A very handy conceptual framework first posted after the start of the U.S. lockdowns, April 2020. Schools were closed so it seemed natural to link to a superb mini-MBA module.

Eat your heat out HBR.

From FutureBlind:

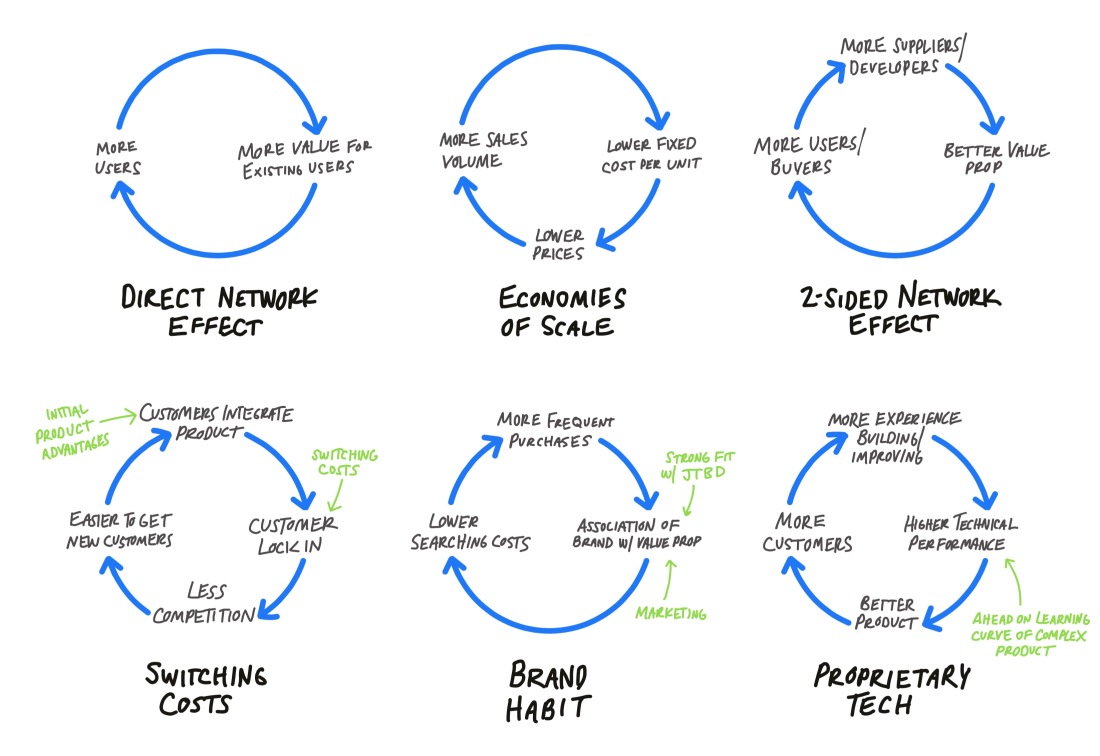

Competitive advantage can be represented visually as 1 or more feedback loops. These create the advantage “flywheel” that maintain and grow a moat over time. Think of a big, heavy wheel that takes some effort to get started but then coasts off its own momentum.

Before continuing, check out Eric Jorgenson’s primer on the flywheel mental model here.

Flywheel archetypes

Here are 6 simple examples of common advantages represented as flywheels (or “causal loops” in systems terminology). These loops are generalized — they’ll be expressed uniquely in every company that has them.

A few examples of how each advantage flywheel can vary:

As Eric discussed in his flywheel post, each wheel needs a push to get started. Written in green on a few of the archetypes above are initial advantages to get the wheels moving. Whether it’s a better user experience, a technical breakthrough, or a bootstrapped network based off of an existing network (college campuses for FB) or a useful utility (Instagram).

- In the Economies of Scale flywheel above, the primary driver of more volume is low prices. This fits for most consumer businesses, but lower prices aren’t always the outcome of lower unit costs. If prices are maintained or increase, scale will yield higher margins → more resources to spend on growth → more sales volume.

- The Brand Habit flywheel exhibits the typical loop for habit-reinforcing association of a brand with a specific quality or job-to-be-done. Think “thirst quenching happiness” for Coca-Cola and “low prices” for Wal-Mart. Another example of brand advantage is more of a social proof effect: Product has success → the cool kids want it → improved perception of product → …

Real world examples

The above archetypes can be combined to create more comprehensive flywheels modeling the driving “engines” of each company’s moat:

The most successful moats have multiple flywheels that feed off of each other’s momentum. Google’s technical advantages enable stronger brand allegiance and vice versa. Coca-Cola’s marketing-driven brand feeds off of it’s distributor/bottler based network effects. Facebook’s brands have at least 3 reinforcing network effects: direct (social network), 2-sided aggregator (advertising and developers), and brand-driven social proof....

....MUCH MORE

As artificial intelligence comes more and more to the fore, the advantages accruing to those companies that can afford to make use of their data and custom train the machines will act as advantage flywheels that shift the distribution of profits from the normal Pareto: 80% of the loot goes to the top 20% of businesses to perhaps as much as 95% of all the profits going to the top 5% of businesses.

I didn't really mean the "eat your heart out HBR" line.Here's the Harvard Business Review on this very point:

HBR—From Pareto To Hyper-Pareto: "AI Is Going to Change the 80/20 Rule"