You know how it goes.

From FT Alphaville:

Michael Pettis explains the euro crisis (and a lot of other things, too)

This is literally the best analysis of the euro area’s problems we’ve ever read. You should take the time to closely read the whole thing yourself. We’ll wait.

Now that you’re back, we thought we could add some value by highlighting and expanding on what we believe to be Pettis’s most important insights.

First, the relevant units within the euro area aren’t countries but economic sectors. For all of the suffering that has occurred in places such as Spain, Ireland, and Greece, we shouldn’t forget that German workers have suffered from stagnant wages and decaying infrastructure.

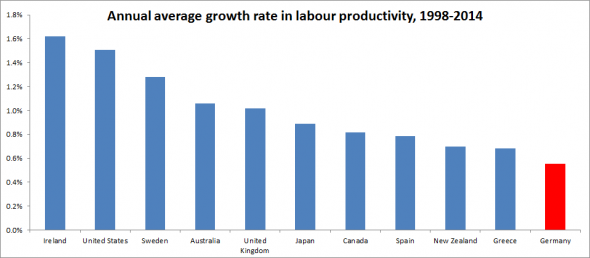

One of the worst costs — for Germany — has been the lack productivity growth. For all the talk of Teutonic competitiveness, German labour productivity has grown at the meagre pace of just 0.6 per cent per year, on average, since 1998. Output per hour worked is actually lower now than it was in 2007. For perspective, this track record is worse than that of practically every other rich country — including Greece and Spain!

(Source: Organisation for Economic Co-operation and Development, author’s calculations)

The right distinction, therefore, isn’t between countries but between classes (emphasis ours):

It was not the German people who lent money to the Spanish people. The policies implemented by Berlin that resulted in the huge swing in Germany’s current account from deficit in the 1990s to surplus in the 2000s were imposed at a cost to German workers, and have been at least partly responsible for Germany’s extremely low productivity growth — most of Germany’s growth before the crisis can be explained by the change in its current account — rather than by rising productivity.

Moreover because German capital flows to Spain ensured that Spanish inflation exceeded German inflation, lending rates that may have been “reasonable” in Germany were extremely low in Spain, perhaps even negative in real terms. With German, Spanish, and other banks offering nearly unlimited amounts of extremely cheap credit to all takers in Spain, the fact that some of these borrowers were terribly irresponsible was not a Spanish “choice.”...MORE