Following on yesterday's "At What Level Will Saudi Arabia And Russia Stop Pushing Oil Prices Higher?".

WTI $88.81 up $1.52 (+1.74%), Brent $91.98 up $1.34 (+1.34%)

From ZeroHedge, September 12:

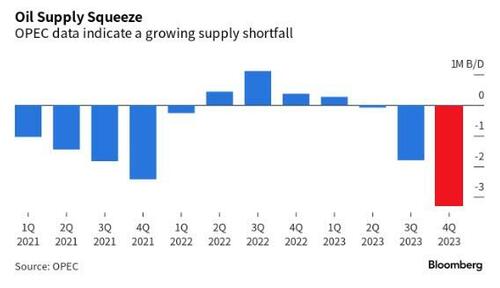

Oil prices had been coiling for a few days ahead of this data and are breaking out now after OPEC reports that global oil markets face a supply shortfall of more than 3 million barrels a day next quarter - potentially the biggest deficit in more than a decade.

If realized, it could be the biggest inventory drawdown since at least 2007, according to a Bloomberg analysis of figures published by OPEC’s Vienna-based secretariat.

OPEC’s 13 members have pumped an average of 27.4 million barrels a day so far this quarter, or roughly 1.8 million less than it believes consumers needed, according to the report.

WTI pushed above $88 on the news, its highest since Nov 2022...

As Bloomberg reports, The kingdom’s hawkish strategy, aided by export reductions from fellow OPEC+ member Russia, threatens to bring renewed inflationary pressures to a fragile global economy....

....MORE