Tesla and their battery partner, Panasonic, have removed a lot of the cobalt (60%) from their battery recipe and are on their way to zero cobalt over the next couple years.

So, more interesting than any time pressure is the potential spur to creativity on the question of alternative chemistries.

From the journal Nature, July 25:

Reserves of cobalt and nickel used in electric-vehicle cells will not meet future demand. Refocus research to find new electrodes based on common elements such as iron and silicon, urge Kostiantyn Turcheniuk and colleagues.

Electric vehicles need powerful, light and affordable batteries. The best bet is commercial lithium-ion cells — they are relatively compact and stable. But they are still too bulky and expensive for widespread use.

The performance of rechargeable lithium-ion batteries has improved steadily for two decades. The amount of energy stored in a litre-sized pack has more than tripled, from around 200 watt hours per litre (Wh l–1) to more than 700 Wh l–1. Costs have fallen by 30 times, to around US$150 per kilowatt hour (kWh). But that still exceeds the $100 per kWh goal for affordability set by the US Department of Energy. And batteries that are powerful enough for an electric car (50–100 kWh) still weigh around 600 kilograms and take up 500 litres of space.

The pace of advance is slowing as conventional technology approaches fundamental limits. The amount of charge that can be stored in gaps within the crystalline structures of electrode materials is nearing the theoretical maximum. Projected market growth will not lower prices substantially — the markets are already large.

Worse, the materials used in electrodes, notably rare metals such as cobalt and nickel, are scarce and expensive. Surging battery production has almost quadrupled wholesale prices of cobalt over the past two years, from $22 to $81 per kilogram.

High demand and prices are already encouraging some producers to cut corners and violate environmental and safety regulations. For example, in China, dust released from graphite mines has damaged crops and polluted villages and drinking water1. In Africa, some mine owners exploit child workers and skimp on protective equipment such as respirators. Small artisanal mines, where ores are extracted by hand, often flout laws. Some companies, including BMW, follow strict policies to verify their cobalt suppliers2. Many do not.

Alternative types of electrode based on cheap, common metals such as iron and copper need to be developed urgently. In our view, the most promising candidates involve ‘conversion materials’, such as copper or iron fluorides and silicon. These store lithium ions by bonding chemically with them. But the technology is still at an early stage. Problems with stability, charging speed and manufacture must be overcome.

We call on materials scientists, engineers and funding agencies to prioritize the research and development of electrodes based on abundant elements. Otherwise, the roll-out of electric cars will stall within a decade.

Scarce and expensive

Lithium-ion batteries work by shuffling lithium ions between two electrodes. Ions flowing from the anode to the cathode discharge a current, which powers the car. The lithium ions flow back when the battery is recharged.

In commercial cells used today for electric vehicles, the lithium ions are held in tiny voids within the crystals that make up the electrodes (these are known as intercalation electrodes). The anodes are typically made from graphite and the cathodes from metal oxides. Common oxides include lithium nickel cobalt aluminium oxide (NCA, commonly LiNi0.8Co0.15Al0.05O2) or lithium nickel cobalt manganese oxide (NCM, often LiNi0.6Co0.2Mn0.2O2 or LiNi0.8Co0.1Mn0.1O2). A lithium-ion car battery with a 100 kg cathode requires 6–12 kg of cobalt and 36–48 kg of nickel.

The prices of metals reflect demand, supply and the costs of extracting them from ores. Cobalt is pricey because it is rare and highly sought after. It requires capital-intensive processes to produce it, involving roasting, flash smelting and the consumption of poisonous gases3. Cobalt is often a by-product of copper and nickel mining, and can also need separating from other metals.

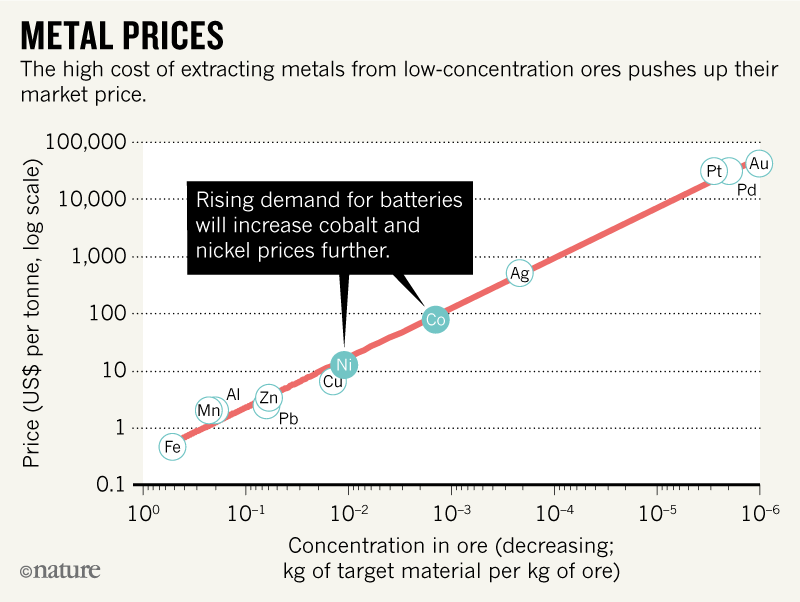

Few cobalt mineral deposits are concentrated enough to be worth mining. Most deposits contain just 0.003% of the metal; more than 0.1% is needed to achieve prices of $100 to $150 per kg (ref. 4). Production costs jump for poor ores because more rock must be processed (see ‘Metal prices’). Thus, only 107 tonnes of cobalt out of 1015 tonnes potentially available in Earth’s crust are profitable to extract5. Similarly, only 108 of 1015 tonnes of nickel reserves are commercially viable5.

Source: London Metal Exchange

Cobalt-rich minerals are found in just a few places6. The Democratic Republic of the Congo (DRC) supplied more than half (56%) of the 148,000 tonnes of the metal mined worldwide in 2015 (ref. 6). Most of this goes to China, which holds stockpiles of 200,000 to 400,000 tonnes6. Australia hosts 14% of the world’s cobalt reserves but has yet to exploit them fully. Cobalt has been extracted from the deep sea floor, but mining here would be too expensive, ecologically and economically....MORE