They Did it Seaway – Canadian Heavy Crude Arrives At The Gulf Coast By Pipeline

Since December the first significant volume of Canadian heavy crude - an average of 240 Mb/d - has flowed to the Gulf Coast on the Seaway Twin pipeline. It’s been a rocky road to the Gulf Coast for Canadian heavy crude producers – beset with delays and congestion that they probably never envisioned when they planned their oil sands projects (including the wider political battle over Keystone – currently back in the President’s hands.) And Canadian crude that does make it to Gulf Coast refineries faces stiff competition from incumbent suppliers. Today we chart the progress of the Seaway Twin and Flanagan South pipelines and look at price competition for heavy crude at the Gulf.

The opening up in December last year (2014) of the Enterprise/Enbridge joint venture 450 Mb/d Seaway Twin pipeline from Cushing to Freeport, TX in conjunction with the Enbridge 585 Mb/d Flanagan South line from Pontiac, IL to Cushing has enabled significant pipeline flows of heavy Canadian crude to reach the Texas Gulf Coast. According to our friends at Genscape, average daily flows on Flanagan South since December 19, 2014 have been 389 Mb/d and average flows on the Seaway Twin have been 240 Mb/d. As we described last year the two new pipelines are part of an extensive expansion project by Enbridge of their Western Gulf Access system, that delivers Western Canadian heavy oil sands crude as well as Canadian conventional crude and shale crude from the northern portions of the Williston Basin into the U.S. Midwest (see ”The Promised Land? Flanagan South and the Seaway Twin”).

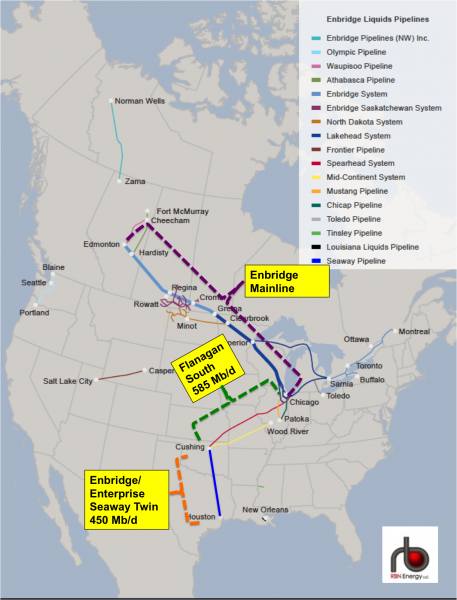

The map in Figure #1 shows the path of the Enbridge Mainline from Edmonton and Hardisty in Alberta to the Chicago area (purple dashed bracket) – with two sections known as the Enbridge system on the Canadian side (light blue line) and the Lakehead System on the U.S. side (darker blue line). The new Flanagan South pipeline runs parallel to the existing 193 Mb/d Spearhead pipeline between Flanagan and Cushing (green dashed bracket). The final Seaway Twin segment from Cushing to Houston (orange bracket) runs parallel to the existing Seaway pipeline that was reversed in June 2012 and expanded to 400 Mb/d in 2014 (see Seaway Reversal). Until the Seaway reversal in 2012 there was no pipeline capacity from the Midwest to the Gulf Coast at that time except for the 98 Mb/d ExxonMobil Pegasus pipeline (itself closed for most of 2013 and 2014 by a rupture). Although the original Seaway pipeline expanded to 400 Mb/d in 2014 and the southern section of the TransCanada Keystone XL TX opened up 700 Mb/d of capacity between Cushing and Nederland, TX in the same year, flows of crude from Canada along those routes to the Gulf Coast were still constrained by a lack of Canadian crude flowing into Cushing. The heavy crude that did flow from Canada into the Midwest (via Spearhead and the original Keystone pipeline) was primarily destined for regional refineries – many of which – like the 400 Mb/d BP Whiting refinery in Illinois had been specifically upgraded to process heavy Canadian crude.

Figure #1 Source: RBN Energy (Click to Enlarge)

For Canadian producers the next logical home for their heavy oil sands crude after Midwest refineries had their fill has always been the Gulf Coast – home to 50% of U.S. refining capacity and 1.5 MMb/d of coking capacity configured to process heavy Canadian crudes. And up until about 2011 plans to build out adequate pipeline capacity to move rising Canadian production from Western Canada to the Gulf Coast were in hand and centered on the addition of the 800 Mb/d Keystone XL pipeline from Hardisty via Cushing to Nederland on the Gulf Coast. But two major events interfered with those well-laid plans. First as everyone who has picked up an iPad recently knows, the northern section of Keystone XL has been delayed for 5 years by permitting and environmental issues. Second, existing and new pipeline capacity into Cushing and the Gulf Coast became congested by the addition of rapidly expanding U.S. domestic crude production from shale basins in North Dakota (Bakken), the Rockies (Niobrara) and the Midwest (Anadarko). To cut a long story short, the Keystone delay has led to a shortage of available capacity out of Canada into the Midwest and rising shale production competed for capacity on the existing Enbridge Mainline out of Canada. All of which left Canadian producers suffering price discounts of over $40/Bbl to get their stranded crude onto congested pipelines. Today the discounts are lower (more on them in a minute) but the lack of pipeline capacity has spurred increased investment in rail alternatives to bypass the congestion (see Go Your Own Way)....MORE