From FT Alphaville:

The new Hanseatica, now with robot dogs

So, Apple has taken advantage of the drop in Swiss funding costs to issue SFr1.25bn of bonds.

A no-brainer funding opportunity for Apple? Or…, alternatively, a sign of things to come: corporates replacing petrodollar and sweatdollar sovereigns as the key accumulators of trade surpluses in the global economy, and issuing debt in a bid to sterilise the effects of too much liquidity on capex they can’t control?

If it’s the latter, we should beware of Andrew Keen’s concerns about the perils of a winner-takes-all tech economy, where a handful of geeks inadvertently become the new masters of the universe, thanks to their cunning monetisation of things Tim-Berners-Lee-types would never have dreamed of rationing to the great tech-ignorant. We’ve dubbed it Silicon Valley’s “god complex” before.

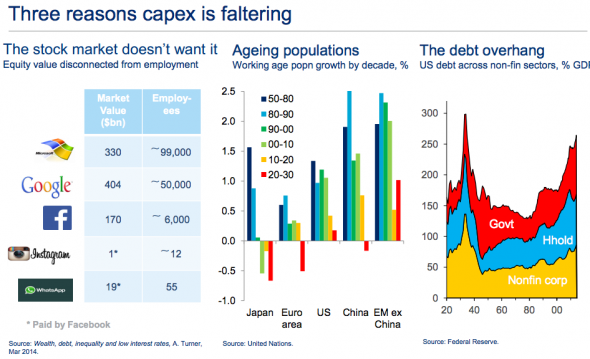

In any case, Citi’s Matt King sums up the problem with slides as follows,

Basically, given that there’s not enough safe “distributive” debt around already — i.e. the sort that governments take on to lessen the effects of concentrated wealth by borrowing from the rich hands to circulate to those who then more than likely send it straight back to the same rich hands — can additional government liquidity at this stage really help the system at all?

Especially once you consider that the private sector is maxed out when it comes to capex opportunities....MUCH MOREThe word plutonomy was created by analysts at Citi in 2005's report "Plutonomy: Buying Luxury, Explaining Global Imbalances.".