Before we get to the headline story a comment on the character traits of President Biden's Cabinet officers. The nation is obviously in 25th Amendment territory where the President is not capable of executing the duties of his office but has not acknowledged what the entire world has seen and known for the last few years. And while the Chief Executive and Commander-in-Chief is right now incapacitated, Democrat honchos and mega-donors are talking about the November election, over four months away. This is where the Cabinet is supposed to live up to the power and place in society they have been elevated to, and execute section IV of the Amendment. And they haven't. More after the jump.

From the Fort Worth Star-Telegram via Yahoo News, June 27:

U.S. Sen. Ted Cruz, a Texas Republican, doubled down on his prediction that Democrats will “dump Biden” and tap former First Lady Michelle Obama as their party’s nominee.

“Watching Biden’s excruciating debate performance tonight, I believe the odds are now greater than 80% that the Dems dump Biden,” Cruz said in a post on X, formerly called Twitter, during Thursday’s presidential debate. “Nine months ago, on Verdict I predicted that the Dems would replace Biden with Michelle Obama. I think that’s going to happen.”....

Watching Biden’s excruciating debate performance tonight, I believe the odds are now greater than 80% that the Dems dump Biden.

— Ted Cruz (@tedcruz) June 28, 2024

Nine months ago, on Verdict I predicted that the Dems would replace Biden with Michelle Obama. I think that’s going to happen. https://t.co/CCn1g3YJ68

....MUCH MORE

Here's the last section of the 25th Amendment, the one that is applicable in this situation.

Via Cornell Law School's Legal Information Institute:

Section 4.

Whenever the Vice President and a majority of either the principal officers of the executive departments or of such other body as Congress may by law provide, transmit to the President pro tempore of the Senate and the Speaker of the House of Representatives their written declaration that the President is unable to discharge the powers and duties of his office, the Vice President shall immediately assume the powers and duties of the office as Acting President.

Thereafter, when the President transmits to the President pro tempore of the Senate and the Speaker of the House of Representatives his written declaration that no inability exists, he shall resume the powers and duties of his office unless the Vice President and a majority of either the principal officers of the executive department or of such other body as Congress may by law provide, transmit within four days to the President pro tempore of the Senate and the Speaker of the House of Representatives their written declaration that the President is unable to discharge the powers and duties of his office. Thereupon Congress shall decide the issue, assembling within forty-eight hours for that purpose if not in session. If the Congress, within twenty-one days after receipt of the latter written declaration, or, if Congress is not in session, within twenty-one days after Congress is required to assemble, determines by two-thirds vote of both Houses that the President is unable to discharge the powers and duties of his office, the Vice President shall continue to discharge the same as Acting President; otherwise, the President shall resume the powers and duties of his office.

It is the cabinet's job to put country above party and they have failed.

Previously on Michelle as President. First up, the introduction to a May 30, 2023 post:

"Democrats: Save Us Michelle!"

You may have noticed that for the last year or so the former First Lady's press peeps have kept her mentions on a low simmer, nothing dramatic or flamboyant or controversial but enough to keep the public from forgetting her. For example, our last post re: Michelle was in January of this year:

"Top secret documents reportedly found in Biden cache"

For the purposes of the powers that be, President Biden has to hang in there until January 20. If he were to leave office prior to that date Vice-President Harris could only fill-in for his remaining term and run for President once, in 2024. Should the transition take place more than half-way into President Biden's term, the Veep can fill out the remainder of his term and run herself in 2024 and 2028.

It gets really interesting if President Harris chooses a V.P. and steps aside herself and/or Michelle Obama, despite her protestations to the contrary, decides to run for Prez (no Veep for her, I'm sure). President (Barack) Obama didn't become the first ex-President to buy a house in D.C. for the:

"Northern charm and Southern efficiency"—Senator Warren G. Magnuson, 1945And before that November 2021.*

The fact that deep embed Susan Rice just left the O'Biden-Harris administration without discussing her future plans certainly is in keeping with the possibility of a fourth and fifth Obama term (placeholder Joe being #3 and fall guy should one be required)....

