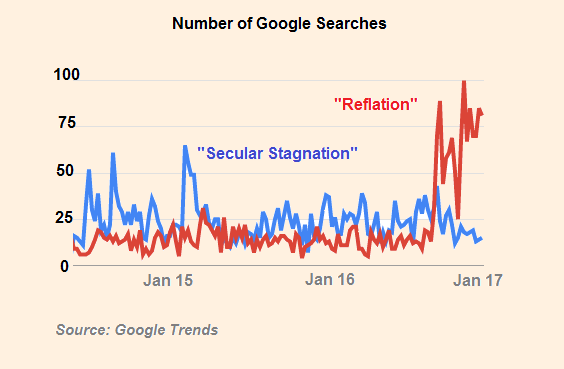

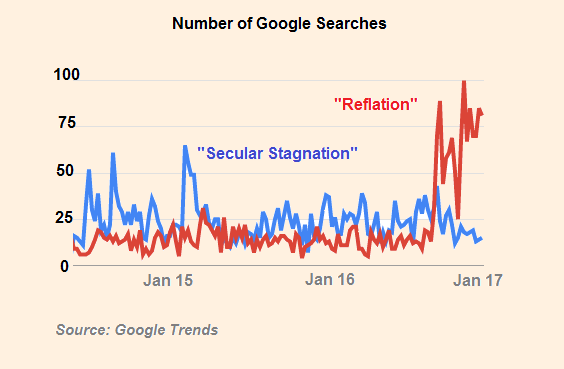

From Gavyn Davies' blog at the Financial Times:

A year ago, Lawrence Summers’ perceptive warnings

about the possibility of secular stagnation in the world economy were

dominating global markets. China, Japan and the Eurozone were in

deflation, and the US was being dragged into the mess by the rising

dollar. Global recession risks were elevated, and commodity prices

continued to fall. Fixed investment had slumped. Productivity growth and

demographic growth looked to be increasingly anemic everywhere.

Estimates of the equilibrium real interest rate in many economies were

being marked down. It seemed possible that the world economy would fall

into a “Japanese trap”, in which nominal interest rates would be

permanently stuck at the zero lower bound, and would therefore not be

able to fall enough to stimulate economic activity.

Just when the sky seemed to be at its darkest, the outlook suddenly

began to improve. Global reflation replaced secular stagnation as the

theme that dominated investor psychology, especially after Donald

Trump’s election in November. Why has secular stagnation lost its mass

appeal, and has it disappeared forever? Was it all a case of crying

wolf?

Lawrence Summers has always made it clear that in his mind secular

stagnation was a hypothesis, not a proven reality, especially in the US.

He and others have argued that the combination of very low global GDP

growth, alongside falling real interest rates, could be caused by two

factors: (i) inadequate global demand, stemming from low business

investment, high savings rates in Asia, wide disparity in income

distribution and rising risk aversion; and (ii) inadequate global

supply, stemming from falling productivity growth, and slowing growth in

the labour force....MORE