Substitute Sam Bankman-Fried for Gatsby, and crypto thefts for thefts of the bearer bonds that financed WWI, in the headline and we have a ninety-seven year-old story:

The only question is: who bankrolled the operation, who's the Arnold Rothstein?

If you search the New York Times archives there are dozens, maybe

hundreds of reports of thefts of the untraceable "cash that paid

interest." (yield farming anyone>)

From the Michigan Law Review, University of Michigan Law School, Volume 88 Issue 2. (1989):

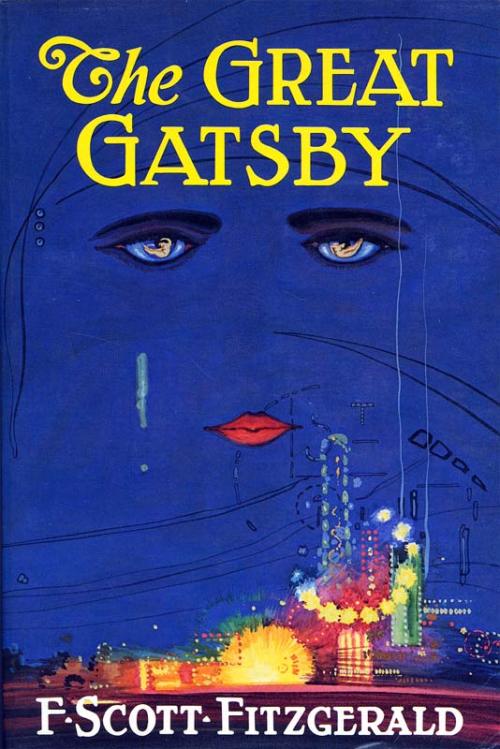

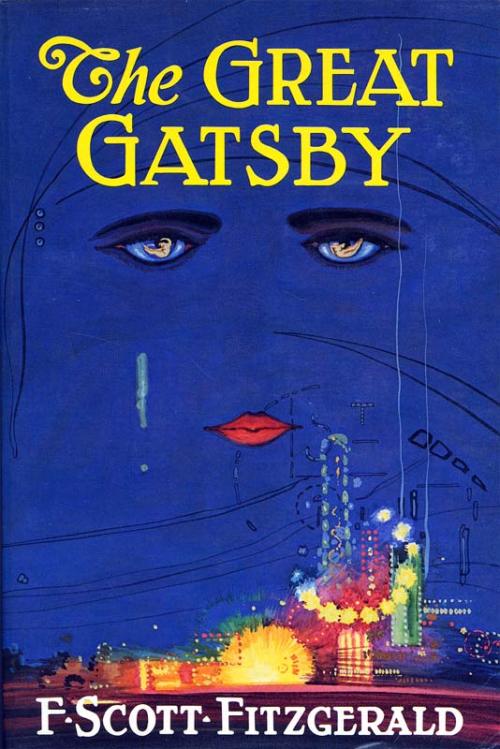

The Great Gatsby, The Black Sox, High Finance, and American Law

Allen Boyer

Special Counsel, Division of Enforcement, New York Stock Exchange

The Great Gatsby, by F. Scott Fitzgerald, is the great novel of America in the 1920s. It is about someone pursuing a girl, and, more than that, it is about someone pursuing a dream. Jay Gatsby is some-one who believes in the American dream of success. His life plays out the most famous piece of repartee between Fitzgerald and Hemingway -that the rich are very different from you and me, because they have more money. Gatsby is a man who thought that if he had the money, he would be rich, and could therefore be different.

After reading Gatsby, one remembers the parties which its hero threw: dusk-to-dawn galas peopled by financiers, Broadway stars, and the polo-playing aristocracy. But behind the glitter there are occasional glimpses of darkness. Gatsby is a man with no background. Some say he is the Kaiser's nephew, some have heard that he once killed a man. He has unsavory connections -perhaps even criminal connections. His past is a mystery, and there is something in his present which he wants to conceal.

What Gatsby's connections are, where he made his money, Fitzgerald keeps vague.1 Nick Carraway, the narrator, asks Gatsby what business he is in. Gatsby replies, brusquely, "That's my affair" -then apologetically realizes his rudeness, and says that he was in the drug business for a while, and that he was in oil for a while.

It is just barely possible, given the timing, that Gatsby was involved with Teapot Dome. And his pharmaceutical business meant bootlegging: he owned part of a chain of drug stores which sold grain alcohol over the counter. Tom Buchanan, his rival for Daisy Buchanan, reveals this bootlegging connection near the end of the novel. But there is something else Gatsby is involved with. Even Tom Buchanan can't identify it, because his sources are too scared to talk. All we know is that, as Tom says, compared to it, the bootlegging is ''just small change."

