"The Fed Actually Begins its QE Unwind "

From Wolf Street:

But what’s happening with mortgage-backed securities?

Thursday afternoon, the Fed released its weekly balance sheet for the

week ending November 1. This completes the first month of the QE

unwind, or “balance sheet normalization,” as the Fed calls it. But

curious things are happening on the Fed’s balance sheet.

On September 20, the Fed announced

that the QE unwind would begin October 1, at the pace announced at its

June 14 meeting. This would shrink the Fed’s balance sheet by $10

billion a month for each of the first three months. The shrinkage would

then accelerate every three months. A year from now, the shrinkage would

reach $50 billion a month – a rate of $600 billion a year – and

continue at that pace. This would gradually destroy some of the

trillions that had been created out of nothing during QE.

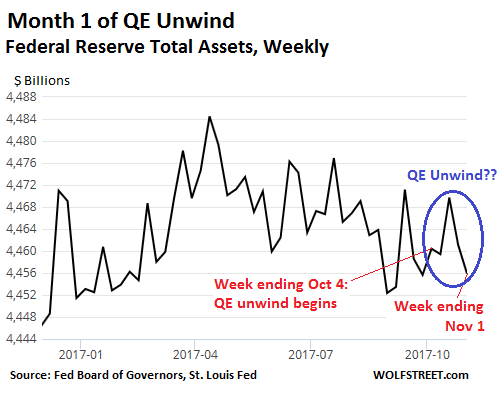

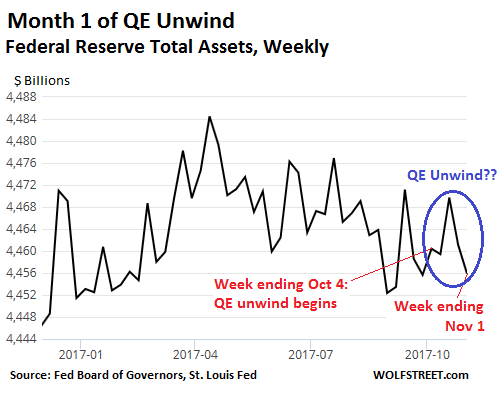

Over the five weekly balance sheets since the QE-unwind kick-off

date, total assets rose initially by $10 billion from October 4 to

October 18 and then fell by $14 billion, for a net decline of $4

billion. By November 1, total assets were $4,456 billion:

The Fed is supposed to unload $10 billion in October. Instead it

unloaded $4 billion. And the variations from week to week are entirely

in the normal range of the prior months.

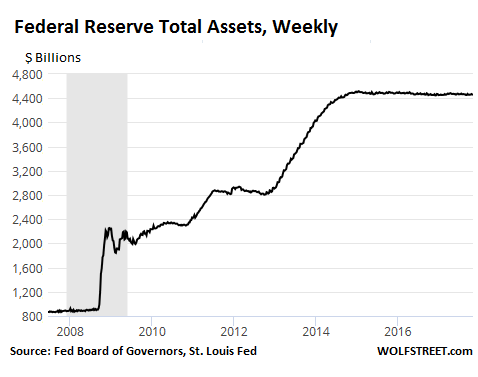

The chart below shows the Fed’s total assets since 2007, covering the

entire QE period from the Financial Crisis on. The tiny $4-billion

decline in October gets lost in the massive table mountain of assets:

But a first real step has happened.

As part of the $10 billion that the Fed said it would shrink its

balance sheet in October, it was supposed to unload $6 billion in

Treasury securities...MUCH MORE.