A very deep dive from Mining.com November 23:

Pressure on carmakers in the EV battery supply chain is only building.

Original equipment manufacturers (OEMs) faced with an 8-fold increase in lithium prices, convulsions on the nickel market and ever-present worries about cobalt supply from the Congo, are being forced to look downstream to secure supply for their ambitious expansion plans.

Andy Miller, chief operating officer of Benchmark Mineral Intelligence, told an annual industry gathering in Los Angeles last week that soaring lithium prices and LME nickel market turmoil are signs of the huge momentum that is building in the battery supply chain.

“The events of the past 12 months are just the warning signs of what is to come across the raw material markets,” Miller said.

“All of this is being compounded by what is happening now at the policy level.

“It is no exaggeration to say that there is no bigger regulatory milestone for Western electric car markets than the Inflation Reduction Act, which has far-reaching consequences for all aspects of the energy transition.

“The impact goes well beyond US markets and will shape global trade as the EV supply chain is being built out,” he said.

Trading at a fraction of the prices of nickel, cobalt and high-purity manganese, anode material graphite is an often overlooked part of the EV supply chain.

In contrast to ternary cathode materials, graphite prices have drifted lower this year thanks to weakness in the steel industry, although there have been wide disparities between grades.

According to Benchmark’s Flake Graphite Price Assessment for October, China FOB 94-95% purity -100 Mesh sizes are up 31% over the past year, last trading at $765 a tonne while +100 Mesh prices have hardly moved over the same period to exchange hands for $890 a tonne. Benchmark also tracks the price of value added products such as uncoated spherical graphite (99.95%, 15 micron) which has risen by 10% in 2022 to average $3,065 a tonne.

Source: Via BenchmarkWeek2022

Both the mined and synthetic graphite market is at a turning point, said Miller.

Batteries became more than 50% of the cobalt market back in 2016 and the same happened for lithium in 2018, Miller said, and according to Benchmark analysis next year lithium-ion batteries will overtake the steel industry as the number one source of demand for graphite.

Benchmark sees demand for graphite over the next decade growing at an annual compound rate of 10.5% but supply will lag, expanding at only 5.7% per annum, despite a trend of supply diversification, particularly new mining projects coming in stream in Africa.

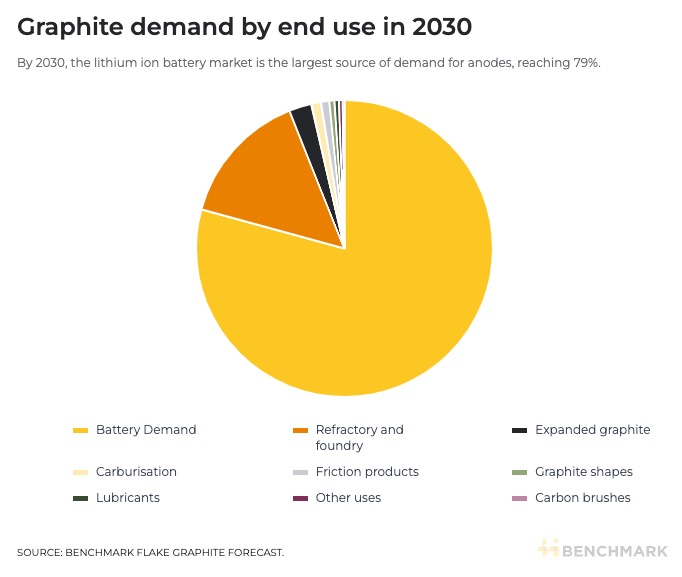

This year refractories and foundries will still dominate demand, but by 2025, the battery industry is set to consume two thirds of the world’s flake graphite, increasing to 79% in 2030, according to Benchmark’s Natural Flake Graphite Forecast....

....MUCH MORE