We've found the author of this piece, free-lancer Jennifer Zeng, to be a straight-shooter and handy with the numbers, she was a researcher at the Development Research Center of the State Council of the People's Republic of China.

Regarding the platform, Japan Forward, they were new to me as of yesterday and looking at their offerings seem to be center-right or somewhat conservative or whatever it would be called in Japan. They were linked in an Asia Times article if that means anything.

From Japan Forward, October 3:

A Big Turning Point in China's Fiscal Bankruptcy

Even official figures indicate that China's fiscal revenue is facing a severe, long-lasting decline, with the real estate crisis having a significant impact.

Everybody knows that China's economy is in serious trouble. But how serious is the problem? When will the tipping point be reached? What could Xi Jinping do after a full financial collapse across the People's Republic of China (PRC)? The latest fiscal data offers us some insights.

Sharp Revenue Drop in August

In August, China's economy hit a critical point. The government's monthly budget income took a sharp drop.

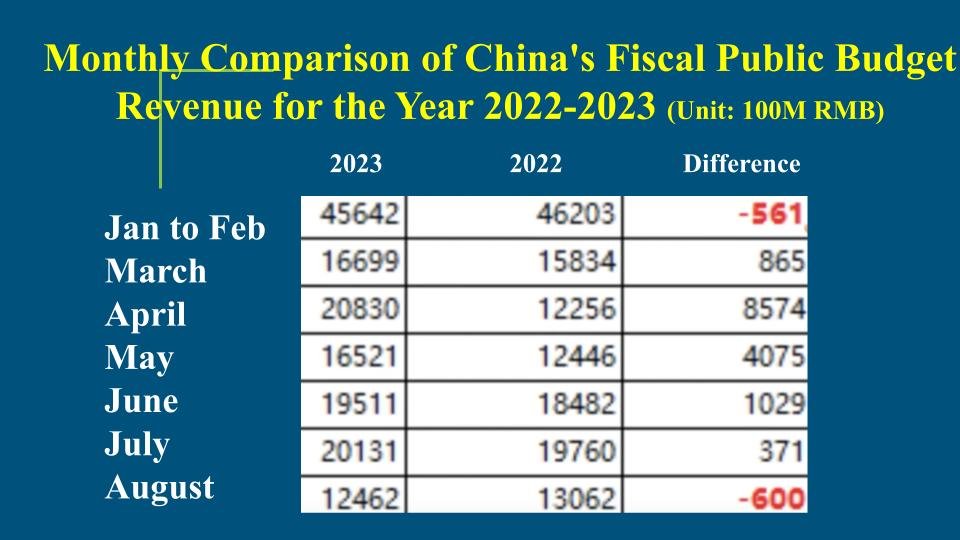

Let us compare China's public budget income from January to August 2022 and the same period in 2023, as summarized by a Chinese economist named Lao Man.

These are official numbers and so may not be entirely reliable. However, we can still find some trends.

In January and February 2023, most industries and government departments were either closed or half-closed. This was due to the sudden lifting of COVID-19 lockdowns and the long Chinese New Year holiday. As a result, the income for these two months combined was ¥56.1 billion CNY (around $7.68 billion USD) less than the same period in 2022. Afterward, China's economy had a brief recovery.

At the same time, 2022's deferred value-added tax was paid in 2023, boosting tax revenue. So, in March and April of 2023, China's financial data looked very impressive. Each month had significant increases, especially April, with an astonishing ¥857.4 billion CNY ($117 billion USD) added.

However, starting in May, with the weakening of China's economy, almost all other tax revenues began to shrink significantly. This was despite the deferred value-added tax payment having been added in. Monthly budget income quickly faltered. The revenue difference dropped to ¥400 billion CNY ($54.7 billion USD) in May, ¥110 billion CNY ($15 billion USD) in June, and just over ¥30 billion CNY ($4.1 billion USD) in July. In August, the difference became negative.

Individual Incomes Are Dropping

Compared to August 2022, income was down by ¥60 billion CNY ($8.2 billion USD) in August of 2023. This made August of 2023 a turning point for China's fiscal revenue.

