That would not be good for Germany. Not at all

On the export front it means Chinese exports getting more competitive simply by virtue of the currency, competition that furthers the slowing of an already slowing German economy.

From ZeroHedge (the first third is about Japan and the Yen before Albert gets going on China):

Yen At Risk Of "Explosive" Downward Spiral With Kuroda Trapped... And Why China May Soon Devalue

*****

.... In a recent note published by SocGen's resident skeptic Albert Edwards and titled "Something huge is happening in FX world, and it's not the dollar" (available to pro subs in the usual place), the strategist writes that "despite core CPI inflation surging in the US and the eurozone, Japan remains locked in deflation with core CPI there (excluding fresh food and energy) falling 1.0% yoy" and he observes that "surging commodity prices just do not seem to have the impact in Japan that they do in the west" (another SocGen strategist, Kit Juckes, thinks he may have found an explanation why with the BoJ publishing a paper this week on the topic of the contrasting Phillips Curves in the US and Japan - link.)

Albert then goes on to note that by capping the 10y JGB at 0.25% the BoJ has committed itself to unlimited intervention – and if yields continue to rise elsewhere, that will likely accelerate QE to pin JGB 10y yields at 0.25% (now 0.23% after rising as high as 0.248%). "The further widening of the yield spread and QE/QT contrast with the US can only weigh heavily on the yen" he notes.

What does this mean in pratical terms? Well, since Japan is the one country where rates are never allowed to normalize - since the country has so much accumulated sovereign debt even a modest rise in rates would lead to an instant debt crisis - at a time when other central banks are tightening more aggressively in a tacit acknowledgement that rising bond yields reflect valid inflation concerns, "the BoJ may perversely be forced to accelerate QE as JGB yields attempt to rise above 0.25%. It’s a strange world" as Edwards puts it.

And this is where the second massive implication of the BoJ relative easing of policy comes in. Extending on this article, Edwards warns that "as the yen declines, the trend becomes a self-perpetuating phenomenon known as the ‘carry trade’ where participants actively borrow in a depreciating yen to fund higher yielding investments abroad. The appetite for such trades increases markedly when – as last week – the yen breaks below key support levels and begins to decline sharply: in short, the fundamentals combine with the technical, leading to an explosive expansion of the carry trade."

We have seen this before, most notably in the years before the Global Financial Crisis. Typically, the cheap yen funds are invested into similar instruments like higher yielding US Treasuries but as risk appetites mount, this extends into whatever momentum trade is dominant at the time. That may be commodities or it may be equities. Of course, ultimately it ends in tears (as it did in 2008 when it unwound), but as this new carry trade re-emerges, it means that the yen could fall an awfully long way from here – the ramifications of this might surprise investors.

So are we about to see another roll of the dice in Japan embracing (by default) another period of super-loose yen policy, Edwards asks. This effectively would mean that Japan is willing to soak up the west’s runaway inflation via higher import prices in the hope of kickstarting that wage / price spiral that (as we correctly predicted) never materialized in 2013 onwards. Or as the SocGen strategist rhetorically puts it:

Can a surge in Japan’s headline CPI this time around break the entrenched deflationary psychology of Japanese households? We’ll see.

We, for one, doubt it. Japan, as the premier exhibit of the insanity that is MMT, is coming to its inevitably monetary collapse. Which also means that the yen will drop much, much lower. Edwards agrees, and writes that "despite the yen being undervalued and over-sold, it is entirely plausible that it could fall a long way from here as traders get the bit between their teeth. Is Y150/$ possible? It is, because when the yen breaks, it moves sharply (eg in 2013 from 80 to 100, and again in 2015 from 100 to 120)."

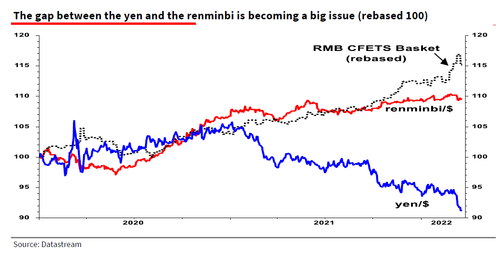

But while Japan may be a lost cause, a bigger question emerges: how will Japan's latest devaluation impact its fellow exporting powerhouse competitors, i.e., China, and as Edwards frames it, "this beggars the question how will China react? Maybe just like they did in August 2015 when the PBoC devalued? Back then persistent yen weakness had dragged down other competing regional currencies and left the renminbi overvalued."

Wait, yen weakness leading to China devaluation? According to Edwards, that indeed was the sequnece: as he shows in the chart below, the super weak yen of 2013-15, by driving down other competing Asian currencies, ultimately led us to the August 2015 renminbi devaluation.

Fast forward to today when the aggressive relative easing of the BoJ comes at a time when the PBoC also sticks out as a central bank unwilling to join the global tightening posture and instead is shifting towards an easier stance (after all, China has an imploding property sector it must stabilize at any cost)....

....MORE

Even if Germany can convince the euro poobahs that a weaker currency is required you've got your Scylla: "Germany's inflation rate jumps to 7.6%" where food and energy imports would rise in price if the ECB were to follow China in the devaluation game or you've got your Charybdis: "Bundesbank: "Germany tipped into second recession by virus".

Last I saw the rouble was at 82.8837 to buy a dollar, versus 81.3166 on February 24th, the day of the invasion.

That's compared to the record low recorded on March 7th, 150.119 to 1.

She's pretty good at what she does.