the outperformance of US ‘tech’ has very much been driven by the Magnificent 7, and that many mega-cap internet stocks are not even officially categorized by the FTSE/MSCI/S&P as ‘tech’ stocks – but that makes it all the more amazing that US tech stocks now comprise almost one third of US market capitalisation (see chart below).

•So, 2024 begins with the US tech sector accounting for as much of the US broad market index as it did for a few months of madness in the summer of 2000.

•Recall that until the end-2018 ‘Powell Pivot’ (the other one!), US tech was trading at only a slight P/E premium relative to the overall market, with forward P/Es in the mid-teens for both. Compare that to a current US IT 12m forward P/E of 27x vs a market at under 20x (ie a 7x premium). Yes, 27x is down from the end-2022 high of 30x, but the current 7x IT premium is as high as it ever has been, apart from the madness of the 2000 Nasdaq bubble.

•I understand all the arguments as to why the current conjuncture is sustainable. I even find some of them plausible. But you know what, I’ve been doing this job for 40 years and I’ve heard it all before. So, if I had to warn of one seismic shock for 2024 that would shake investors to their core, it is not whether the US or China does or doesn’t go into recession or if inflation and interest rates are a bit higher or lower than expected. No, the biggest surprise that could send a shockwave through portfolios is the US IT market cap bubble bursting and tipping the entire US market into a slump.

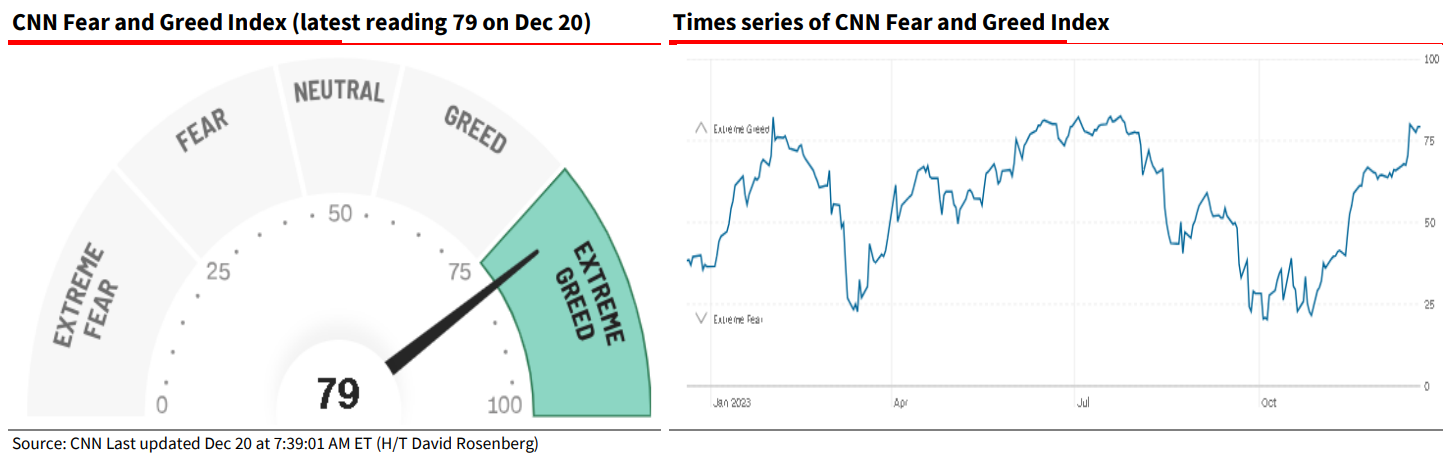

We end the year with the usual Santa rally. My recollection it is that it is often the New Year reappraisal that brings a change of direction. Technically the US equity market is now looking stretched. The CNN Fear and Greed Index, for example, is showing Extreme Greed, with price momentum, the put/call ratio and volatility all stretched. But CNN’s Index was at such high levels as recently as July this year, just ahead of a three month, 11% swoon. And the current 79 Extreme Greed reading contrasts with the lowly 38 Fear signal this time last year.

