In October last year many, many markets turned, here's a U.S. equity example, the Dow Jones Industrial Average:

It was the same pattern for the other major U.S. indices although the Nasdaq 100 actually did a quadruple bottom around ~10,700 before setting of on its 47% run:

I've been thinking about that eye-popping turn in prices and combined with these two charts below, have been wondering if there is any correlation with the dramatic change in asset buying by Japan's central bank at around the same time. First up, the more exaggerated of the two, the year-over-year change in JCB assets:

And the bank's total assets, now at a record:

Combined with this from the JCB's chairman: Central Banks: "World isn’t ready for what Ueda’s trying to say" and there may be some opportunity to the downside in the next six weeks.

The first hint of action would probably show up in USDJPY, currently at 147.740 −0.090.

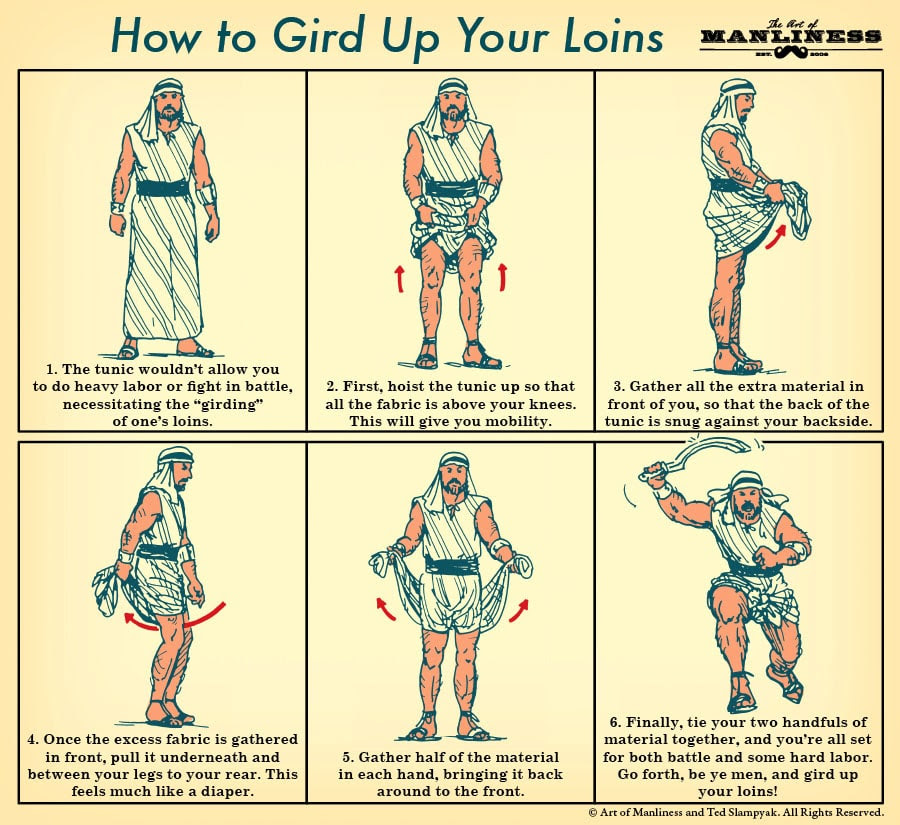

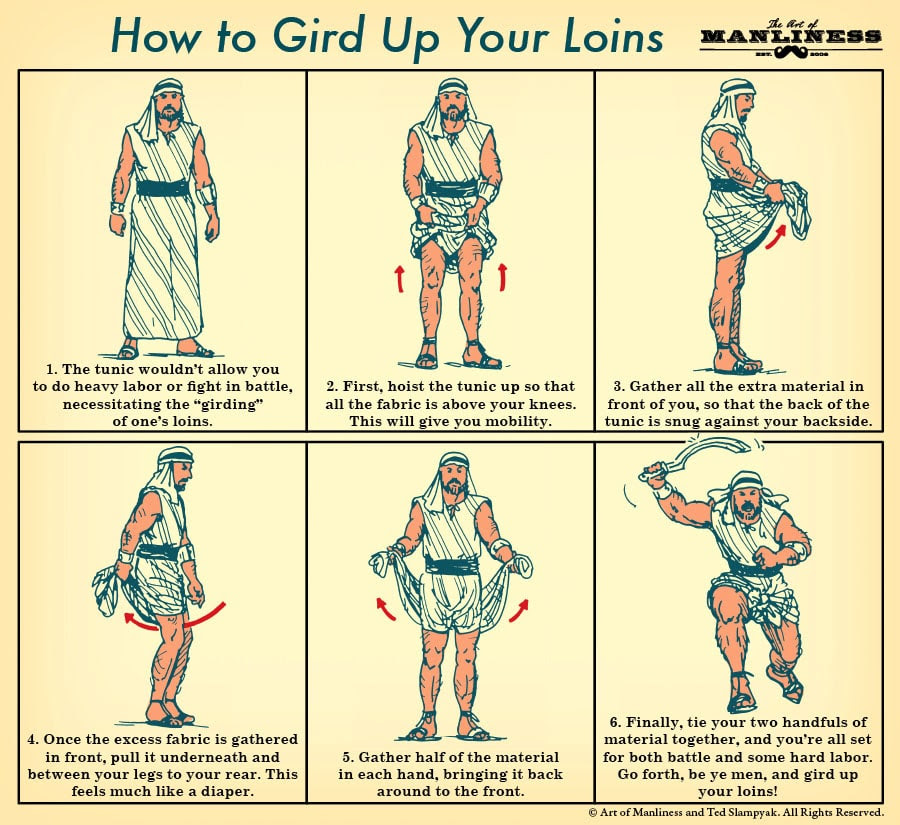

Although we don't plan a Dress & Grooming column, this may come in handy should the markets descend into madness.

From The Art of Manliness:

Also at the Art of Manliness:

How to Recover From a Bad First Impression

From The Art of Manliness:

If you’ve read the Bible, then you’ve probably come across the phrase “gird up your loins.” I’ve always thought it was a funny turn of phrase. Loins….heh.

Back in the days of the ancient Near East, both men and women wore flowing tunics. Around the tunic, they’d wear a belt or girdle. While tunics were comfortable and breezy, the hem of the tunic would often get in the way when a man was fighting or performing hard labor. So when ancient Hebrew men had to battle the Philistines, the men would lift the hem of their tunic up and tuck it into their girdle or tie it in a knot to keep it off the ground. The effect basically created a pair of shorts that provided more freedom of movement....MORE

Also at the Art of Manliness:

How to Recover From a Bad First Impression