From ZeroHedge, October 12:

"Nothing Here To Convince Fed To Hike In November": Wall Street Reacts To Today's CPI

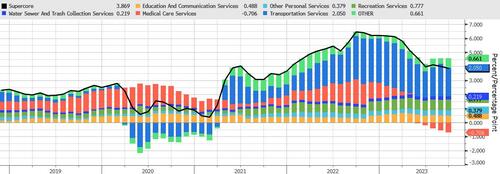

There are two diverging views following today's CPI print: the first looks at the hotter headline inflation (which beat expectations on both a MoM and YoY basis) and argues that the Fed will have to hike at least once more. The second counters by pointing to the continued slowdown in supercore inflation...

... and notes that excluding shelter, which as we noted continues to lag real-time data by 12 months at a time when rents are now dropping...

CPI and its stale data: "The shelter index increased 7.2 percent over the last year, accounting for over 70% of the total increase in all items less food and energy."

— zerohedge (@zerohedge) October 12, 2023

Meanwhile, real-time rent indicators are in freefall. Apt List's Sept rent drop was the biggest on record pic.twitter.com/WXwFAKfJv5

... core CPI is up just 0.1%.

For a more granular view of Wall Street's takes, here is a snapshot of some of the initial hot takes from a variety of traders, economists and strategists.

Capital Economics

Excluding shelter, the core CPI rose by just 0.1% m/m. Overall, there is nothing here that will convince Fed officials to hike rates at the next FOMC meeting, and we continue to expect a more rapid decline in inflation and weaker economic growth to result in rates being cut much more aggressively next year than markets are pricing in.”

CBK:

"US inflation is cooling, but only slowly. From the perspective of the Fed, the figures are probably not worrying enough to trigger another interest rate hike. However, they are not good enough to sound the all-clear either."

MUFG, George Goncalves

"The Fed is done as its recent commentary suggests a shift from already thinking of moving from how high to how long. The data and recent Fed speak means it looks hard to get 10s to make a run towards 5 again -- not impossible -- but the double top in rates in September might prove to be the near-term high."....

....MUCH MORE