Because of Bessemer's rather self-effacing Anti-Portfolio we are rather fond of the old boy. More after the jumps.

From Bessemer Venture Partners, June 14, 2023:

State of Deep Tech

Investments in the commercialization of scientific research have propelled humanity forward—here are the businesses defining the deep technology category.

Over the past half millennium, investments in scientific research have given rise to a parade of “deep technologies” that defy imagination and re-shape the human experience. One of the clearest examples came in 1969, when Apollo 11 landed Man on the Moon, untethering humanity from this Pale Blue Dot and opening a window of possibility into the next physical frontier. Exiting the Earth’s atmosphere, surviving the most extreme environment imaginable, and landing on a rock a quarter million miles away were feats once dismissed as mere science fiction. But the commercialization of scientific research has transformed aspiration into reality, driving the future of humanity. Other notable examples include the telescope in 1608, the steam engine in 1774, anesthesia in 1844, steel smelting in 1857, the lightbulb in 1879, the airplane in 1903, the computer in 1945, the Internet in 1969, and clinical genomic sequencing in 2014. We call this category of advancements deep tech.

In the State of Deep Tech, we explore what innovators are building today and celebrate the XB100, the definitive ranking of 100 of the most promising deep tech startups. XPRIZE and Bessemer partnered to create the list, and a panel of scientists helped rank the companies. From quantum computing to rocket technology to next-generation biotherapeutics, the companies in this report are tackling problems on a planetary scale. Their speed and success will ultimately determine the plot for our next chapter of humanity.

What is deep tech?

Our favorite definition of deep tech is technology that was science fiction in the past but is reality today; it pushes the boundaries of human capability through novel research and directed commercialization. Although this definition encompasses an umbrella of technologies, it’s important to note additional commonalities and distinctions that all deep tech companies share:

- The risks facing deep tech companies are different from those facing software investments. Market and customer risks dominate in software startups— Is the market big enough for this software? Does the software product have product-market fit with customers? —whereas technical and financing risks dominate risks in deep tech. For instance, if a deep tech company actually manages to build a commercial quantum computer, it’s a no-brainer that the market is more than big enough and that customers will clamor to use it. (We describe these risks in more detail in the Challenges section below.)

- It’s hard to establish growth and go-to-market metrics with deep tech. While different software verticals face similar product development and marketing processes, the engineering challenges across deep tech categories, such as drones and hydrogen production, are too different to make them easily comparable.

