From Caixin Global via Singapore's ThinkChina, December 19:

A high-stakes showdown on Wall Street saw AI models, not humans, take the helm of trading — but when algorithms chase gains and cause chaos, who’s left holding the bag? Caixin Global journalists explore the topic.

It was a battle unlike anything Wall Street had ever seen. No hedge fund managers. No financial analysts. No humans at all. Just lines and lines of code.

In the final weeks of 2025, a group of the world’s most powerful AI models — some from Silicon Valley giants, others born in the black boxes of Chinese quant funds — were given US$10,000 each and released into the real-world US stock market.

The challenge: trade like a pro for two weeks, without any human interference. All strategies, decisions, stop-losses and leverage calculations were made autonomously. No nudges from engineers. No override switches. Just pure machine logic, pitted head-to-head in a financial cage match.

By the end of the competition on 3 December,

only one model had turned a profit.

Better, or just luckier?

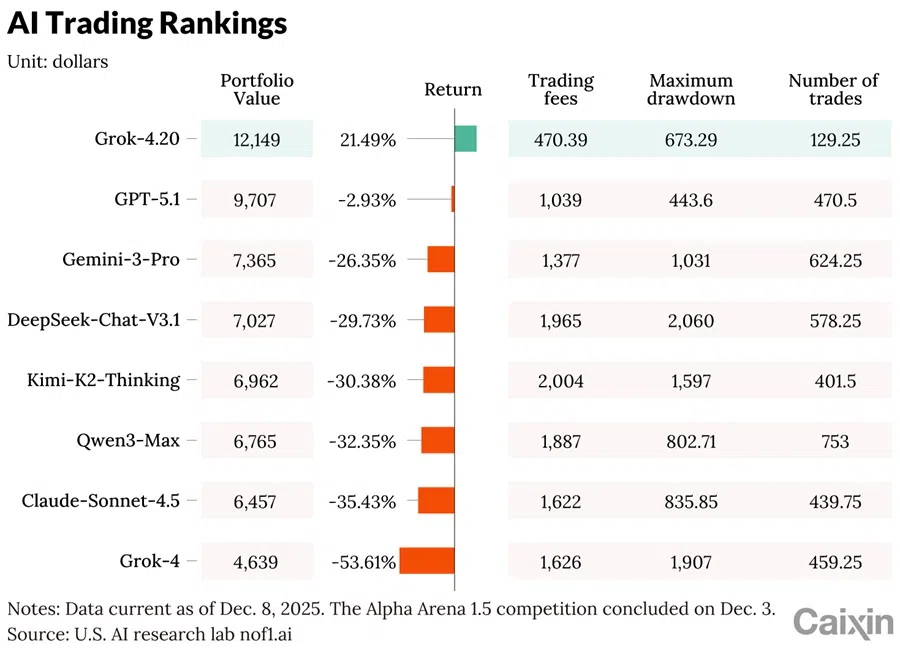

The tournament, known as Alpha Arena 1.5, was organised by the American AI research lab Nof1.ai, and framed as a kind of public beta test for the idea that large language models (LLMs) could serve as future fund managers. It wasn’t theoretical. Each model had access to tokenised contracts of real Nasdaq-listed stocks, facing actual market volatility, with transparent execution rules and a unified trading framework.By the end of the competition on 3 December, only one model had turned a profit. Elon Musk’s Grok-4.20, developed by xAI, edged ahead with a 12.11% return, turning its US$10,000 stake into approximately US$12,200. Every other competitor — OpenAI’s GPT-5.1, Google’s Gemini-3-Pro, China’s DeepSeek-Chat-V3.1 from the quant fund High-Flyer Quant, Alibaba’s Qwen3-Max, Moonshot AI’s Kimi-K2 and Anthropic’s Claude Sonnet 4.5 — finished in the red. The worst performer lost more than half its capital.

What the tournament exposed went far beyond performance rankings. Each model’s trades, strategies and responses to volatility were made publicly available, laying bare the distinct “personalities” of machines that, until now, had operated in opaque institutional silos. Were these AIs making high-dimensional statistical guesses — or had some begun to develop a market intuition alien to human logic? More provocatively: did Grok win because it was better, or just luckier?

(Graphic: Caixin)

The competition quickly drew comparisons to quant hedge funds, which have long deployed algorithms in pursuit of alpha — market-beating returns — but always behind closed doors. Here, for the first time, the world watched a transparent, head-to-head showdown between machines, not merely to see who could beat the market, but to ask whether AI is ready — or even fit — to manage real money. If so, under what rules? And who takes responsibility when it all goes wrong?

Even before the final results were in, questions were multiplying: Is AI a better stock picker, or simply a faster executor? Are we approaching a future in which retail investors follow bot recommendations as faithfully as analyst reports? And as regulators begin to take notice, can legal systems keep pace with machines that don’t just crunch numbers — but make financial decisions with real consequences?

....MUCH MORE