Huh.

A twofer. First up, from OilPrice, October 2:

- The copper market's extreme contango, not seen since 1994, indicates accumulating inventories and faltering demand, especially from a weakening Chinese property market.

- Amidst global manufacturing slowdowns and concerns of recessions in developed economies, the copper market hints at an uncertain future, with risks leaning towards a decline in price.

- Long-term projections, however, remain positive for copper due to the decarbonization drive, with industry experts predicting elevated prices and increased demand as the decade progresses.

The copper market is in a state of extreme contango—a state of the futures curve where futures contracts trade at a premium to the spot price and signal weak prompt demand.

The cash to three-month contango on the London Metals Exchange (LME) jumped at the end of September to the highest since at least 1994 in data compiled by Bloomberg, as inventories pile up while demand seems to falter.

Analysts say that increasing inventories signal weakening demand amid slowing global manufacturing and a weak Chinese property market, and are potentially anticipating recessions in developed economies.

Due to the energy transition push, industry executives and analysts still expect high demand for copper in the medium and long term. But near-term demand and prices could continue to be weak amid an uncertain outlook for the global economy and copper market in China, the world's top commodity consumer.

The faltering Chinese economic rebound after the reopening and the continued weakness in China's property sector have weighed on copper prices this year.

Without a meaningful recovery and amid weaker economies elsewhere, copper prices could further slide in the coming months.....

....MUCH MORE

Related:

November 24, 2022

Copper: What's Your Timeframe?

Four from Mining.com:

Tomorrow through month-end? Dollar Index down again is almost mechanistically supportive for commodities priced in bucko's.

Next month? "World’s biggest copper mine moves closer to strike"

Next year? "BHP sees 2-3 years of elevated costs, near-term copper oversupply"

Next decade? "Codelco sees copper deficit at 8 million tonnes by 2032"

For now and into Q2 2023 the West and maybe China have a recession they have to get through.

And enough with this nonsense: "Copper price rises on China’s property support".

As we've said a few times, government support of the overindebted property developers is not nearly the same thing as supporting the construction of new housing.

And from Bloomberg via India's MoneyControl, October 3/4:

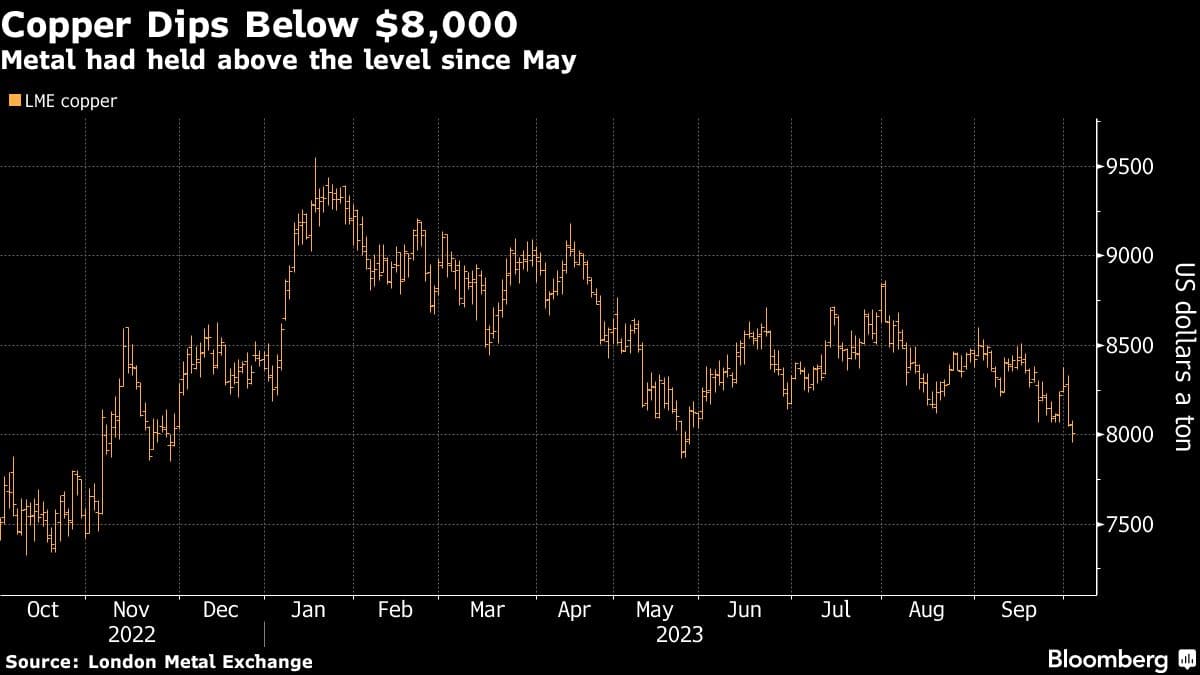

Copper extends retreat to below $8,000 for first time since May

The concerns were reinforced by an unexpected increase in US job openings that highlighted the durability of the labor market.

Copper fell for a second day as hawkish signals from the Federal Reserve and weak manufacturing data across major economies damped the demand outlook.

The industrial metal briefly traded below $8,000 a ton on the London Metal Exchange for the first time since late May as worries over higher-for-longer US interest rates spurred risk-off sentiment in global financial markets. The concerns were reinforced by an unexpected increase in US job openings that highlighted the durability of the labor market.

....MUCH MORE

This would tend to point toward Trafigura attempting to manipulate at minimum, perceptions, and possibly manipulate markets. More after the jump....