In recent weeks there have been stories circulated about large U.S. inventories of bacon. Specifically, it was noted that frozen inventories were at 40-years highs. This caught our attention as it seemed the U.S. was running out of bacon (as inventories reached 50-year lows) just a few years ago. What is going on? This week’s post is a closer look at the U.S. bacon and pork situation.

A 40-Year Record

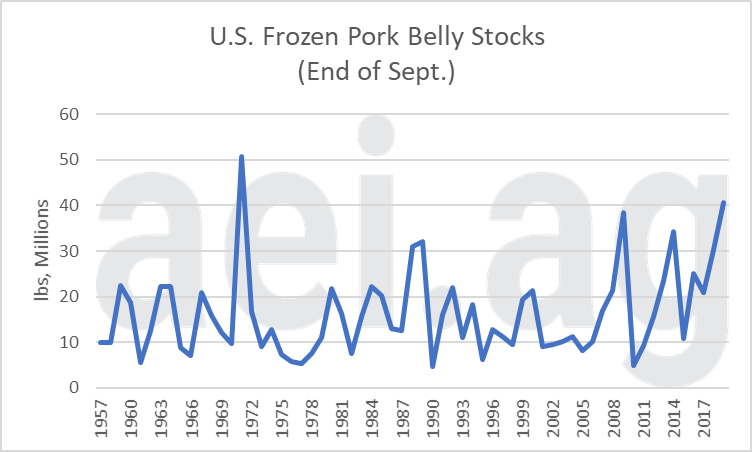

Figure 1 shows U.S. frozen pork belly stocks – measure at the end of September- since 1957. At more than 40 million pounds, inventories at the end of September 2019 were at the highest levels since 1971. Furthermore, stocks are 34% higher than levels a year ago (30.3 million pounds).

Figure 1 also captures an uptick in the variability of September stocks in recent years. Before 2009, September inventories were typically between 10 and 20 million pounds. However, stocks in 2009 exceeded 38 million pounds – a noteworthy high at the time. This was followed by a sharp contraction in 2010 (4.8 million lbs.) and 2011 (9.3 million lbs.). The whiplash continued as stocks again swelled in 2014 (34 million lbs.) before falling in 2015 (10.9 million lbs.).

While the large September 2019 stocks are significant, perhaps the most significant insights from the data are that 1) frozen stocks of pork bellies have been highly volatile over the last 10+ years and 2) the large swings – from highs to lows – can occur in a short time period.

Figure 1. U.S. Frozen Pork Belly Stocks, End of September. 1957-2019. Data Source: USDA NASS.

Seasonality of Bacon Stocks

Digging into the data revealed the USDA reports frozen pork belly stocks every month. The most recent headlines were generated using the September data. The “running-out” story in early 2017 was based on December data.

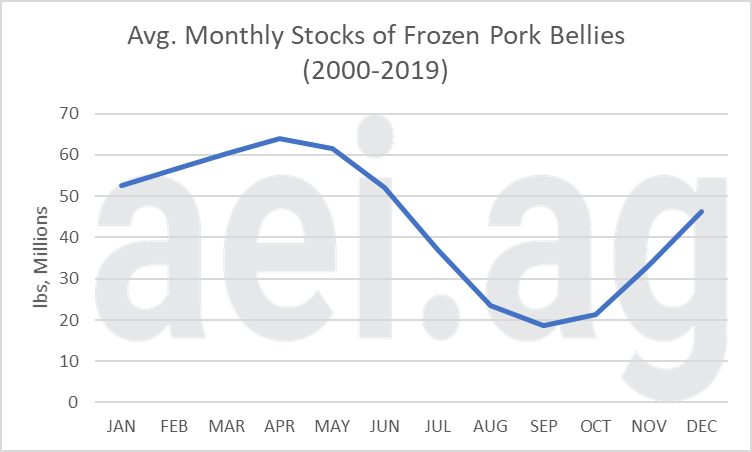

Figure 2 shows the average monthly stock of frozen pork bellies since 2000. These data give us an idea about the seasonality of frozen stocks. It turns out that frozen stocks vary significantly throughout the year. On average, inventories reach lows in September before trending higher throughout the winter, peaking in April.

The range of the seasonality is also worth noting. During the late-summer lows, pork belly stocks fall to 20 million pounds. By early spring, seasonal inventories nearly tripled to more than 60 million pounds between March and May.

When considering current levels, 40 million pounds of pork bellies in frozen storage in September is more than twice the average stocks in September. On the other hand, 40 million pounds in April would be a completely different story.

Figure 2. Average Monthly Stocks of Frozen Pork Bellies,

September. 2000-2019. Data Source: USDA NASS.

The Bigger Pork Story....

.....MORE

I guess we know why cold storage facilities have been such a hot real estate play:

Logistics: Big Money For Warehouses, Looking at Cold Storage.

"It's About To Become A Hot Market For Cold Storage Facilities"—CBRE

And why I shouldn't skip breakfast.

Immediately below:

Here's How To Actually Cook Food Over Lava