From ZeroHedge, September 5:

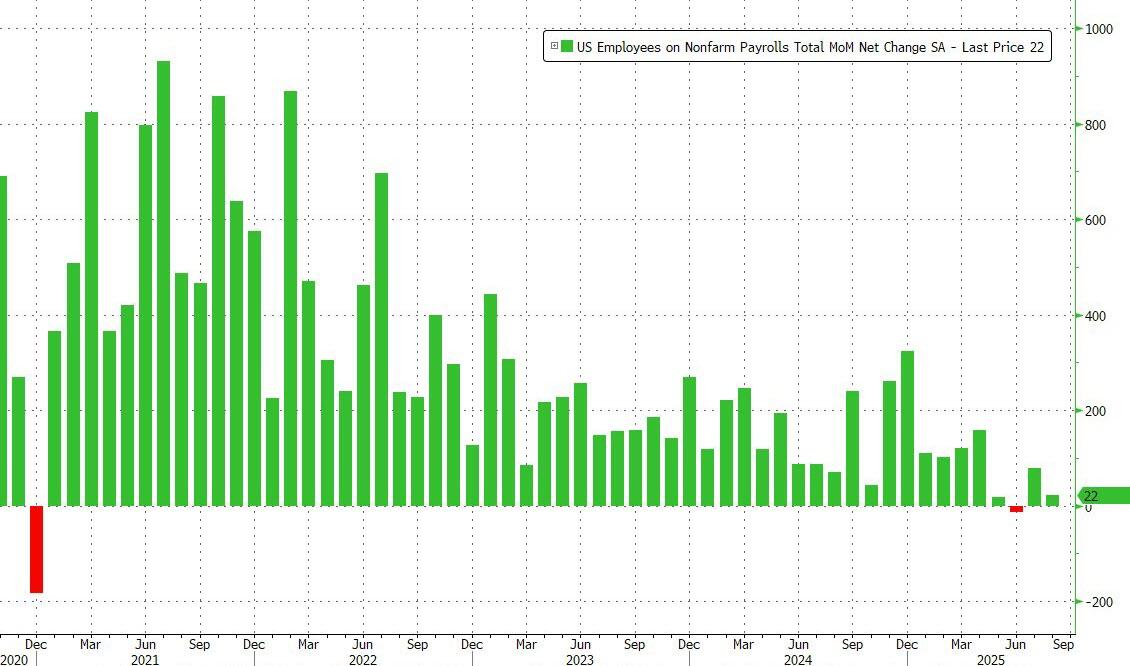

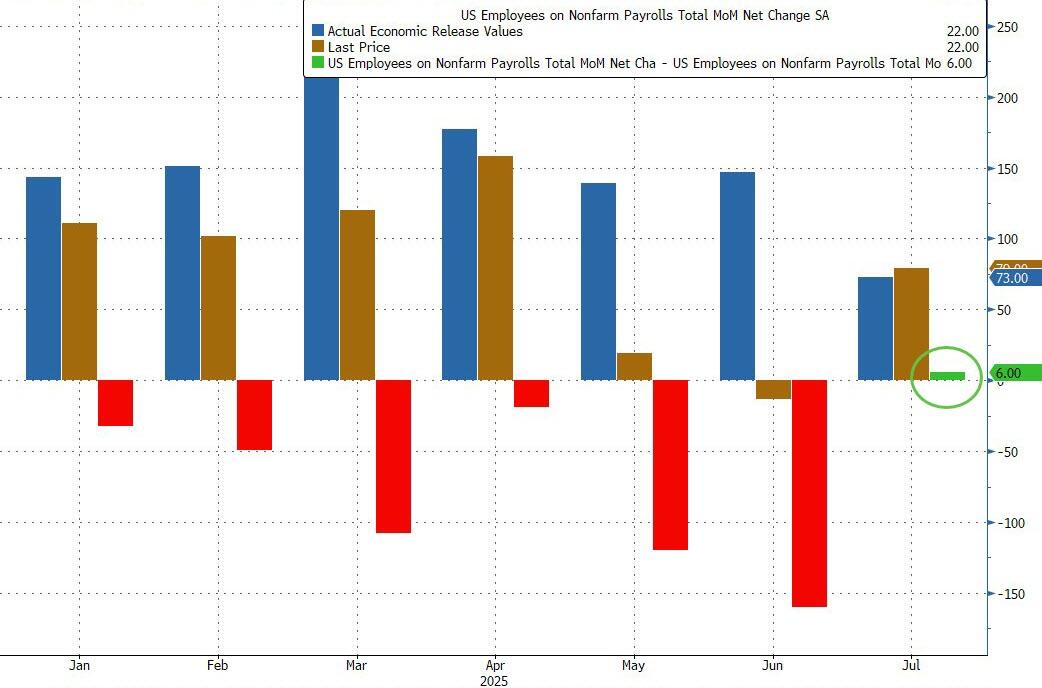

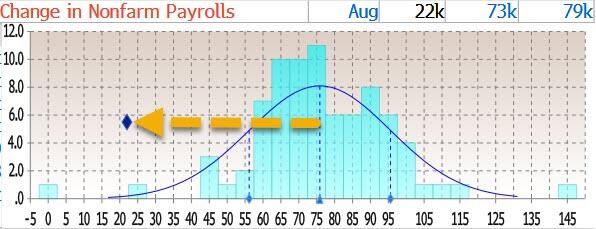

Ahead of today's jobs report, consensus was that a print between 40K and 100K is largely priced in and greenlighting a 25bps rate cut by the Fed in two weeks, and that we would need a real outlier number for the Fed to either cut 50bps... or not hike. Well, we got a real outlier when moments ago the BLS reported that in August the US added only 22K jobs, a big drop from the upward revised 79K (from 73K previously) but more importantly June was revised from 27K to -13K, ushering in the first negative jobs print since 2020.

With these revisions, employment in June and July combined is 21,000 lower than previously reported, continuing to trend of negative revisions into a labor market slowdown.

