Friday, February 18, 2011

From The Big Picture:

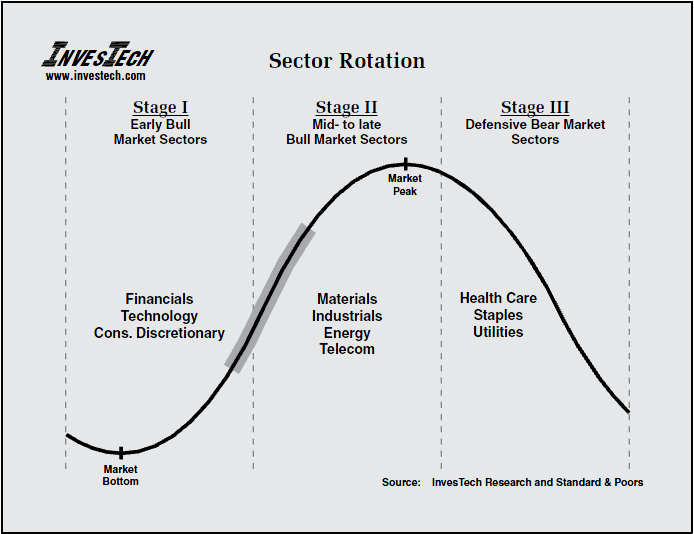

From Goldman Sachs, last week:Here is another one of our favorite charts, courtesy of Jim Stack and Investech Research. It shows how leadership shifts over three stages of a Bull run:>

Stages of Sector Rotation

• Stage I: The transition from bear market to bull. Cyclical sectors — Financials, Technology and Consumer Discretionary — outperform.

• Stage II: Mid-to-late bull market. Materials and Industrials outperform, as do Energy and Telecom stocks;

• Stage III: Nondiscretionary sectors — Health Care, Consumer Staples and Utilities — Recession proof products and services — are the most resilient as the bull begins to die.Three Stages of Sector Rotation

Chart courtesy of Investech Research

...The S&P 500 has been flat during the past month but significant internal rotation has occurred with the traditionally defensive sectors of Consumer Staples and Health Care outperforming. In our April 13th US Equity Views report New 3-, 6-, and 12-month targets reflect 5%, 8%, and 16% returns we shifted away from a purely pro-cyclical bias (lowering Financials to Neutral) and moved closer to benchmark (reducing the size of our Underweight in Health Care). We currently remain Overweight Energy and Information Technology, so we still have a preference for growth particularly via foreign sales. A business cycle transition would support a shift in our stance....via ZeroHedge