Much of this stuff is familiar to readers who have been with us for a while—flywheel effects, chips for training and for inference, millions (I thought it was 2 billion) of miles of real-world motoring to train on, dedicated chips à la ASICs, and so on and so on—but MS puts it together in a less ADDled format.

A threefer, first up ZeroHedge, September 11:

Tesla shares are up nearly 6% in the pre-market session after Morgan Stanley's Adam Jonas raised his price target on the name to $400, upgraded the company to "overweight" and named Tesla a top pick.

Jonas predicts that Tesla's Dojo supercomputer may add as much as $500 billion to the company’s market value as a result of faster adoption of Robotaxis and the company's network services. Jonas says the technology can open up "new addressable markets" in the same way AWS did for Amazon.

Dojo could put Tesla at “an asymmetric advantage” in a market potentially worth $10 trillion, the note says.

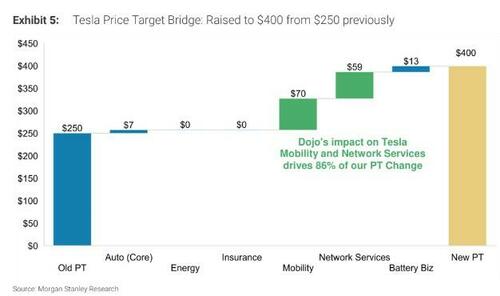

In its 66 page note out Monday morning, MS wrote: "We believe that Dojo can add up to $500bn to Tesla's enterprise value, expressed through a faster adoption rate in Mobility (robotaxi) and Network Services (SaaS). The change drives our PT increase to $400 vs. $250 previously. We upgrade to Overweight and make Tesla our Top Pick."

Tesla is on track to tack on about $46 trillion in market value on Monday by the cash open. Morgan Stanley has been the investment bank that has followed Tesla and Musk the closest over the years.

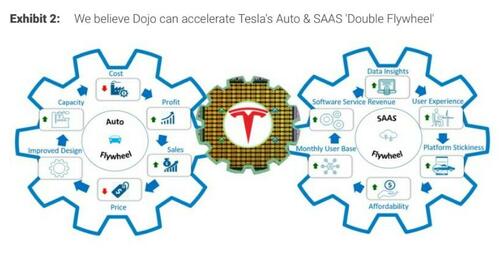

"Investors have long debated whether Tesla is an auto company or a tech company. We believe it's both, but see the biggest value driver from here being software and services revenue," Jonas says opening his note. "The same forces that have driven AWS to reach 70% of AMZN total EBIT can work at Tesla, in our view, opening up new addressable markets that extend well beyond selling vehicles at a fixed price. The catalyst? Dojo, Tesla's custom supercomputing effort in the works for the past 5 years."

Jonas adds: "We believe Dojo can represent the next step-change in market perception of Tesla. Dojo emphasizes 3 of Tesla's core capabilities: 1) speed, 2) performance, and 3) cost. In the near term, we believe Dojo can accelerate the development and monetization of Tesla's software and services business. Longer term, we see scope for Dojo to provide avenues for Tesla's software and hardware capabilities to extend well beyond the auto industry. If Dojo can help make cars 'see' and 'react,' what other markets could open up? Think of any device at the edge with a camera that makes real-time decisions based on its visual field."

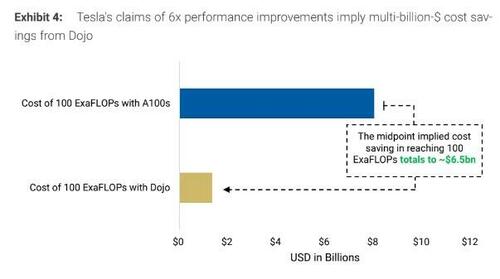

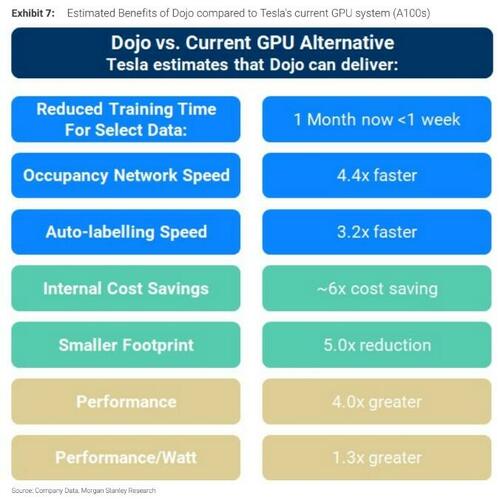

The note then talks about the cost savings that Dojo will ultimately be able to provide:

Tesla estimates that Dojo can provide 6x cost saving vs current, state of the art, GPU alternatives. On our calculations, when com paring what Tesla would have to spend on equivalent compute from NVDIA, Dojo has the potential to drive ~$6.5bn in cost savings for Tesla over the next couple of years to reach the company's stated goal of materially increasing internal computing power by October 2024 (to 100 exaFLOPs). This is achieved by having a purpose built, in-house semiconductor and AI tech stack. Dojo became operational in July of this year and we believe the continued rollout and subsequent company announcements will provide the catalyst for investors to appreciate Dojo's potential.

