As recent market action suggested, they are not independent threats.

The following article was originally published in “What I Learned This Week” on April 5, 2018. To learn more about 13D’s investment research, please visit our website.

In these pages, we have repeatedly dissected two preeminent threats to the bull run: a regulatory crackdown on tech giants, and the backfiring of passive and algorithmic strategies pegged to low volatility. As Monday’s market action suggested, they are not independent threats.

FAANG stocks lost $78.7 billion in market value on Monday as the continued barrage of negative tech headlines spooked investors. Yet, the bleeding was not reserved just to the giants targeted by the political and regulatory backlash. As The Wall Street Journal’s Tuesday recap suggests, investors fleeing tech-heavy indexes likely spread the pain: “As the rout intensified, shares of companies ranging from chip makers to electronic-payment providers to biotechnology firms tumbled too, highlighting the indiscriminate selling spreading across the technology industry. Every stock in the S&P 500 technology sector ended lower for the day.”Throughout the near-decade-long bull run, tech giants and passive and algorithmic investing ascended hand-in-hand. The more a small group of tech companies dominated market returns, the less active investors could outperform tech-heavy indexes. And the more capital herded to passive and quant strategies, the less firm-by-firm price discovery could restrain tech stock inflation. It was a virtual feedback loop and the consequence is historic capital concentration in the tech sector.

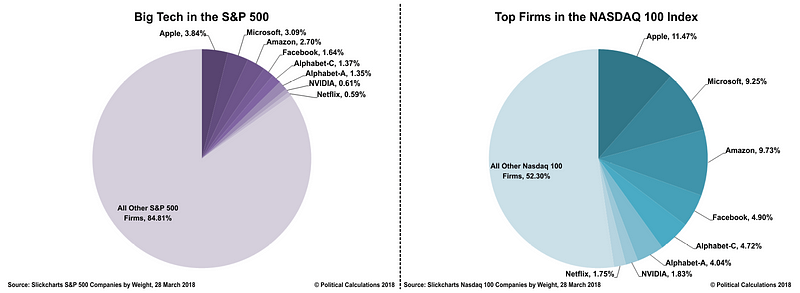

Companies in the NYSE FANG+ Index are valued at a multiple that’s almost three times that of the broader gauge, a greater divergence than at the top of the dot-com bubble. According to a Morgan Stanley analysis, “the e-commerce bubble” — which includes FANG plus Twitter and Ebay — has inflated 617% since the financial crisis, making it the third largest bubble of the past 40 years behind only tech in 2000 and U.S. housing in 2008.Now, the key question is: What would cause tech-heavy passive and quant strategies to unwind and where will capital go when they do? With tech earnings to be released soon and the buyback blackout period ending thereafter, there’s good reason to believe a seismic rotation might not be imminent despite the recent turbulence. However, global regulatory headwinds will only intensify. To understand the implications of the tech drawdown that could result, it is essential to understand how tech’s bull run sculpted the passive and quant investing revolution.The topline stats are staggering regardless of how often they’re repeated. From the 2009 low to the recent highs, the S&P 500 advanced 331%. Meanwhile, Facebook advanced 413% (from its 2013 IPO), Amazon surged 2,102%, Apple 1,123%, Netflix 5,349%, and Google 586%. Combining those names with Microsoft and Nvidia, just eight tech stocks now account for over 15% of the entire S&P 500 index, and a staggering 48% of the Nasdaq 100.

Source: Political Calculations

However, digging deeper into the passive investing universe, the tech overweighting grows even more severe. Almost 10% of all ETF assets under management — or roughly $340 billion — track either growth or value indexes, as Nicholas Colas reported for Bloomberg View last month. These indexes have very concentrated sector and stock holdings. Colas writes:“All-or-nothing methods of index construction create portfolios with dramatic over/under weights in volatile sectors…Instead of helping investors diversify via traditional “style boxes,” growth and value now herd them into tightly fenced pens…[creating] dramatic and potentially risky sector concentrations versus broader market averages.”As that concentration pertains to tech, growth indexes are the concern. Colas goes on:“The S&P 500 Growth Index has a 41.3% weighting to technology. The Russell 1000 Growth Index carries similar exposure, at 39%. At the average of the two, this represents a 60% overweight versus the S&P 500’s 25% exposure to technology stocks.”This brings us to passive investing’s great illusion: diversification. As Jared Dillian, former head of Lehman Brothers’ ETF desk, explained to Bloomberg in November: “Retail investors who are buying ETFs or indexed funds are being sold on the idea that they’re diversified. What [they] don’t realize is that the trade is very crowded — like 20 million-other-people crowded.”Index owners may technically hold tens, if not hundreds of equities, but it is still just a single trade that can be exited with a single “click”. Moreover, indexes weight according to market cap so ownership concentrates in the biggest companies, and in a sustained bull run, narrower indexes — like growth — can outperform broader indexes, further herding passive investors towards greater concentration. Given their weighting in indexes, tech stocks could shatter the diversification illusion....MORE