Further down the efficiency ladder are lawmakers. Listen to the first inductee into the prestigious Climateer Hall of Fame:

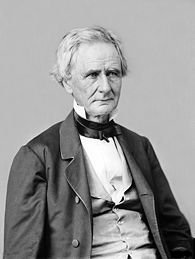

The 26th Secretary of War, the Democrat and Republican (!) Senator from Pennsylvania, Simon Cameron:

Our Hero

"The honest politician is one who

when he is bought, will stay bought."

$25 Billion Hedge Fund Manager Explains 'How To Be A Great Trader'

Some perspective on 'efficient markets' from Elliott Management's Paul Singer,

The fact that the vast majority of investors and traders cannot (with rare exceptions) beat the markets over long periods of time is not an argument for efficiency. Rather, the reason is that they are mostly doing the same thing sharing the same set of assumptions, and following the same impulses.

The fact that a basic assumption about the world is widely held does not make it true, nor does it make trading and pricing decisions based on that assumption efficient regardless of how liquid markets pricing in that assumption appear to be!

Certainly there are periods of time when some markets and submarkets appear to be efficient, but those who have vision, creativity and an understanding of the broader context of markets will make greater returns and/or attain a superior risk profile (assuming they do not get run over by standing rigidly against the sometimes-deeply false passions of the day expressed by the consensus).

How do the select few more or less continuously make money when the “efficient” markets are moving all over the place? Why do most investors fail, over long periods of time, to keep up with their desired index? And why do some people blow up?

There are many factors that help explain why the small handful of long-term “winners” succeeds, but one primary reason is that they design unique strategies that do not rely on “efficient” markets to achieve success for long periods of time.

...

Every money manager makes mistakes in the course of a career. Sometimes the mistakes are isolated, and sometimes they come in bundles or waves. It is not necessarily fewer mistakes or a perfect process that accounts for Elliott’s consistent track record. Rather, we think that a strategic factor is very important in minimizing the impact of such miscues.

We are referring to the pursuit of “manual” situational trading (activist equity, hands-on participation in bankruptcies, and activist event arbitrage), as well as process-driven trading (in areas where process, not the value of businesses, drives the result) in which there is commonly an opportunity following a mistake to dig oneself out of the hole, move in another direction, and impact the situation so as to minimize the loss from the mistake or turn it into an opportunity for profit.

By contrast, outright directional investing does not present these opportunities. If one has an outright passive directional bet that goes sour, you can add to the position or subtract from it, but you are not as likely to be in a position to influence the result and turn it around. Of course, Elliott takes on some passive directional trades, but wherever possible we try to orient our capital toward situations whose characteristics give us the opportunity to lift ourselves out of mistakes....MORE