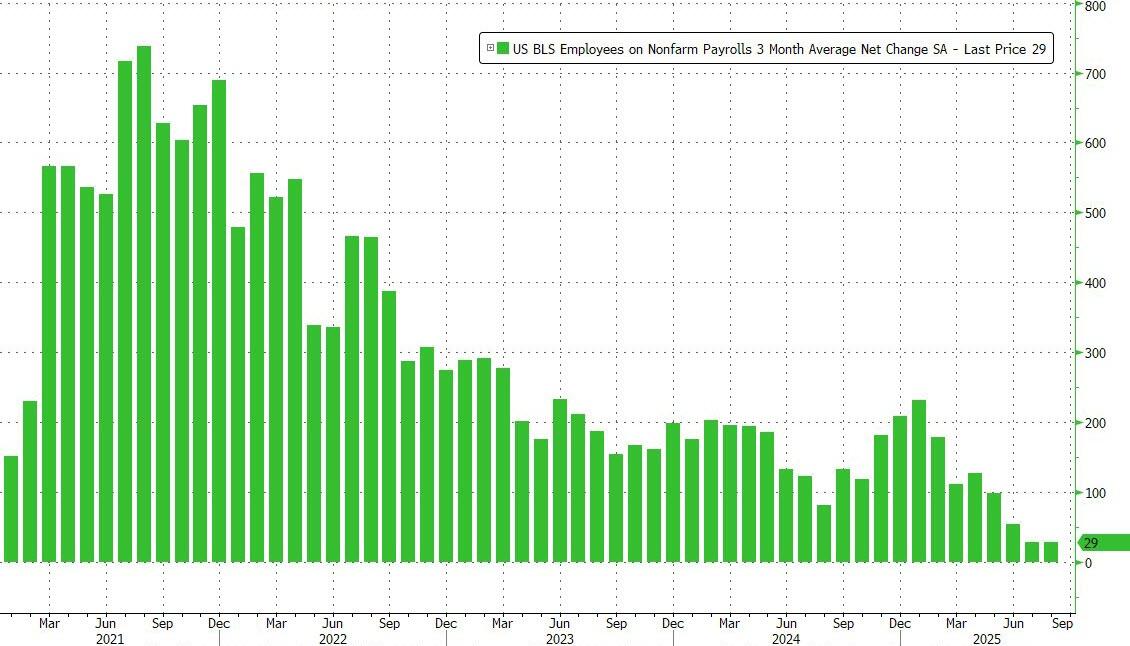

The revisions pushed the 3-month average jobs print to just 29K, which however was a tiny improvement from the 28K in July.

Just as importantly, the payrolls number came in far below Wall Street estimates of a 75K print. In fact, it was higher than just one of the 80 estimates provided to Bloomberg.

The household survey was not quite so bad, and in fact the number of employed workers rose by 288K to 163.394MM, the biggest increase since April........MUCH MORE

Here's the whole package at the BLS:

Employment Situation

Table of Contents

Table A-7. Employment status of the civilian population by nativity and sex, not seasonally adjusted

Last Modified Date: September 05, 2025