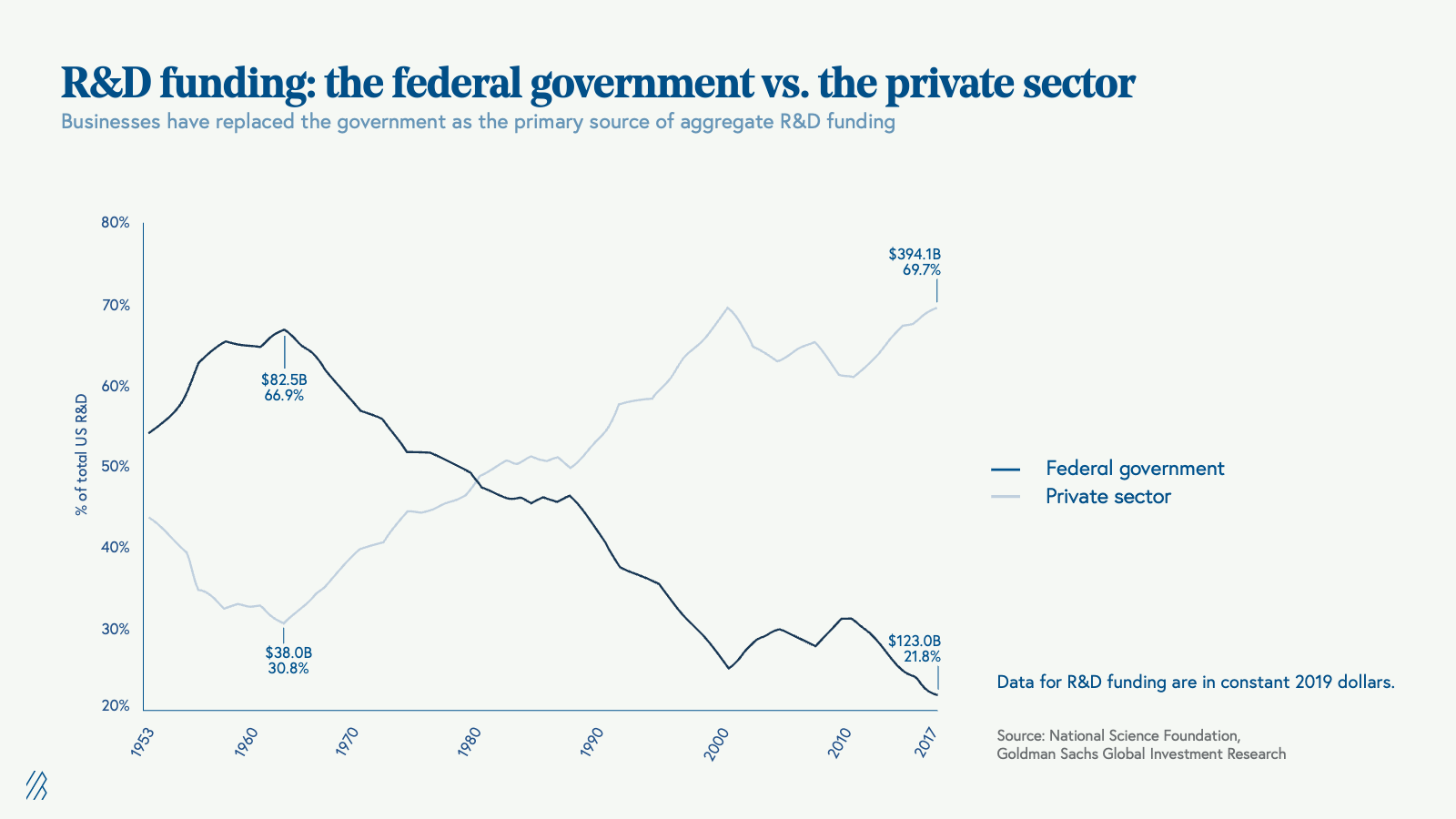

- Deep tech is more than just government research. Though governments have historically played an important role in building deep technologies—take rockets and the Internet as examples—they have functioned more as a funder and regulator of deep tech than its progenitor. Over the past 50 years, more and more R&D has been migrating to the private sector as opposed to the public sector (see graph below). Today, the government can still catalyze deep tech with non-dilutive funding, but it also does so through other policy means (e.g., tax credits).

- Deep tech commercializes scientific research. Science pushes the boundaries of human knowledge, adding to our understanding of the world. Meanwhile, deep tech occurs downstream of science experiments, applying cutting-edge science to solve concrete problems.

Introducing The XB100

The XB100 is the definitive ranking of the world’s top private deep technology companies. XPRIZE Foundation and Bessemer Venture Partners have set out to identify and study this promising cohort of businesses shaping the future.

We evaluated these businesses based on four criteria: impact on humanity; valuation; scientific difficulty (evaluated using number of PhDs and patents); and commercial traction [evaluated using NASA’s Technological Readiness Level (TRL) framework].

The XB100 encompasses nine categories of deep tech:

- Agriculture: As the global population approaches 10 billion people by 2050, we'll need new ways to feed people and support improved living standards. Agricultural deep tech companies are developing new, sustainable methods to produce or grow food, such as vertical farming, offshore aquaculture, and alternative meat.

- Artificial intelligence (AI): Thanks to advancements in chips, AI models, training methods, and ways to collect, label, and analyze data, AI is transforming from a rules-based machine to a human-like creator. In the long-run, these AI developments will become personal assistants that augment our productivity and the way we work.

- Aviation: From drone-based disaster response deliveries to autonomous flying taxis and supersonic aircraft, people and goods are going to travel in the air in ways they never have before.

- Climate: Climate change poses an existential risk to humanity, and we need to deploy a number of different solutions to tackle it. With climate headwinds picking up globally, many entities, from universities to governments to corporations, are deploying capital to develop, produce, scale and market a deep technologies ranging from energy storage to carbon capture.