And March 6, 2024

That statement seems carefully worded, it's obvious she's not running. And it is not exactly General Sherman's "I will not accept if nominated and will not serve if elected."

It's also not another Sherman quote (my fave) regarding his friend and superior officer General Grant:

"Grant stood by me when I was crazy, and I stood by him when he was drunk, and now we stand by each other."

but then again the former First Lady probably wouldn't say something like that regarding President Biden.I wonder though if she would accept her party's nomination at the convention in Chicago.

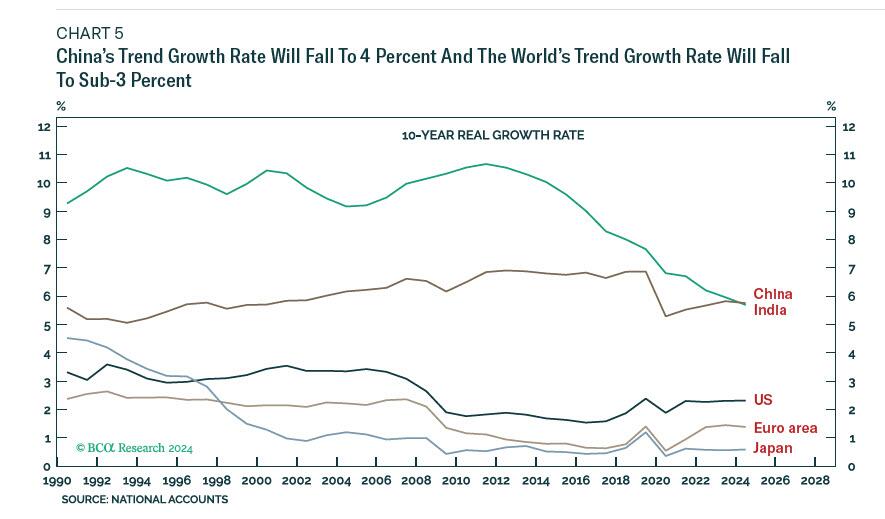

President Biden would have a whole bunch of delegates he could release if he were to retire from the field.On the other hand, I'm not sure you would want to be President during the next four years, there are so many problems that have been growing and metastasizing just beneath the surface of the daily news that the person in the hot seat could end up just plain reviled....

A couple weeks later in "Hotshot Wharton professor sees $34 trillion debt triggering 2025 meltdown as mortgage rates spike above 7%: ‘It could derail the next administration’" we took the idea a bit further:

This is the sort of stuff I was thinking about in the intro to March 6's "Michelle Obama's office says the former first lady 'will not be running for president' in 2024":

...On the other hand, I'm not sure you would want to be President during the next four years, there are so many problems that have been growing and metastasizing just beneath the surface of the daily news that the person in the hot seat could end up just plain reviled.If I were a Democrat strategist I would propose letting Donald Trump win a second term while concentrating on House and especially Senate (to bottle up judicial, including Supreme Court, nominees) races.

A Trump win would give an excuse for riots (for the visuals) and if he is handcuffed by the Legislative branch to limit the range of possible responses, you go beyond polycrisis to the omnicrisis. Throw in a bit of Frances Fox Piven with her "overwhelm the system" and "motor voter" strategies and you could see one-party rule for thirty years.

There are probably a dozen ways things could come to a head, Joe steps down, Kamala is elevated, appoints Gavin or Michelle as Veep, steps down herself etc.

After Nixon resigned the country ended up with Gerald Ford and Nelson Rockefeller in the top two spots, with neither of them having run for their respective position. So all sorts of possibilities.

Stay tuned!

/cdn.vox-cdn.com/uploads/chorus_image/image/58821251/getty_images_drone_fashion_show_1600x1066.0.jpg)