From ZeroHedge, October 1:

Buyers of physical oil across the planet are experiencing an acute supply shortage and are facing some of the highest premiums for supplies they’ve seen in months as plunging stocks at the largest US crude storage hub send shockwaves cross markets from Asia to Europe and the Middle East.

As Bloomberg reports, US crude cargoes on offer in Asia are being offered at the costliest premium this year. The spread between Brent and Middle East oil has jumped to the highest since February while the premium for near-term US supply is close to the highest since July 2022.

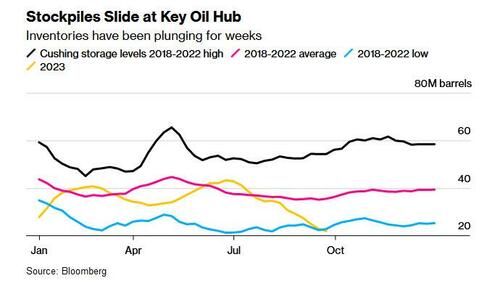

Behind the soaring premiums is Cushing, Oklahoma, the delivery point for benchmark US crude futures, which helps to set the price of oil across the Americas and beyond. As we have noted in recent weeks, inventories at the hub are now sitting just above seasonal lows last seen in 2014, and are effectively at the level known as "tank bottoms" below which inventories are for the most part unusable.

Stockpiles at Cushing, Oklahoma tumbled below 22 million barrels last week, the lowest since July 2022, and have dropped for seven straight weeks, reaching the lowest level at this time of the year since at least 2018. At these levels, many traders consider inventories to already be at the lowest levels that allow tanks to function normally.

The situation is forcing some traders to pay up big for last-minute supplies at Cushing. The prompt futures spread, which closely tracks supply and demand at the site, surged above $2 a barrel on Wednesday, the highest since July 2022.

Meanwhile, the US refinery maintenance season is getting underway, which will prevent the storage hub from draining to absolute lows. Still, exports remain a wild card for balances, given that demand for American oil is high amid OPEC+ supply curbs, meaning domestic users will likely have to pay up to keep barrels in the US.

Operationally, pulling oil out of tanks when levels fall below the so-called “suction line” is difficult and expensive, and the quality of crude can be compromised by the presence of water and sediment. For now, traders are expecting stockpiles to halt their decline by October and possibly start building up again, depending on how exports shape up. Indeed, this week’s drawdown was less than 1 million barrels — the first time that’s happened since early August.

Cushing’s role in global oil markets has also diminished in recent years since the US lifted an export ban. Most barrels now flow straight from the prolific oilfields in Texas’ Permian Basin to the coast, where they are shipped to overseas buyers.

“Cushing can stay at minimum operating operating levels for an extended period of time,” said Scott Shelton, an energy specialist at ICAP. “It’s now a transit point to the US Gulf Coast and a supply point for Cushing-based refiners.”

The latest surge in US crude spreads also fueled a jump in Brent spreads, with the prompt spread climbing above $2 as well, to the widest in a year....

....MUCH MORE

Brent futures $92.47 up 27 cents; WTI $91.08 up 29 cents.