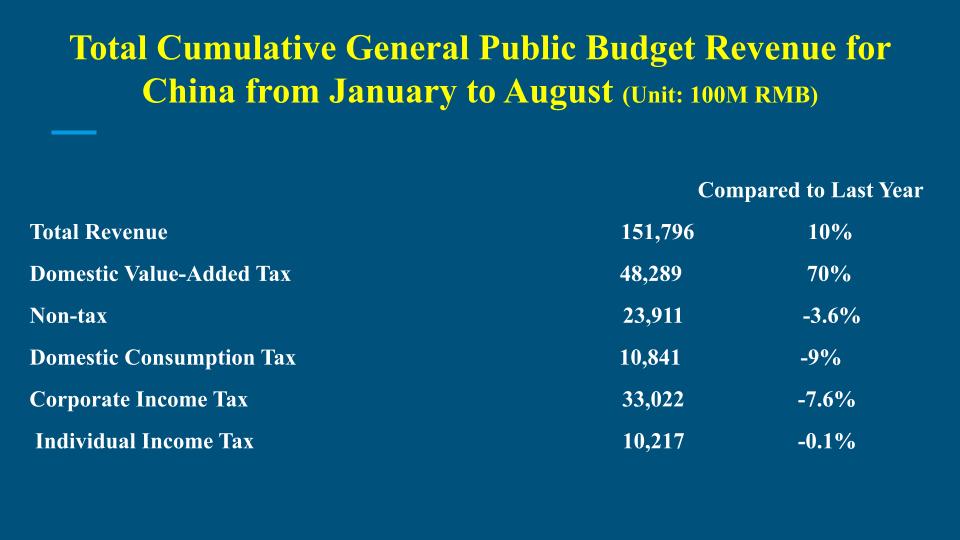

Consider some specifics. Apart from the value-added tax, most items have shrunk dramatically. From January to August 2023, non-tax revenue decreased by 3.6%. The "non-tax revenue" includes fines, meaning the economy is so bad now that even fining people is difficult.

Consumption tax fell by 9%, showing the real state of consumption. People aren't spending as much. Corporate income tax fell by 7.6%, meaning companies aren't making as much profit as before.

Individual income tax fell by 0.1%. This is not a huge drop, but it does signify a historical moment. The decreased value for individual income tax means that ordinary people's incomes are dropping. This marks the first time this has happened since China joined the World Trade Organization (WTO) in 2001.

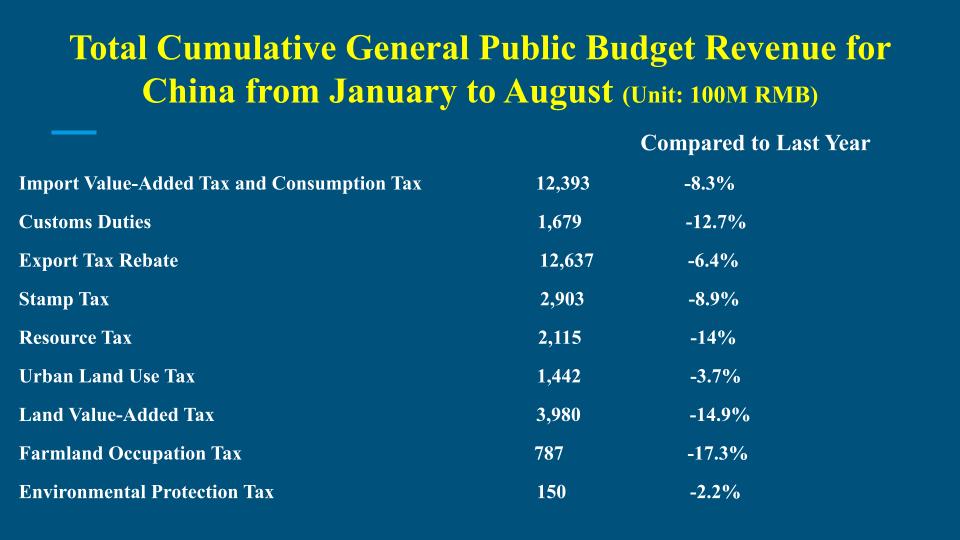

China's Economic Numbers Are Down Across the BoardAs the Total Cumulative General Public Budget Revenue graphic shows, import value-added tax, consumption tax, and export tax rebates all decreased from January to August 2023. These three sets of data complement each other, showing that China's exports are losing momentum....

....MUCH MORE, a lot to chew on.