- Mobility: Deep tech mobility companies, like those building autonomous vehicles, are changing the way we move on the ground, which will inevitably impact the way we design cities, infrastructure, and buildings.

- Next-gen biotech: New biotech companies use advancements in AI, genomics, and other novel modalities (e.g., CRISPR, single particle tracking) to prolong life through cheaper, more rapid diagnostics and the treatment of diseases like cancer.

- Quantum: When quantum computers reach "quantum advantage," the point where they're powerful and stable enough to outperform classical computers in solving commercially valuable problems, they will revolutionize pharmaceuticals, logistics, financial services, automotive, and other industries.

- Robotics: In combination with AI, machines that operate autonomously (e.g., robotic arm, humanoid robots) can perform physical tasks with greater precision, accuracy, and speed than humans can.

- Space: Humans haven’t been to the Moon since 1972, but we expect to return before the end of the decade. In addition to launch and travel, a number of other space technologies—like remote sensing and in-space manufacturing— are changing our lives here on Earth.

....MUCH MORE

The List - I knew the top ten but only around half of the remaining 90.

Our latest look at the Anti-Portfolio was in 2023's "Bessemer Venture Partners: State of the Cloud 2023 (plus Bessemer's Anti-Portfolio)":

They launched their cloud index in 2013, no cumulus-come-lately's here.

And the Anti-Portfolio, something we've been linking to since 2008:

Bessemer Venture Partners is perhaps the nation's oldest venture capital firm, tracing our roots back to the Carnegie Steel empire. This long and storied history has afforded our firm an unparalleled number of opportunities to completely screw up.

Throughout our history, we did invest in a wig company, a french-fry company, and the Lahaina, Ka'anapali & Pacific Railroad. However, we chose to decline these investments, each of which we had the opportunity to invest in, and each of which later blossomed into a tremendously successful company.

Our reasons for passing on these investments varied. In some cases, we were making a conscious act of generosity to another, younger venture firm, down on their luck, who we felt could really use a billion dollars in gains. In other cases, our partners had already run out of spaces on the year's Schedule D and feared that another entry would require them to attach a separate sheet.

Whatever the reason, we would like to honor these companies -- our "anti-portfolio" -- whose phenomenal success inspires us in our ongoing endeavors to build growing businesses. Or, to put it another way: if we had invested in any of these companies, we might not still be working.

....MUCH MOREJeremy Levine met Brian Chesky in January 2010, the first $100K revenue month. Brian’s $40M valuation ask was “crazy,” but Jeremy was impressed and made a plan to reconnect in May. Unbeknownst to Jeremy, $100K in January became 200 in February and 300 in March. In April, Airbnb raised money at 1.5X the “crazy” price. In December 2020, Airbnb went public at a $47 billion valuation.

AppleBessemer had the opportunity to invest in pre-IPO secondary stock in Apple at a $60M valuation. Neill Brownstein called it “outrageously expensive.”

AtlassianByron Deeter flew straight to Atlassian in 2006 when he caught wind of a developer tool from Australia (of all places!). Notes from the meeting included “totally self-financed, started with a credit card” and “great business, but Scott & Mike don’t ever want to be a public company.” Years and countless meetings later, the first opportunity to invest emerged in 2010, but the $400m company valuation was thought to be a tad “rich.” In 2015, Atlassian became the largest tech IPO in Australian history, and the shares we passed on are worth more than a billion dollars today.

CoinbaseOn a late summer evening in 2012, the email came in to Ethan Kurzweil’s inbox with the subject line: “Demo day, follow up, Coinbase.” After the standard pleasantries, the sender, Coinbase founder and CEO Brian Armstrong quickly got to the point: “What questions can I answer for you in the next two weeks that would cause you to invest in Coinbase?” The round on offer was $500k on a standard SAFE at a $10M cap for something almost no one had ever heard of! Ethan’s pithy response would go on to earn Brian and Coinbase a spot in the Anti-Portfolio for life: “There’s really no questions you could answer that would cause me to invest!” Almost nine years later, Coinbase would go public in a direct listing valuing the leading crypto exchange at $85.8 billion – or just a mere 8,580x the price Brian had eagerly offered up!....