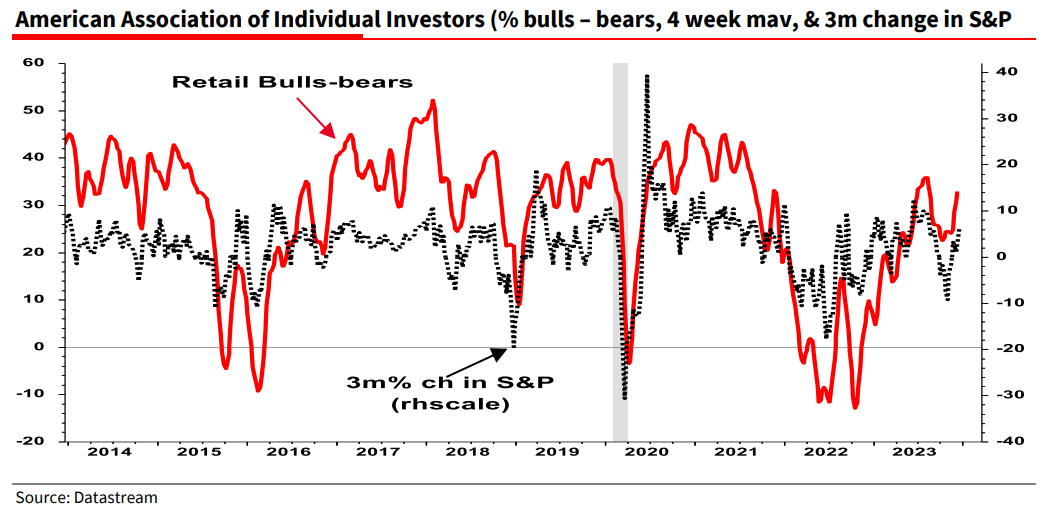

One key technical measure that the CNN Index does not capture is the retail investor balance between bulls and bears, which also signals that the market is ripe for a correction.

Whether a correction turns into a full-blown bear market depends on whether the economy slides into recession. The current surge in the S&P tells us nothing about that risk. Gerard Minack, of Downunder Daily fame, notes that the SPX is typically within 2% of its cycle high twomonths before the start of a recession. So much for the equity market being forward looking.

The excellent David Rosenberg makes a very important point about what the recent bond market rally tells us; “I’m not sure that the pundits or even market participants have a complete understanding or appreciation as to how far interest rates can go down from here now that the bond bear market has been broken. … Whether the first cut is March or May, the die is cast and what matters most is the magnitude and duration of this renewed easing cycle that is now in full view…

…A 110-basis point plunge in the 10-year Treasury note yield serves as an exclamation mark in that regard. We have seen ten such declines from a peak over the past forty years. And not once did the fresh bull market stop there. The average additional drop was -200 basis points; the median was – 170 basis points; the mode was -150 basis points. So historically speaking, it shouldn’t surprise anyone other than the bond permabears that we end up seeing the 10-year T-note yield slice below 2.5% before this thing runs out of gas. Of these other prior episodes, 4 involved recessions, 3 occurred in the context of a financial crisis, and 3 needed none of those, only requiring a big decline in inflation.”

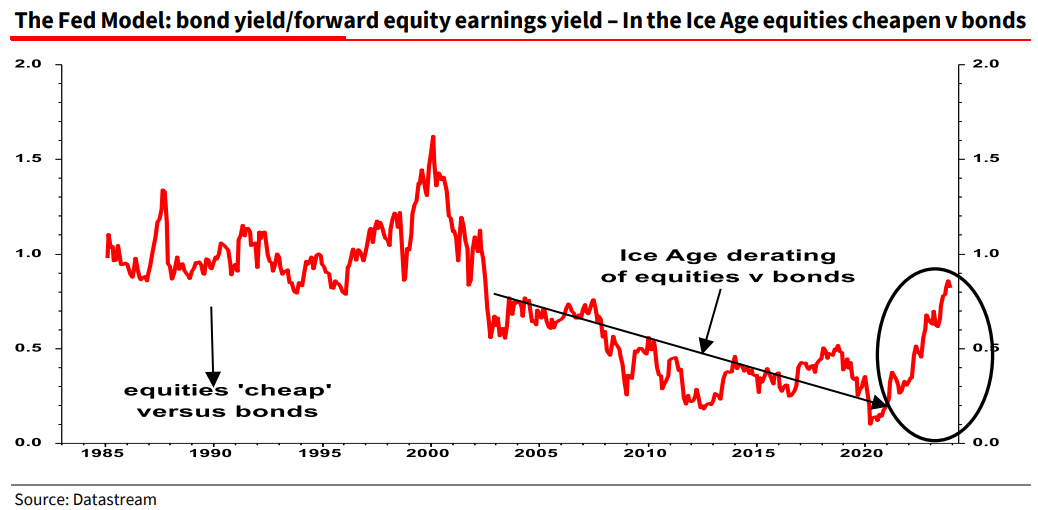

I absolutely agree with @EconguyRosie’s analysis. There is a lot further to go in this bond rally, and I think many investors may even start believing we are returning to the ‘Ice-Age’ interest rates that prevailed pre-pandemic – as the IMF suggested not so long ago. They would be mistaken in my view. I anticipate only a brief cyclical visit back to ultra-low yields....

....MUCH MORE

MacroBusiness home