Two shadows fall directly across Gatsby's career. We know that he is involved with stolen securities. He sounds out Nick, a bond salesman, about working for him:

"[I]f you'll pardon my -you see, I carry on a little business on the side, a sort of side line, you understand. And I thought that if you don't make very much -You're selling bonds, aren't you, old sport?" "Trying to." "Well, this would interest you. It wouldn't take up much of your time and you might pick up a nice bit of money. It happens to be a rather confidential sort of thing."2

At the novel's end, when Nick answers a phone call in Gatsby's empty house, he finds out what this sketchy invitation meant. The man on the long-distance line from Chicago tells him: "Young Parke's in trouble. They picked him up when he handed the bonds over the counter."3

We also know that Gatsby is the business partner of Meyer Wolfsheim -and that Wolfsheim is the man who fixed the 1919 World Series. Nick remembers their introduction:

"[H]e's a gambler." Gatsby hesitated, then added coolly: "He's the man who fixed the World's Series back in 1919." The idea staggered me. I remembered, of course, that the World's Series had been fixed in 1919, but if I had thought of it at all I would have thought of it as a thing that merely happened, the end of some inevitable chain. It never occurred to me that one man could start to play with the faith of fifty million people -with the single-mindedness of a burglar blowing a safe.4

Both of these scandals -securities fraud and the Black Sox -trace back in fiction to Meyer Wolfsheim. In life they trace back to Wolfsheim's real-life counterpart, Arnold Rothstein.

I. CAPITAL AND THE UNDERWORLD

Arnold Rothstein was the first great financier of organized crime. Rothstein talked very little about himself. Others, however, called him "the Brain" and "the Big Bankroll." His attorney, William FalIon -unsurpassed for courtroom eloquence, but so crooked that he makes Roy Cohn look like a saint -described Rothstein as "a man who dwells in doorways. A mouse standing in a doorway, waiting for his cheese."5

We will not discuss Rothstein's role as the contact man between Tammany Hall and the New York City underworld. We will not dis-cuss his role in labor union racketeering. We will not discuss his role as mentor to John T. Nolan, Arthur Flegenheimer, and Charles Lucania -who would later be known, respectively, as Legs Diamond, Dutch Schultz, and Lucky Luciano. We will not discuss his interests (financial, not personal) in heroin and cocaine. We will mention only briefly his role as the man behind New York's first bootlegging operations -briefly, because the point requires no particular explanation. We will discuss his role as a gambler and a mastermind of securities fraud.6

Fixing the World Series was only one episode in Rothstein's career. He played the horses, played high-stakes craps and higher-stakes poker, and sometimes cut cards at $40,000 a cut. He would bet on literally anything, from the serial numbers on dollar bills to the license plates on passing cars. He owned and managed gambling houses. On and off the race-course, he was to ordinary bookies what reinsurance companies are to the insurance trade.

As an underworld financier, Rothstein was the man who probably masterminded (or fenced) the Liberty Bond thefts of 1918-1920, in which $5 million of bonds were stolen. 7 He was an insurance broker, appreciating the value of a business which offered a steady flow of cash and checks.8 In the years bracketing World War I, moreover, he was the man who stood behind the bucket-shops of New York City.

A bucket-shop was a discount retail securities house. Some bucket-shops were legitimate; many others were not. These bucketeers were not above advertising their house stocks, knowing them to be worthless. A common practice was to make a phone solicitation, pocket the money, and postpone filling the order. If the customer's stock went down, the bucketeer could buy the shares at that lower price and keep the difference. If the stock went up, he would persuade the customer to roll over the money into a new investment. Leo Katcher, Rothstein's biographer, wrote:

No official total of bucket-shop "take" has ever been compiled. Nat J. Ferber, the New York American reporter who did more to expose buck-eteers and their activities than any other newspaperman, estimated their take in his book, I Found Out, as $6,000,000,000 .... This much is on the record. In New York State, in one five-year period, bucket shops went into bankruptcy owing their customers more than $212,000,000! 9

To stay in business, the bucketeers needed protection, which Rothstein provided. When circumstances caught up with them, he was indispensable in providing bondsmen and lawyers.

In 1922 and 1923, the biggest of the bucketing scandals was constantly in the press. E.M. Fuller & Company, the largest brokerage house on the Consolidated Exchange, had gone into bankruptcy, owing its customers an amount estimated at $5 million. The trials that followed -no fewer than four of them -brought out Rothstein's involvement with New York's bucket-shops. Edward M. Fuller awaited arrest in Rothstein's house, and Fuller's attorney was William Fallon. The firm's papers revealed that Rothstein had taken some $425,000 out of the Fuller company's coffers.10

....MUCH MORE (16 page PDF)

Originally posted without the crypto refs in February 2021.