Every penny of spending that isn't covered by taxes is stimulus. Full stop.

And the way things have evolved, the stimulus cannot be allowed to stop or the whole system—it's not capitalism, I'm not sure what to call it—the whole system collapses.

From ZeroHedge, September 14:

Authored by Michael Maharrey via SchiffGold.com,

The federal government charted a surprising budget surplus in August...

...but don’t be fooled. The feds didn’t miraculously fix their deficit problem.

The Biden administration continued to spend money at an unsustainable pace last month.

The surplus was merely a function of the reversal of student loan forgiveness.

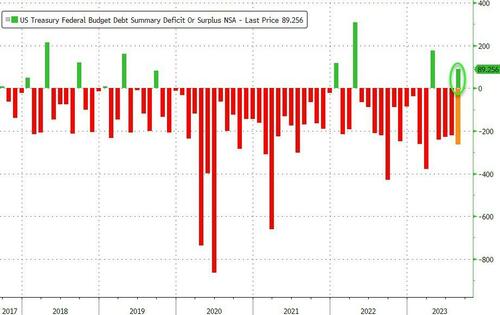

Officially, the US government recorded an $89.26 billion surplus deficit in August, according to the Monthly Treasury Statement.

But if you factor out the $333.65 billion student loan forgiveness reversal, there was a $244.39 billion budget shortfall. That was a 56.8% increase over the August 2022 deficit.

The reversal of student loan forgiveness, funds added to the spending ledger in September 2022, was necessitated when the Supreme Court ruled the forgiveness scheme unconstitutional.

With one month left to go, the deficit for fiscal 2023 now stands at $1.52 trillion.

To put the deficit in perspective, prior to the pandemic, the US government had only run deficits over $1 trillion four times — all in the aftermath of the 2008 financial crisis. Trump almost hit the $1 trillion mark in 2019 and was on pace to run a trillion-dollar deficit prior to the pandemic. The economic catastrophe caused by the government’s response to COVID-19 gave policymakers an excuse to spend with no questions asked. Now the Biden administration has settled into the new status quo – running ’08 financial crisis-like deficits every single year.

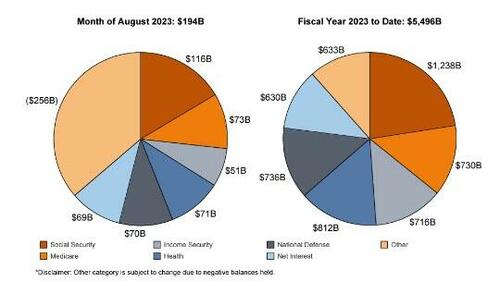

Declining tax receipts continue to plague the Treasury. The government recorded $283.13 billion in receipts in August. That was a 6.78% decrease from August 2022.

The continues a generally downward trend in government receipts. Revenue is down 10% year-on-year.

The federal government enjoyed a revenue windfall in fiscal 2022. According to a Tax Foundation analysis of Congressional Budget Office data, federal tax collections were up 21%. Tax collections also came in at a multi-decade high of 19.6% as a share of GDP. But CBO analysts warned it won’t last. And government tax revenue will decline even faster as the economy spins into a recession.

The bigger problem is on the spending side of the ledger.

The Biden administration blew through another $527.53 billion in July (excluding the credit for the student loan adjustment). That was a 0.8% increase over August 2022 spending.

Now, you might be thinking that with the spending cuts in the Fiscal Responsibility Act, Congress fixed this problem. But we live in an upside-down world where spending cuts mean spending keeps going up.

In other words, the spending cuts will not put a dent in current spending levels. That means we can expect these massive deficits to continue month after month.

And the Biden administration already wants more money. Last month, the president asked Congress to appropriate $40 billion in additional spending, including $24 billion for Ukraine and other international needs, $4 billion related to border security, and $12 billion for disaster relief....

...MORE