We note that 6x cost savings is Tesla's claim and we are unable to verify it with specificity given the early stage of Dojo roll-out. We also note that there are other pieces of data provided by Tesla that suggest other implied cost savings out comes that could differ from the 6x claim. Finally, just because Tesla is making a major effort to commercialize Dojo for its in-house purposes does not mean that the system will ultimately represent the best cost/performance alternative on the market longer term give continuous improvement of rival compute technology.

And finally, what would a shiny new technology be for a car-turned-tech company if it didn't help the "attach rate" with new vehicle purchases (this, as Full Self Driving, paid for by many Tesla owners years ago, has still not arrived). Jonas writes:

For our Tesla modeling purposes, we focused on the potential for Dojo to deliver autonomy and network services revenues at a faster attach rate with higher average monthly revenue per user (ARPU), driving a material increase to our estimates. We have NOT given Tesla credit for specific cost savings from Dojo vs. its current supercomputing budget. Nor have we given Tesla credit for any non-auto-related revenue streams. With significantly increased computing power and faster processing speeds (latency), Tesla's path to monetizing vehicle software can materialize sooner, and at higher recurring revenue rates. We also for the first time incorporate non-Tesla fleet licensing revenue into our Network Services model as we expect recent charging station cooperation will extend into FSD licensing (discussions ongoing) and operating system licensing.

The note continues:

We now forecast Tesla Network Services to reach $335bn in revenue in 2040 vs $157bn previously, and expect the segment to represent over a third of total company EBITDA in 2030, doubling to over 60% of group EBITDA by 2040 (vs. 38% previously). T

his increase is largely driven by the emerging opportunity we see in 3rd party fleet licensing, increased ARPU, with operating leverage driving higher long-term EBITDA margin vs. prior forecast (65% from FY26 onwards, vs. 50% previously).

In addition to Network Services, we indirectly ascribe the value of Dojo to our Tesla Mobility robotaxi assumptions (increased long term fleet size and margin), and 3rd Party Battery Business, as we believe the charging and FSD deals will also result in higher hardware attach.

Jonas also provides a timeline of how Tesla's development of Dojo has gone over the last 5 years....

....MORE

From Electrek:

Tesla (TSLA) stock surges from optimistic look at Dojo supercomputer

Tesla’s (TSLA) stock is rising in pre-market trading on an optimistic new report about the automaker’s Dojo supercomputer coming from Morgan Stanley.

The firm massively increased its price target on Tesla’s stock because of it.

Dojo is Tesla’s own custom supercomputer platform built from the ground up for AI machine learning and, more specifically, for video training using the video data coming from its fleet of vehicles.

The automaker already has several large NVIDIA GPU-based supercomputer clusters, which are some of the most powerful in the world, but the new Dojo custom-built computer uses chips and an entire infrastructure designed by Tesla.

The custom-built supercomputer is expected to elevate Tesla’s capacity to train neural nets using video data, which is critical to the computer vision technology powering its self-driving effort.

....MORE

And from Tesla Aficionado Sawyer Merritt, some clearer graphics:

BREAKING: Morgan Stanley's Adam Jonas has increased his $TSLA price target by 60% to $400 per share (from $250), and upgraded his rating to Overweight (from Equal-Weight). $TSLA is now their "Top Pick"

— Sawyer Merritt (@SawyerMerritt) September 10, 2023

"We believe that Dojo can add up to $500B to @Tesla's enterprise value,… pic.twitter.com/TY3JxDzUvd

Some previous posts (there are hundreds):

Nvidia Wants to Be the Brains Of Your Autonomous Car (NVDA)

NVIDIA Partner Tesla Reportedly Developing Chip With AMD (TSLA; NVDA; AMD)

The only reason for Tesla to do this is that NVIDIA's chips are general purpose whereas specialized chips are making inroads in stuff like crypto mining (ASICs), Google's Tensor Processing Units (TPUs) for machine learning and Facebook's hardware efforts.

"Nvidia CEO is 'more than happy to help' if Tesla's A.I. chip doesn't pan out" (NVDA; TSLA)

Elon Got Himself A Supercomputer: "Tesla's $300 Million AI Cluster Is Going Live Today" (TSLA)