From ZeroHedge, December 13:

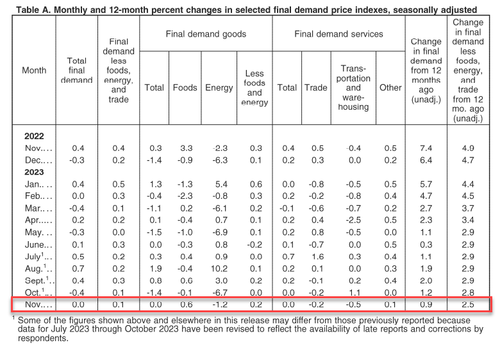

After collapsing 0.5% MoM in October (the most since April 2020) on the back of plunge in gasoline prices, analysts expect Producer Prices to be unchanged MoM in November and they were spot on (although October was revised up to a 0.4% MoM decline).

Headline PPI YoY declined to +0.9% - the lowest since June.

Source: Bloomberg

Excluding food and energy, the core PPI was cooler than expected, unchanged MoM in November versus expectations of a 0.2% MoM rise. That dragged the Core PPI YoY down to 2.0% - its lowest since January 2021...

Source: Bloomberg

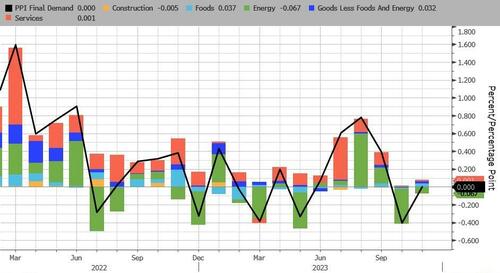

Energy was once again a big driver of the decline...

While Food and Services inched higher MoM...

...thanks to as 58.8% surge in the price of chicken eggs.

Final demand goods:

The index for final demand goods was unchanged in November after dropping 1.4 percent in October. In November, price increases of 0.6 percent for final demand foods and 0.2 percent for final demand goods less foods and energy offset a 1.2-percent decrease in the index for final demand energy.

Product detail: Within final demand goods in November, prices for chicken eggs jumped 58.8 percent. The indexes for fresh fruits and melons, utility natural gas, electric power, and carbon steel scrap also moved higher. In contrast, prices for gasoline fell 4.1 percent. The indexes for processed poultry, industrial chemicals, jet fuel, and liquefied petroleum gas also moved lower.

Final demand services:

The index for final demand services remained unchanged in November, the same as in October. In November, prices for final demand services less trade, transportation, and warehousing edged up 0.1 percent. Conversely, the indexes for final demand trade services and for final demand transportation and warehousing services declined, 0.2 percent and 0.5 percent, respectively. (Trade indexes measure changes in margins received by wholesalers and retailers.)...

....MUCH MORE